by Yuchuan Wang

JD.com released third quarter 2021 earnings on Nov. 18. During a call to discuss the results, Lei Xu, president of JD.com, said that, “When the external environment shifts, JD is able to continue to outperform the industry with more certainty and stronger resilience.”

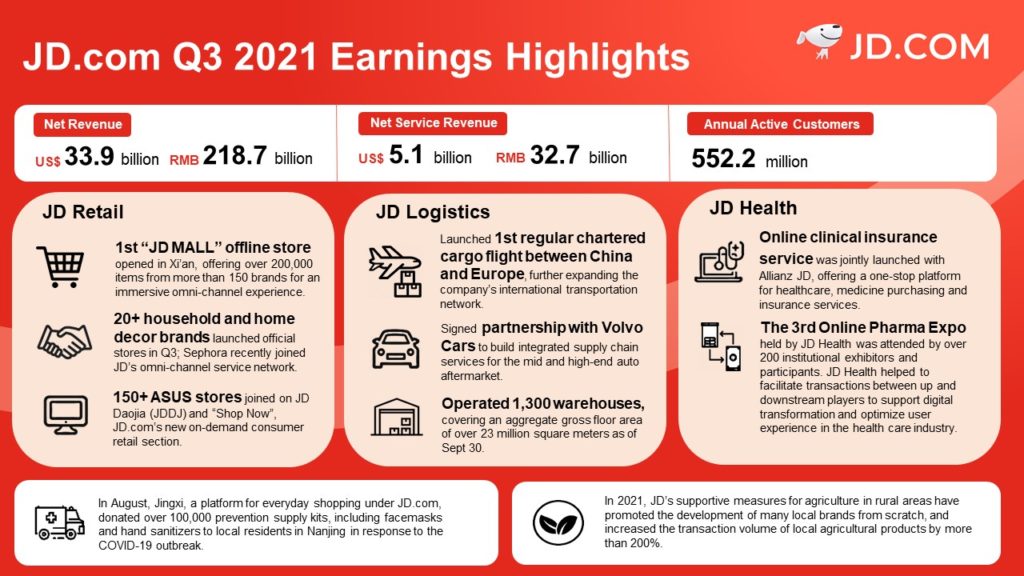

In the third quarter, JD.com saw a solid net revenues increase of 25.5% from the third quarter of 2020, reaching RMB218.7 billion (US$33.9 billion), despite macro and industry challenges. The growth of net service revenues was a highlight at over 43% year-on-year, compared to 23% growth of net product revenues. Net service revenues contributed a historical high of 15% to the total revenues.

Third-party marketplace also generated positive results. Lei Xu shared on the call that the number of third party merchants joined JD in Q3 tripled that of Q1 and Q2 combined, with apparel and home categories leading the growth. He said, “Going forward, we will leverage the healthier competition and development environment of the industry to continuously enrich our marketplace ecosystem, explore new models and formulate our differentiated strategic approach.”

JD’s continuous improvement in user experience has also resulted in stronger consumer mindshare, engagement, and the increase of purchasing frequency. The company’s annual active customer accounts increased by 25.0% to 552.2 million in the twelve months ended September 30, 2021. In Q3, JD’s mobile DAU (Daily Active User) grew faster than annual active users, accelerating to over 30% year-on-year in September. Average order frequency for all users increased 23% year-on-year, driven by both new and existing users. And total order volume sustained a year-on-year growth of about 40% in Q3.

“Within JD retail, the number of categories users purchased expanded to a historical high even in a low season,” said Sandy Xu, CFO of JD.com. “In particular, users who have stayed with JD for more than a year tend to double the number of the categories they purchase.”

Sandy Xu also shared insights in JD’s supermarket categories which were again the largest contributor of JD’s new users in the quarter. The average number of orders per user for supermarket categories continue to increase and reached its all-time highest level. Additionally, users are purchasing more high-frequent supermarket products on JD including food and beverage, fresh produce, and baby and maternity products.

In addition, JD made further progress in omni-channel retail. In Q3, GMV of JD’s omni-channel business grew by nearly triple digits year-on-year. ASUS, a global technology leader, launched more than 150 ASUS stores on JD Daojia (JDDJ) and “Shop Now”, JD.com’s new on-demand consumer retail section. In September, JD opened its first “JD MALL” physical store in Xi’an providing over 200,000 items from more than 150 brands, in categories including home, furniture, kids, smart healthcare products and auto accessories.

These omni-channel pushes “will serve as our second curve for growth to break the ceiling of JD’s long-term growth,” said Lei Xu. “The (omni-channel) strategy is also designed to facilitate further integration and digital transformation of China’s offline retail sector.”

Speaking of recent global supply chain challenges, Xu said that, “JD will focus on the core strength of supply chain, and this will give us a better position to work together with our partners. Our partners would also like to work more closely with JD to leverage our strengths to help them reduce cost and increase efficacy.”

(yuchuan.wang@jd.com)