May 12, 2023|

JD.com Announces 2023 Q1 Earnings: Embracing Opportunities in the Post-Covid Era

by Vivian Yang

JD.com released its 2023 Q1 financial report on May 11, which highlights the company’s commitment to agile management, everyday low prices, an open ecosystem, and objectives for the upcoming JD 618 Grand Promotion.

Key highlights:

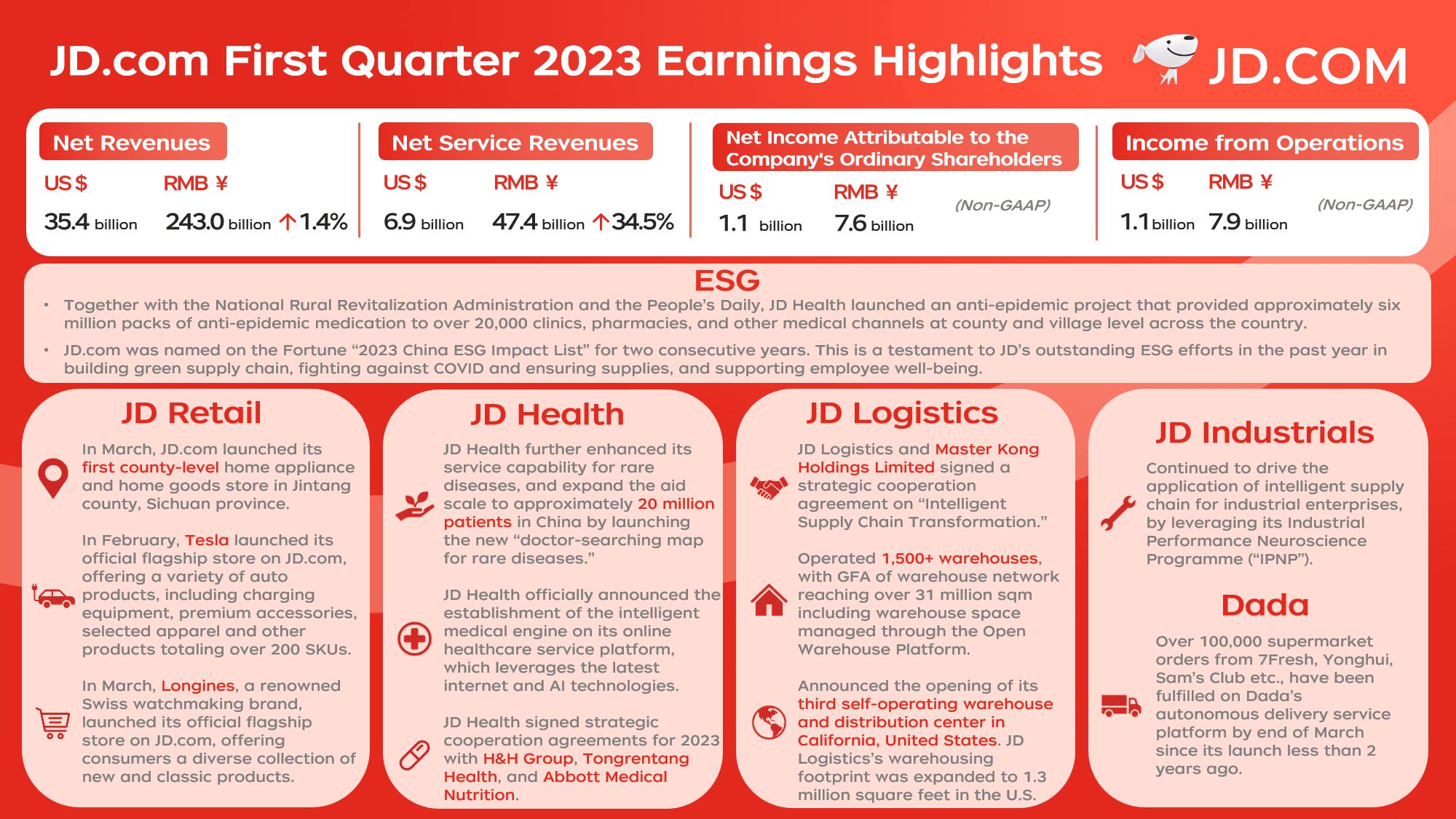

- Robust Revenue Growth: JD.com achieved a 1.4% year-on-year increase in net revenues amounting to RMB 243 billion (US$35.4 billion) amid proactive organizational restructuring and other operational reforms.

- Strengthened Service Revenues: Net service revenues increased 34.5% year-on-year, totaling RMB 47.4 billion (US$6.9 billion), constituting 19.4% of overall revenues. Notably, logistics and other service income accounted for nearly 60% of this segment.

- Exceeded Profit Expectations: The non-GAAP net income attributable to ordinary shareholders reached RMB 7.6 billion (US$1.1 billion), resulting in 88.3% year-on-year growth. This performance surpassed market expectations, resulting in a net profit margin of 3.1%, marking the highest profitability level among Q1 performances.

- JD Logistics Thrives: JD Logistics’ external customer income increased by 59.8% year-on-year, accounting for nearly 70% of its total income.

- User Growth and Engagement: Users’ shopping frequency, average revenue per user (ARPU), and daily active users (DAU) all experienced high-quality growth. The number of JD PLUS members reached 35 million, with their annual consumption on the platform surpassing that of non-PLUS members by 8.4 times.

- Dominant Market Shares: JD.com continued outperforming the industry average in various competitive categories, including household appliances, home goods, 3C, electronics, and more.

- Rapid Growth of JD Shop Now: The gross merchandise value (GMV) of JD Shop Now, the on-demand retail program, grew by 60% year-on-year. This program has successfully collaborated with over 300,000 brick-and-mortar stores across China, providing a diverse range of products to more than 2,000 counties.

- Flourishing Merchant Base: The number of new merchants surged by 240% year-on-year, driven by multiple merchant supportive measures such as the “Spring Dawn Initiative.”

- Efficient Inventory Management: JD.com achieved a world-leading inventory turnover speed with 32.4 inventory turnover days, all while managing over 10 million self-operated SKUs.

- Reduced Fulfillment Expenses: Fulfillment expenses accounted for 6.3% of net revenues, the lowest percentage compared to the same period in previous years.

- Expanding Warehousing Capacity: JD Logistics now operates more than 1,500 warehouses, with an overall gross floor area (GFA) exceeding 31 million square meters. Additionally, its self-operated warehouses in the United States have surpassed 120,000 square meters in GFA.

During the earnings call, Lei Xu, CEO of JD.com, highlighted that 2023 is an opportune time for JD.com’s proactive adjustments, considering the fluid external environment and the emergence of new opportunities in the post-Covid era. These adjustments include streamlining JD Retail to a three-level reporting structure, optimizing product categories and channels, and fostering a level playing field for first-party businesses and third-party merchants.

Sandy Xu, CFO of JD.com, emphasized the company’s open ecosystem strategy as a crucial element for JD Retail’s supply-side reform. This strategy aims to provide consumers with a wider selection of price ranges, product categories, and an enhanced shopping experience. She further emphasized that JD.com leverages its supply chain advantages to achieve economies of scale and pass on the benefits to consumers. The company’s ability to offer “Everyday Low Prices” is rooted in its unwavering focus on “Everyday Low Costs.”

Looking ahead, Xu commented on the preparations for the upcoming JD 618 Grand Promotion. In light of insufficient consumption demand and the operational and inventory pressures faced by many merchants, the event will serve as a vital opportunity to restore confidence and accelerate growth. It is expected that third-party merchants on JD.com will experience accelerated growth during this year’s 618 event.

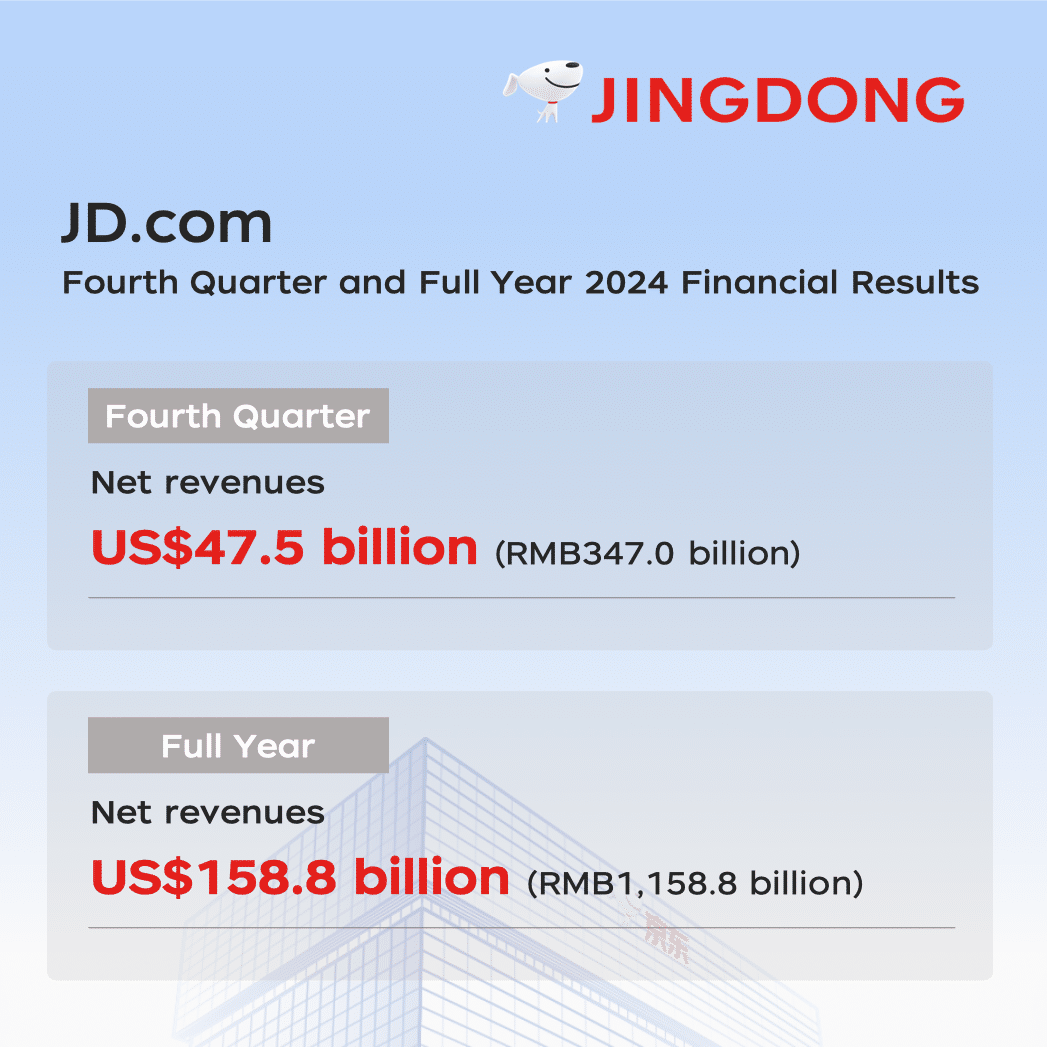

For more detailed financial information and a comprehensive overview of JD.com’s performance in the first quarter of 2023, please refer to the official financial report available on our website.

JD.com Announces First Quarter 2023 Results

JD.com Announces First Quarter 2023 Results