Mar 11, 2022|

JD Executives on Q4 and Full Year 2021 Earnings Call Highlights

by Doris Liu

“JD.com maintained a healthy growth momentum and continued to outperform the industry, contributing to the high-quality expansion of China’s consumption in a dynamic external environment.” Lei Xu, president of JD.com, said during a call to discuss JD’s Q4 and full year 2021 earnings on March 10.

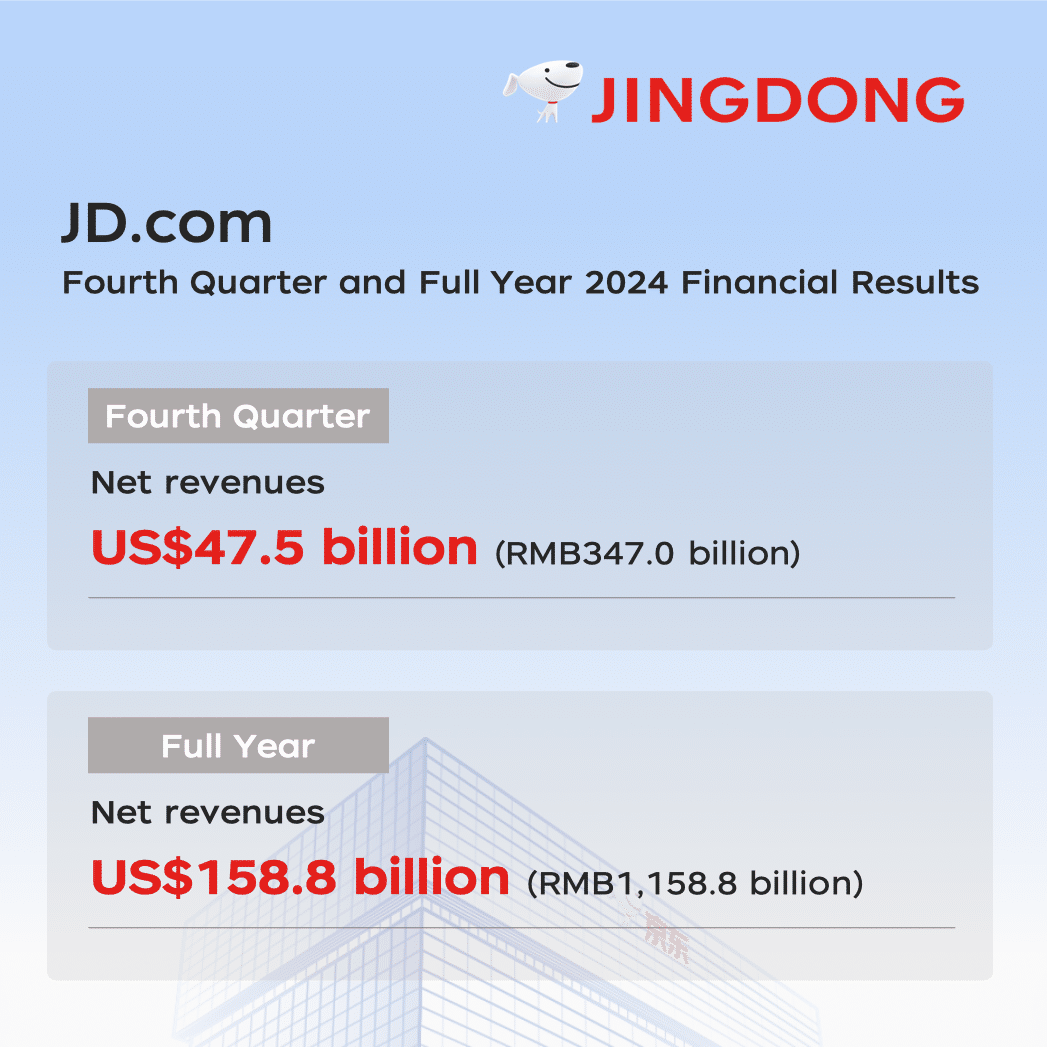

JD.com recorded 23 percent year-on-year net revenue growth in Q4 of 2021 on a high comp, reaching RMB275.9 billion yuan (US$ 43.3 billion). Net service revenues for Q4 were RMB41.2 billion yuan (US$6.5 billion), an increase of 28.3 percent YoY. Net revenues of 2021 were RMB951.6 billion yuan(US$149.3 billion), up 27.6 percent YoY; and net service revenues were RMB135.9 billion (US$21.3 billion) with a rise of 44.7 percent YoY.

Amid the evolving macro-economic and competitive challenges, JD achieved an increase in both user volume and quality (as measured by spending power). The company’s annual active users reached 569.7 million in 2021, up 20.7 percent, with meaningful improvements in shopping frequency, range of categories purchased as well as Average Revenue Per User (ARPU).

“As China’s internet industry develops into a more mature stage, the traffic-driven growth model relied on subsidies is being replaced by a user quality and operating efficiency-oriented model,” Lei Xu said during the earnings call, adding that JD will explore and satisfy more user needs with higher standards and goals in 2022.

With direct management of nearly 10 million SKUs, JD further shortened inventory turnover days from 33.3 days last year to 30.3 days, the lowest level in the industry.

Facing the booming and fierce competition brought by live streaming e-commerce, Lei Xu said JD was less affected by its emergence as more customers choose JD for planned consumption.

“JD has complete capabilities of supply chain infrastructure, fulfillment, customer service, platform governance and so on,” Lei Xu said. “Compared with other e-commerce platforms, we can effectively reduce the circulation costs of the supply chain and have a greater differentiation advantage.” Operating with an open-minded attitude, JD is willing to strengthen cooperation with content platforms, and support merchant partners to better operate on these platforms, Lei Xu added.

It’s notable that the growth of third-party merchants accelerated to the highest level on JD.com in the past three years. Meanwhile, the number of new merchants added in Q4 exceeded that of the previous three quarters combined.

JD expects that third-party merchant business will grow faster than self-operated business in 2022 as the company has been optimizing the third-party ecosystem and merchant tools, said Sandy Xu, CFO of JD.com.

“The overall consumption in Q1 or even the first half of the year 2022, will be relatively conservative,” said Sandy Xu during the call. However, she was confident in JD’s performance this year: “Overall, although the retail consumption is currently under pressure to a certain extent, we will deliver higher growth than the industry average.”

JD.com Announces Q4 and Full Year 2021 Results

JD.com Announces Q4 and Full Year 2021 Results