Jun 19, 2020|

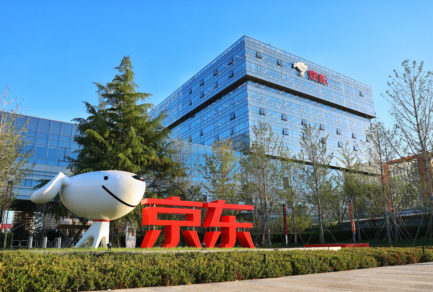

JD Retail CEO Lei Xu’s Interview with Tom Mackenzie of Bloomberg at JD’s Headquarters in Beijing on June 15, 2020

Click Here to view the video report from Bloomberg TV.

Reporter: Thank you very much for your time. Why did JD decide to have a second listing in Hong Kong at this particular time?

Lei Xu: We have achieved over eight-time growth in profit and user number since JD listed in the United States six years ago. The past six years have seen high-speed growth and many changes. Regarding the Hong Kong listing, we took into consideration several factors. First, JD’s main business is mainly in the Chinese mainland region and some countries and regions in Asia. Our primary users, including investors in Asia, might be more familiar with our market. Second, we hope our investors, including those from Asia and China, can have a more in-depth understanding of JD’s business philosophy, services and future development. At the same time, Hong Kong is an important and the best free economic zone in the world. We hope more mature and stable investors and investment institutions can share in JD’s development.

Reporter: How would you like to prioritize the use of the funds that are raised in this IPO?

Lei Xu: JD has witnessed very fast growth in the past six years. However, if you look back six years, JD was not what it is now. Our main business was a B2C shopping website. But now JD has not only transformed into an omnichannel platform, but made significant progress in technology and services. Supply chain is the cornerstone for both JD Retail and JD as a whole – it is time- and cost- consuming. So, we hope to further develop our supply chain capabilities, then we will be able to bring a better experience to consumers. Compared with competitors in the market, JD is better recognized for our user experience. Such experience requires longer-term investment. Let me give you an example. We have invested 15 billion yuan in customer service since the birth of JD. This is why more consumers recognize us and our service. We need to make continuous investment. Meanwhile, Internet technology needs more innovation. Compared with the past, we need to keep up with the times in many aspects and envision the future. We hope to make more investment in technology, which will ultimately result in reduced cost and increased benefit.

Reporter: JD was better positioned during the Coronavirus pandemic largely thanks to your logistics and your services that you were able to offer other platforms or other companies that use your platform. As the economy starts to recovery in China, do you start to lose that advantage to your competitors or can you continue to lead in terms of how you compete with the likes of Pinduoduo and Alibaba?

Lei Xu: With the growth of JD, the open market will see more competitors. I believe each company has its core competitiveness, or its own moat, as we call it. JD’s most solid moat is user trust and reliance. People trust JD for our product quality and service. JD is a supply chain-based retail platform, so we are able to make more values for partners in cost and efficiency. I can’t comment on competitors, however, I strongly believe that China is advanced in digital development. Chinese consumers have better awareness and adoption of digitalized shopping and consumption. Meanwhile, China is a huge and there are many consumers who haven’t turned to digital consumption. These will provide us future growth. There may be many new concepts, like we saw in the 20 years of China’s Internet development different modes, concepts, products, platforms and companies. However, the key factor as to the sustainability of a business is always whether you can provide unique value for consumers, industry partners and stakeholders in the supply chain. I believe JD chose the right path, a long run, instead of a sprint. A span of one or two years can’t predict the future ten, twenty, thirty or even longer years. This is how we understand industry and market, as well as value for consumers.

Reporter: As the economy recovers, do you still hold on to that advantage that you had over your peers?

Lei Xu: First, I have to make a slight clarification. From February to April the worst pandemic period in China, JD provided reliable logistic service and earned wide recognition among consumers. However, this is just a visible aspect of JD, a result of adherence to our philosophy and continued investment. There are also many aspects internally which consumers can’t see of our strong supply chain capability. Consumers can’t see our algorithm, selection of products, inventory optimization, fast product recommendation. Among all these aspects, maybe industry and consumers are prone to labeling JD as a leader in logistics, compared with competitors. Actually, behind this is a complex of technology, product and service. I believe such comprehensive capability, combined with our business philosophy, ensures that JD can have both short-term benefits during the pandemic and sustainable growth in the longer term.

Reporter: 6.18 is JD’s own shopping festival. Last year’s 6.18, JD achieved sales of US$29 billion. Do you have an expectation for this year’s data? Will it be better than last year?

Lei Xu: Because we are a listed company, I can’t give you a sense of concrete figures, but I can share some changes this year. This year, we indeed can see the impact of the epidemic, both domestic and foreign brands were affected by the epidemic in the first half of the year. The overall sales situation is not ideal. 6.18 has become the most important sales opportunity for domestic and international brands and merchants, so compared with previous years, brands participation in this year’s 618 is comparatively higher than in previous years. At the same time, we can also feel that brands which were pretty affected by the epidemic and have inventory pressure in the first half of the year are providing much higher sales discounts than in previous years. In addition, from JD.com, we also see that the overall growth of traffic and new and old users is very fast. Many people still think that JD.com is just a B2C website and a shopping website, but JD.com is actually an omni-channel retail platform based on supply chain. So far, nearly 40% of sales volume comes from innovative channels, that is, channels outside of traditional B2C, such as decentralized sales from online channels, and supply chain empowerment. For example, our offline self-built stores or stores we cooperate with other brands have seen very high sales growth, and so far they have accounted for nearly 40% of our total sales. I think there will be a big change in the sales structure. In addition, there is our services income. Over the past six years since JD’s listing, what we can see is that the proportion of our services income in the whole group continues to increase. This year, whether in our technology, advertising business, or logistics, the growth of our income from services is higher than the overall sales growth, which also shows that we hope to adopt a technology-based approach and become a technical service-oriented company rather than simply a commodity trading company, there is more service ability behind selling goods.

Reporter: From your point of view, is there any change in the consumption trend with the outbreak of epidemic?

Lei Xu: During the whole epidemic, we can see that, first of all, daily necessities, health goods are growing rapidly. Second of all, for some categories are affected by the epidemic, compared with previous years, growth is not particularly strong, such as large household appliances, data that can be seen in the open market, and real-estate, and the door-to-door installation services were impacted during the epidemic. The growth in March and April was not very good. However, with the gradual lifting of the epidemic, we can see that its growth is recovering, and it may not be able to achieve the consumption rebound that people want, but I think it is possible to resume consumption. At the same time, the impact of the epidemic on the entire supply chain is smaller; industries and enterprises with stronger supply chain capacity will be less affected by the epidemic. However, the capacity of the whole supply chain is relatively not very strong, greatly affected by many aspects, such as inventory preparation and product development. But I think with the very obvious easing of the epidemic in the second half of the year, the supply chain capacity of Chinese enterprises as a whole is much higher than that of previous years, and we also believe that in such a large market in China, under the circumstances of scientific control of the epidemic, there should be restorative growth.

From the consumer’s point of view, when consumers are shopping, based on the uncertainty of the future, they may want to see more products when they shop. At the same time, more choices are family-based, and the demand for personal shopping will slowly come down. But the demand for family shopping can basically be maintained. At the same time, in terms of the choice of goods, the consumer is willing to see more products. In the past, he/she may be able to make a decision by looking at a few products. Through our background data analysis, we can see that this is all very normal.

Reporter: JD.com expects sales revenue to grow by 20-30% this quarter. What do you expect the growth rate to be?

Lei Xu: I can’t make a very accurate forecast, because 6.18 is not over yet, and 6.18 is very important for the second quarter. What I can predict is that growth is basically in line with our expectations, and from the point of view of our operations, we are still very confident.

Reporter: Reporter: For you personally, what do you think what is more important for JD.com, your ability or the growth and experience of users?

Lei Xu: First of all, I prefer to stay in a longer period of time and sit in the position of JD.com Retail CEO prefer to take this from a long-term perspective. From the first day, I became CEO of JD Retail, I am looking at the medium and long term. I have a reason. I think there are various ways to achieve a certain number of growth target in the short term, but if it is not sustainable, its growth will be weak at a certain time at a certain point the growth will be weak. Second, if we only pursue the growth of a number growth according to a certain number, bigger problems will arise in the future. So from my point of view, I prefer balanced growth., I will not pursue the improvement or growth of a single number, I prefer to be sustainable. A lot of people asked me (25:10), this, for me, I will think about it, consider everything, I prefer to be sustainable, rather than a single numerical indicator. to be sustainable rather than focus on a single numerical indicator. Perhaps the most important indicator in my mind is not a financial indicator, but a user experience indicator. We look at the overall NPS (Net Promoter Score) every month, whether it is the platform or the merchant’s NPS, or the product quality or customer’s NPS. Because I think that after many companies go public, they will make some short-term judgments because of the influence of capital, and I think what we really have is the user, and it is the user who can go to the end with us, and the user experience. In particular, JD.com is a company based on trust, and user indicators often cannot be displayed financially, but as a business manager, I am more worried about it whether it is sustainable or not being sustainable.

Reporter: Now it is a very competitive market. Pinduoduo is also working hard to enter the market. This is almost one of our strengths of JD.com. Alibaba is also working hard to build its logistics infrastructure. To what extent do you think it is a challenge for JD.com?

Lei Xu: First of all, from Day One when JD.com was established, we were a very open and competitive market. At that time, there might be 20, 30, or even 50 companies about the same size as JD.com. Some of the companies you just mentioned were very large in our view at that time, and they were even bigger and bigger than they are now. Through more than 10 or 20 years of continuous operation, we have become a well-known brand in China with more than 380 million active users. It is true that many new companies will emerge at every stage of the Internet, and now there are more companies that are growing very fast, but I think about whether they can go further and last longer, rather than rely on a short-term sprint. No matter whether it is subsidy or sales transfer, many people still think that JD.com is a digital products-centered e-commerce platform. There are two mistakes. The first is digital products-centered. The second is e-commerce platform. In fact, currently more than one third of our revenues come from fasting moving consumer goods, and we are already the largest retailer in China in many subcategories of fasting moving consumer goods. We are not a pure e-commerce platform. We are a supply chain-based retail platform. Of course, it also reflects that in the minds of consumers, we have a high brand awareness among consumers in certain categories or areas, which is also a good thing. From the operator’s point of view, I will take different actions at each stage. From my personal point of view, I will pay attention, but I will not sway with the wind and dance with them, because I think I should dance with users and dance with myself (JD). I’m not going to dance with them.

Reporter: Pinduoduo did not exist 4 years ago, but now his company’s market capitalization is about the same as yours. What do you think of a company like Pinduoduo?

Lei Xu: I won’t evaluate the competitors specifically, but I think four years ago, in the whole industry, in front of consumers, maybe I didn’t even know that JD.com will do a health business, but now JD Health operates independently in the health industry. If we take 3-5 years as a unit, many things cannot be seen now, so I do not care too much about whether there was a certain company four years ago. Of course, its emergence must have its existence value, but the question is whether this value is sustainable or not. This is not up to me to judge it should be left to the market to judge. As for the market capitalization you just mentioned, I think as a business operator, on the one hand, we need public capital. On the other hand, we should not pay too much attention to capital, because we also see that many excellent foreign companies or century-old enterprises have ups and downs in the capital market, and we even see some companies making some short-term actions for market capitalization management. I think time is the best mirror, and will ultimately reflect that 3-5 years is not enough to explain a lot of problems.

Reporter: JD.com also has its own fresh supermarket in China, 7Fresh. What do you think of the operation model of JD’s fresh supermarket?

Lei Xu: First of all, I think we should not look at the offline stores as a single category. In fact, I think it is inevitable for JD.com to move from a B2C ecommerce platform to an omni-channel retail platform. I made this judgment two or three years ago. We can see that more than 90% of the e-commerce platforms or websites in China were dominated by B2C, but two or three years later, we see that the growth of the whole industry is very fast, but the proportion of B2C has come down, and we see that there are many new models and scenarios emerging. At that time, we can only judge that there are just two ways to go. One way is to continue to adopt a B2C model, and there is still room to do it very well. On the other hand, we need to do something that we are not good at, but from a market point of view, we have to be wherever the users are, so at that time we did some online (34:32), which was the first step. Then we saw that China’s retail market is still very large. So far, online retail has probably exceeded 20%, but we think there is more room for offline. But when we go offline, it doesn’t mean that all we see is money. We have to admit that offline has an offline way of operation. Many traditional retail enterprises have been operating offline for 20 or 30 years, and they have worked hard step by step, and they have their own successful experience. What we see more is whether JD’s ability can enter offline independently, or empower offline partners, which will benefit all of us.

At this time, we think about what kind of enterprise JD.com is. We think we are a digital enterprise, because from the day we were born, all transactions, all data, the whole process is digital. If we can combine these capabilities with offline operations, we will have more market space, business improvement and growth potential, so we begin to try. But so far, we can see offline operations that cannot be found in some first-and second-tier cities, but we have a lot of JD Home Appliance Stores in many fourth-and fifth-tier cities. It is actually a very large incremental field in our home appliances category. Because traditionally online is more mainstream in first-tier and second-tier cities. In fact, for the fourth-and fifth-tier cities, or even to the sixth-tier cities, we need to combine online and offline, because the population density of a single city or region is not large enough. If we want to do it, we need digital and logistics capabilities, commodity capabilities, as well as offline business capabilities. In the field of home appliances, we still run very fast. We also have a lot of cooperation with drugstores, users can place orders online and goods are delivered from offline drugstores. We are also working with the car repair industry, for example, you can change the oil and tires, but we will not send the tires to your home. Instead, we will let you choose one of the offline outlets in our network closest to your home, and the tires will be delivered to the network within a day, so you can change them there the next day. The implementation cost is very low. Offline partners can also get customers, and we have also complete a transaction for the tires.

In terms of the fresh category, we think that the fresh category is a very large category in China, compared with foreign developed countries or regions. In China’s fresh industry, in terms of business model and supply chain efficiency and loss, there is still a lot of room for improvement. We want to create value. Of course, in this process, in the location of our offline stores, because location is indeed a very scientific thing, we also paid some “tuition fees”. In particular, with the impact of the epidemic, in addition to the big stores in the past, especially the small community shops are growing very fast. Why? I think China’s community economy is underdeveloped, because the total population of each community in China is very large, and is actually very suitable for the development of community shops, but in the past, due to a variety of reasons, there are not many services provided in the community or enterprises invested in the community. After this epidemic, I found that many enterprises are very concerned about the community. The community has a small shop, which may be about 150-300 square meters. This kind of fresh shop will also be better. It just so happens that we opened a small shop in Beijing at the end of last year, and the per-square meter efficiency is very high, so this year should be a year of rapid development of the whole fresh industry, including online and offline collaboration. But we still hope to move forward steadily, offline operation requires a certain process and operating laws, and should not be solved quickly by putting in more money. I have seen a lot of cases, in fact, in the process of problem solving, the management ability cannot keep pace. I think we all need to think about this, but fresh is certainly an important next step in the future.

Reporter: How JD leverages cooperation with JD’s two major shareholders, Tencent and Walmart, to compete with rivals online and offline?

Lei Xu: Tencent and Walmart are JD’s two largest and most important shareholders of JD, we cooperated with each other a lot even before the investment. We had many partnerships even before the investment, but because of the investment partnership, we have mutually strengthened our trust in one another and done some projects together which require more intimate partnership than a pure cooperation. Because of the investment, we strengthen our trust and do some projects together, which is tighter than pure cooperation. Set For example, the WeChat market as example, I can understand that some may think that JD’s ability to make good use of WeChat is worse than someone will think JD’s ability to make good use of WeChat is worse than that of other enterprises, while f, but for JD, it is more important to or JD, more importantly is to respect your partner and customers. and to be a company that will not harm hurt the customer experience. Thus we have a lot of cooperation with Tencent, WeChat, Tencent Video as well as content.

Walmart is very typical representative. Their global ecommerce growth is very high, while and China market is among highest growth the China market should be among their fastest growing, while JD is an important partner for Walmart China, including Sam’s Club flagship store on JD. This is because Walmart and Sam’s Club normally open physical stores, which will cover a range of several kilometers surrounded, which will cover the surrounding several kilometers, but while there are still provinces and cities where Walmart couldn’t enter nor open a store hasn’t entered or opened a store. Walmart can introduce many good products, especially their own self-owned labeled products to more customers through JD. Besides, at the same time, JD and Walmart have launched joint membership, for example, combined membership card between Sam’s Club and JD, this, which has also brought a large number of new customers to them. I talked spoke with the head of Walmart China last week, g. Going forward, we want to tighten our cooperation, especially investment in digitization and omnichannel, in order to better serve customers. As for offline fulfillment, JD Daojia (one of China’s largest local on-demand retail platforms by GMV in 2019) is also an important partner of Walmart. That is, in terms of on-demand retail in cities – I think this is now a relatively large new shopping model in China. JD has been assisting Walmart and other supermarkets to promote their digital development.

Reporter: JD is expanding its categories, such as beers, daily necessities, cosmetics, do you think this will bring more customers and orders?

Lei Xu: Of course. If you look at a traditional offline retailer, its inventory shelves will be limited by the physical space, while theoretically, an online shopping platform is unlimited, while customers’ attention is limited. So when we expand our categories, we are not mainly looking at how large the chance is in market, we are looking at whether there’s customer demand, and whether it can be satisfied are looking at whether our customers have need demands and whether we can meet them, rather than how big the market opportunity is. JD started its business to do with IT products, and very beginning, for selling optical disc burners at the very beginning, and gradually expanded expanding to PCs, digital products, mobile phones. Why was JD can able to sell mobile phones online? It’s because at that time, the major sales channels for IT and digital products are were offline digital products malls, and when mobile phones were introduced to the malls, many customers think thought they can buy mobile phones there, and JD also started to sell mobile phones online. Then we started to sell home appliances, which is among the earliest ecommerce companies to sell this category online and were among the earliest e-commerce companies to sell this category online in China, and perhaps earliest globally. Many people weren’t optimistic about us doing this and questioned who will would buy home appliance online? But why I have confidence? Because we think JD can solve industry pain points. But why was I confident. Because we can see that JD’s entry into this industry can solve problems in the industry.

A few years after when JD entered home appliance industry, the industry’s profit margin significantly improved. With the increase of our market share, our profit margins have also improved to a certain extent, because we have improved the cost of many processes in the middle and at the same time, the inventory turnover rate of brands has also improved.

Then we expanded to daily necessities, which is a very large category. We started with the household category, with product such as quilts and pillows, but then we found that most of our users were family users, and many young customers will form a family and raise babies, and when they have children, they will need baby and maternal products, and these goods were highly relevant to the category, but its fulfillment expenses are very high.

So, when we enter an industry, we are not looking at whether the business is profitable. Our baby and maternal category is probably still not profitable today because the category is very huge and SKU-heavy, the fulfillment expense in the whole industry is very low, similar to beverages. But not making money does not mean the category is worthless. If I want to make money, I am more likely to do so by improving fulfillment capabilities. Customers still expect that we can maintain competitive prices.

So, we are constantly expanding our categories based on customer need – if there is demand and we think we can do it well. Any new category will not be profitable at first, and may even lose money. Some of our new categories are still losing money after eight years, but it doesn’t matter. We believe that it be reflected in customer stickiness. We care whether customers recognize our value in each category, and whether we can be Top 3, or even Top 1 in a category. This is our logic.

Reporter: In terms of the economy of China, we are looking at economic growth at its weakest level in the past three decades, there’s pressure on people’s wages, etc. What is your sense of where China’s economy is at now and when consumer demand might start to rebound?

Lei Xu: First, China’s economy is already very large. No matter if you look from country, government or individual enterprise perspective, the high speed growth of the past decades will not come back, so the high-speed growth mentality that we used to have should be abandoned. For now, what we should pursue is high-quality growth. That’s why JD came up with the “Quality Growth” idea in last October, as we hope to be a long-distance runner in this path. Admittedly, the outbreak of epidemics increased the uncertainty in the entire economy. From a data perspective, this year’s numbers might not be as high as last year, but I believe that China is an enormous market, and the growth potential for the consumer base is also huge. For example, two years ago, many people argued about whether there the Chinese market was in a consumption upgrade or a consumption downgrade. I’m a firm supporter for consumption upgrade because the overall shopping trend shows that Chinese consumers are becoming pickier and paying a lot attention of the quality of products. This means a consumption upgrade is happening.

On the other hand, people’s random shopping behaviors are increasing. When we talk about consumption downgrade, it often points to the low-price products that consumers buy in their unplanned random shopping activities. Whereas when they make planned purchases, there is a consumption upgrade, no matter whether we are talking about white-collar consumers in the 1st and 2nd tier cities, or the consumers in the lower tier cities. 10 years ago, there were a lot of no-name products or knockoffs in many 4th and 5th tier cities in China. Today these places have been covered by well-known brands, even in remote regions and rural areas, brand-name products are not rare. This shows a growing trend of brand awareness among Chinese consumers whose demand of better quality products is on the rise. Meanwhile, I believe the Chinese market is resilient enough to withstand short-term fluctuations. In the long term, it will continue to be a hot market for global investors and brands.

Reporter: Is there more that the government could do to support private enterprises?

Lei Xu: I would like to set straight a mindset that the role of a government is not necessarily to support certain enterprises, but to ensure the whole industry can be developed in a healthy and orderly environment. That’s a very good thing the government has been doing. In China, many companies, including internet companies and e-commerce companies have been developed in intense market competition, without preferential policies or market protections. This is helpful to ensure the whole industry and overall market can continue to grow under sufficient competitions.

Reporter: China has gotten trade tensions between the US, Australia and Canada. For you, how much headwinds are there for businesses like JD.com?

Lei Xu: Currently,JD continues to keep close cooperation with our brand and trading partners in the global market, and no major change has been seen. Of course, from my own perspective, I do wish to run our business in a more open market that is beneficial to consumers, manufacturers and traders. We welcome a globalized market mechanism in which all the parties can participate in and build up together. So far we continue to keep close cooperation with our international partners and not much has been affected.

Reporter: Are you concerned about the US’ threat to delist Chinese companies on the US market?

Lei Xu: There is some speculation in the market around this topic which I think we can discuss, but it’s hard to predict what will happen. From JD’s standpoint, we do not wish for this kind of thing happen. We always hope to make even closer economic and trade ties between China and the US, and also with all economies in the world.

Reporter: Has there been any internal discussion about delisting from Nasdaq?

Lei Xu: There is no such internal discussion. It’s a very far away and uncertain thing for us. Right now, we prefer to focus on improving business operations and services for our customers.

Reporter: There are reports that the management of JD is also considering an IPO for JD Logistics and JD Digits. Is there something that could be part of the plan longer term?

Lei Xu: These businesses of JD are very open and have their respective external investors. In our discussion with shareholders and investors, we have the consensus that IPO is not a destination or a finishing line for us, more importantly, when we make decisions on entering a certain industry, we consider if we can bring enough value to it and whether a listing will be helpful for the business’s future development. Thus we do not have and will not set any IPO timing so far. Instead, we will keep monitoring the right timing according both internal and external factors.

Reporter: What is the focus of JD’s overseas strategy?

Lei Xu: From the first day of establishing JD, when it as a very small company at the beginning, when our founder, Mr. Liu Qiangdong (Richard Liu), was still standing at a counter, when there were only 20 or 30 people in the company, he set a goal, that is, to be the most respectable company in the world and to give consumers the best experience, although he did not imagine at that time that JD.com would become so large. Even when the company was small, a founder had such an ambition, to be the most respected company in the world and to offer the best consumer experience.

From the perspective of business operation, we believe that an excellent enterprise should not only develop in one country or region, but also participate in the globalization process. We will consider choosing some of our existing capabilities to enter some countries and regions. For example, using some of our capabilities to solve local problems.

At present, in Southeast Asia, we have e-commerce joint ventures in Thailand and Indonesia. In Europe and the United States, we may focus on logistics. In this process, I think we should first learn and respect the local culture and laws, and we should also have our distinct business models. Different countries and regions are indeed different. China’s local enterprises have to learn and understand this when they enter overseas markets. We have been doing this for many years.

Second is that we need to evaluate whether our ability can solve local problems, because there are often very good and ambitious business goals, but they don’t match your abilities. In this process, we still adopt a more pragmatic approach. In terms of resource investment, we do not look at the short-term one or two years, we hope to plan for the long term.

Third is to open our capabilities to enable others. This is a painful process because previously JD’s model offered closed vertical integrated capabilities. It is precisely this ability that ensures our efficient, low-cost and good user experience. When it comes to opening our capabilities internally and externally, it becomes very challenging to open our systems, ideas, products and communications. Because in the short term, it is not only about cost and investment, but also whether we can really replicate the success of our model in the Chinese market in other countries and regions. That is quite a challenging. We have explored this process for two or three years.

Fortunately, through these adjustments, what we can see this year is that the word-of-mouth and business growth of users has been maintained, especially in the e-commerce business, but we hope for is long-term development, rather than short-term success by capital investment. The world is crazy sometimes.

Reporter: From your perspective, what do you imagine the e-commerce development in 5 and 10 years will be like?

Lei Xu: Although I think the penetration rate of e-commerce in China is already very high, accounting for more than 20%. The proportion is not very high in Europe or the United States. At the same time, I also think that there is room for further growth of e-commerce in China, because behind e-commerce, is digital support. Companies especially like JD which is based on supply chain, can really bring about major changes in the cost and efficiency of an enterprise or industry, if it continues on this road.

In developing countries like China, the overall supply chain efficiency is not high. And it may be the inefficiency of this supply chain that led JD.com, which is based on the supply chain, to become a leading enterprise in the market. But I think traditional enterprises in China (and overseas), need to be further developed. The epidemic, I believe, will improve the digital ability or awareness of traditional Chinese enterprises by at least 3-5 years.

When the digital and supply chain capabilities are improved, you will find that there will be more enterprises like JD.com that mainly focus on e-commerce or online shopping, but most enterprises will operate online and offline (01:05:17). They will have a first-party offline scenario and an online scenario that is user centered focused on user development, maintenance and operations, including the entire supply chain.

Because China’s manufacturing capacity is indeed very strong, but there is still a lot of room for improvement of supply chain capabilities, including logistics capabilities, in the circulation process.

Therefore, we think that if we look at the industry in 10-year or 20-year cycles, digital capabilities, digital supply chain and digital operations capabilities can bring better development to China’s large, medium and small enterprises, and it will be low-cost, more efficient and sustainable development.

JD Connects with Coca-Cola Online to Celebrate the 618 Grand Promotion

JD Connects with Coca-Cola Online to Celebrate the 618 Grand Promotion