Mar 9, 2020|

In Depth Report: JD Pet Happily Spoils Their “Customers” (Part One of Two)

by Rachel Liu

The coronavirus outbreak has caused a significant surge of demand in daily necessities, health products and fresh produce among Chinese consumers, especially on e-commerce platforms since many people are reluctant to leave their homes. At the same time, demand from another group of “customers” cannot be ignored: pets.

Family members

Pets are important family members and sometimes even experience “role reversal” with their masters. JD’s pet products category saw a jump in sales during the epidemic, especially in the categories that are needed daily, such as pet food, snacks, cat litter and dog diapers (since pets are not able to go out as often either).

JD’s commitment to maintain delivery during the Chinese New Year holiday for the 8th consecutive year has enabled many pet owners to take good care of their animal friends during the epidemic. Many brands have also benefited. A popular multinational pet food brand saw over 100% year-on-year increase in sales during February, and even already achieved its Q1 sales target.

JD’s pet business – including chiefly pet food, products and services – had been growing rapidly even before COVID-19 occurred. Established four years ago, the business department has experienced compound annual sales growth of over 70% (meaning each year sales growth was over 70% higher than the year prior). JD Pet seeks to be the one-stop shop platform for pet lovers to find quality, suitable, and satisfactory products and services.

“Pangpang” (chubby), a golden retriever belonging to Haiyan Cao of JD Pet’s marketing team

More disposable income, huge market

The Chinese pet market has reached sales of over 200 billion RMB in 2019, increasing by 12% compared with 2018. According to China’s Pet Industry 2019 White Paper published by goumin.com, the number of pet dogs and cats in China reached about 10 million in 2019, increasing 8.4% year-on-year, with about 23% of families having pets.

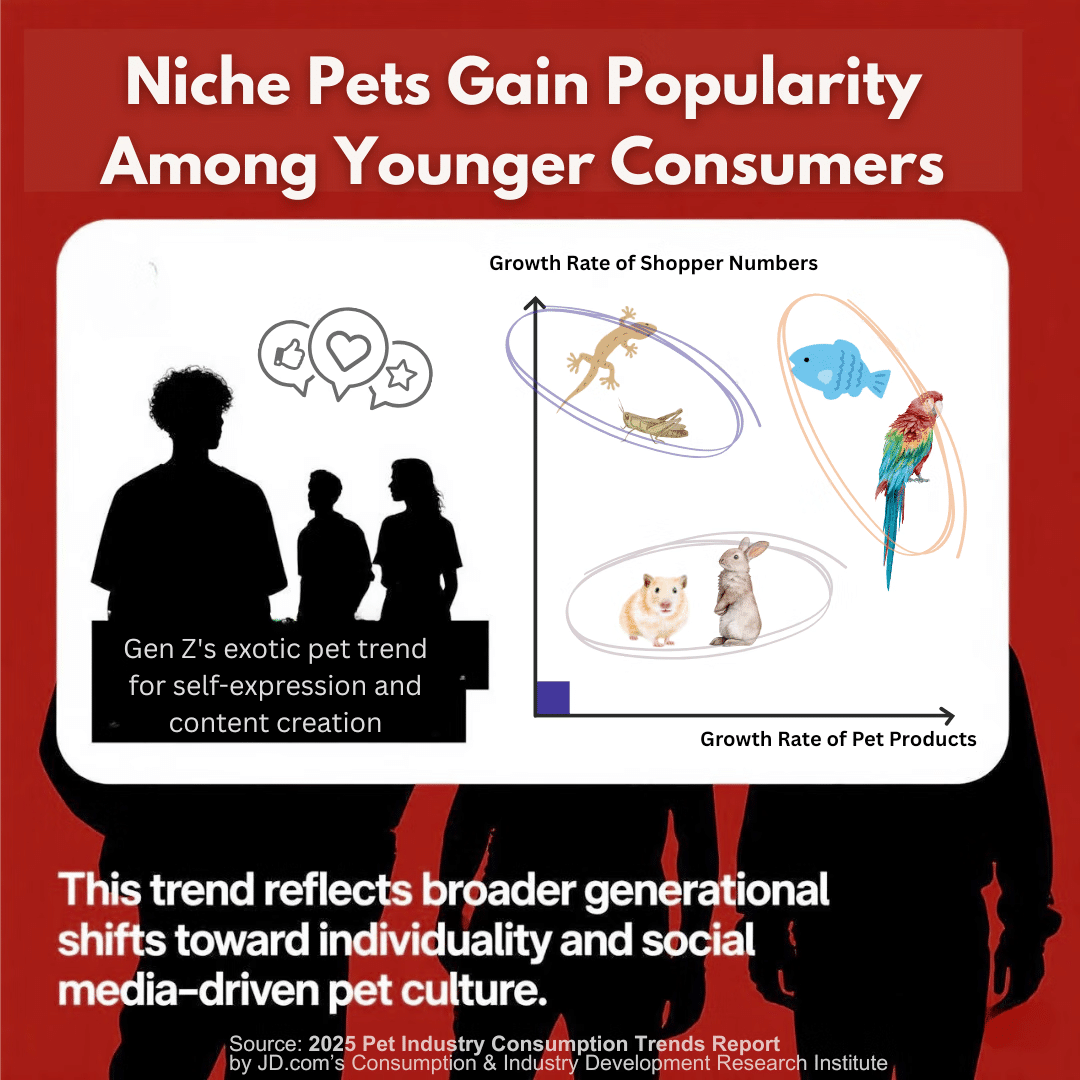

There are mainly three reasons for the increasing popularity of pets in China. The most important one is the growth of China’s economy and people having more disposable income, which gives them extra money to raise pets and provide better care. What’s more, the elderly who don’t live with their children and the number of young people living alone in cities is on the rise. These two cohorts are both looking for companionship that pets can provide. Having pets is becoming part of the integral culture especially among white collar professionals in top-tier cities. This is chiefly because apart from companionship, pets also provide them a way to express themselves. Lastly, the Internet is disseminating “pet culture”, educating customers and providing advice on how to raise pets well.

The e-commerce penetration rate in China is 20.7%, almost twice as high as in the U.S. Chinese consumers are more used to getting everything they need online. According to Internet Retailing, a global research institution, online sales of pet products in China account for 42.9% in 2019, while its only 16.1% globally. The market opportunity for pet e-commerce in China is astounding.

The emergence of the “cat economy”

China is now embracing the age of the “cat economy”, with more people choosing cats over dogs. The numbers of pet cats around China increased 8.6% year-on-year in 2019, surpassing the growth rate of dogs, which is at 8.2%. The phrase “cat lady” may have some negative connotation with some outside China, but in modern Chinese society (especially among those born after 1985 and 1990) having a cat (or several cats) is a symbol of happiness and contentment. Chinese cat keepers usually call themselves “cat slaves”– they like to see the elegant, independent animal as their master, instead of vice versa. Another nickname of cat keepers is “Poo-poo-cleaning Officer” – more uncanny evidence of the high family status of cats.

The 2019 China Pet Products Consumption Report released by JD and Nielsen in November 2019 points out that the future development of China’s pet market will be similar to Japan, where the “cat economy” is already mature. In Asian countries, the working hours are usually longer than in the West. Most people return home exhausted and do not have the time or energy to walk dogs. Most Chinese people live in apartments instead of houses with yards, so cats that require smaller space than dogs became more suitable as pets.

Heyang Liu of JD Pet’s sales team, with his cat “Miss”

JD’s big data shows that the sales growth rate of cat food is over twice as high as dog food. Chinese consumers are focusing more on the health of their cats and on the food they eat, so they are willing to pay a premium for healthful, wholesome food, as well as pet disinfectant products that will help their cats live longer and healthier lives.

Amo Wang, a 27-year-old marketing professional in Beijing, has a three-year-old cat. She shares: “I always buy the most expensive cat food and snacks that I can afford, because this will help my cat stay healthy and energetic. I also buy him a lot of health supplements such as nutrition cream. It costs a lot of money but he is more than just a cat to me. He is my family member now, and it worries me so much every time he gets sick.”

A trusted platform for pet lovers

JD Pet has covered almost all types of pet-related products and services in the past years while developing the business. These include pet food, snacks, toys, clothes, daily products, smart products, OTC drugs and services such as bathing, grooming, vaccines and sterilization. Customers turn to JD for trusted products, one-stop shopping experience, fast delivery service, and a platform that always strives to understand more about them and their animal friends.

China does not have large chain pet supermarkets like Petco in the US. If unable to shop online, customers can only go to the mom-and-pop stores in their neighborhoods or pet hospitals. There are usually limited choices, and it’s not easy to carry 20kg of cat food back home.

“I always shop on JD for cat food and cat litter,” said Molly Zhang, a cat owner who lives in the suburbs of Beijing. “There are not many pet product stores around my place, and my job is so busy that the stores are always closed when I finish work. On JD I can shop anytime and the products arrive the same or next day. It delivers to my door step so I don’t have to carry the heavy cat food alone home.”

When it comes to feeding their animal friends, pet owners wouldn’t want to risk buying counterfeit pet food. Especially with more customers looking for high-end, international brands, it’s essential to have a platform that offers simplicity as well as peace of mind. JD’s retail model purchases products directly from brand partners, stores them in its own warehouses and delivers them through its self-built logistics network, which ensures product authenticity. “I never buy cat food from ‘Daigou’ (purchase agents),” said Wang: “It’s too hard to tell if they are counterfeits or not. I just buy them from JD because I know they are authentic.”

JD’s commitment on authenticity and unparalleled delivery service also won trust from partners. Now JD has partnered with major Chinese and international brands including Royal Canin, Nestlé Purina, Mars Petcare, Bayer, and Nature Bridge, while JD is also the largest retail channel for many of above mentioned brands in China. Lots of brands have chosen JD to be the first channel to launch their new products. On February 28th, JD became the first platform in China to launch Bayer’s Drontal tablets for cats. In 2017, JD became the first e-commerce platform to receive authorization to sell pet medicine in China. In 2018, it became the first ecommerce platform in China to directly partner with the world’s top three animal health brands: Bayer, Zoetis and Boehringer-Ingelheim.

Nestlé Purina’s popular Fancy Feast canned cat food, sold on JD

Pet lovers run the business

JD’s retail model means that the company needs to be responsible for selecting and introducing the products that customers want the most, so it can constantly attract new customers and generate more customer loyalty. The pet business team has a group of experienced professionals who keep track of the changing consumer trends and actively explore the best brands and products. Each of the 30 members of the team even has their own pet, and they are collectively caring for one lizard and two hedgehogs in their office area. Lucy Zuo just took charge of the team a few months ago after leading another department in JD, and she is already planning to have two pets.

Peizhe Li, head of JD Pet’s sales team, joined the team in 2016. Before that, he worked in the electronics department for seven years. “I chose to move to the pet team because I think the pet market in China has great potential, and I can use my experience here to help the business grow,” he said. Having a three-year-old dog named Tiantian (sky), he always shops on JD for all kinds of pet products and sees how to improve the customer experience through being a customer himself.

Capturing the development of the “cat economy”, Li and his team have been working hard on introducing more popular brands among cat owners and co-developing products with brands. For example, they introduced Canadian high-end pet food brands Orijen and Petcurean Go!, and provided traffic and marketing support to the two brands. In 2019, sales of Petcurean Go! on JD increased 300% y-o-y. During JD’s Singles Day shopping festival (Nov.1st -11th ), brand sales increased 23 times y-o-y. For brands that traditionally focus on dog products, like Nature Bridge and Myfoodie, they encouraged them to develop more cat products. In 2019, the sales growth of the brands was mainly driven by cat products.

More and more consumers are feeling that providing only basic pet food is not enough. They want to spoil their pets with all kinds of snacks, toys, clothes and grooming products. Li and his team are also working hard on introducing these products, especially through third-party merchants, because they can provide more diverse products and new brands. Cat lollipops, pet hot pot, pet ice cream, pet beer, and pet shampoo for sensitive skin…these are some of the hot-selling products on JD. Smart pet products such as drinking fountains for cats, automatic feeding machines and heated cat beds are also popular. In the first hour of this past November 11th, sales of smart pet products increased 69 times y-o-y.

A cat drinking fountain

What else has the JD team done to enrich their understanding of the preference of pet owners and even their pets? How did they work with brands to meet customers’ changing demands? And, although e-commerce is soaring in China, customers still feel the need to go to offline stores and hospitals. How can a company provide a true omnichannel shopping experience for customers? Stay tuned for part two of this article to find out.

(Part one of two)

This Harbin tourism boom has also spurred a surge in sales of winter apparel. JD.com’s data indicates a rapid growth in the sales of warm clothing items such as down jackets, snow boots, and thermal underwear between January 1st and 7th. The sales growth is especially pronounced in southern provinces and cities such as Jiangsu, Zhejiang, Guangdong, Sichuan, and Shanghai. Notably, tall snow boots registered a 206% year-on-year increase in transactions, while padded cotton caps and thickened long down jackets soared by 158% and 134%, respectively. Beyond clothing, travel gear has also seen a considerable uptick, with a 98% year-on-year growth in transactions for large suitcases and travel backpacks in these southern regions.

This Harbin tourism boom has also spurred a surge in sales of winter apparel. JD.com’s data indicates a rapid growth in the sales of warm clothing items such as down jackets, snow boots, and thermal underwear between January 1st and 7th. The sales growth is especially pronounced in southern provinces and cities such as Jiangsu, Zhejiang, Guangdong, Sichuan, and Shanghai. Notably, tall snow boots registered a 206% year-on-year increase in transactions, while padded cotton caps and thickened long down jackets soared by 158% and 134%, respectively. Beyond clothing, travel gear has also seen a considerable uptick, with a 98% year-on-year growth in transactions for large suitcases and travel backpacks in these southern regions. Can’t sell? JD’s Live Streaming Makes a Big Difference

Can’t sell? JD’s Live Streaming Makes a Big Difference