Feb 8, 2021|

In-depth Report: Cross-border Ecommerce Rises on JD Amid Pandemic

by Kelly Dawson

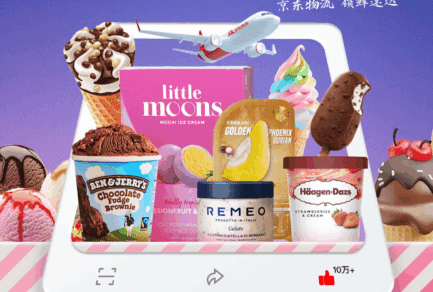

The pandemic has accelerated online shopping and created a surge in cross border-ecommerce imports in China due to travel restrictions that have prevented shoppers from buying luxury and other products abroad.

“With the pandemic keeping customers from shopping overseas, the demand for international brands in China has increased, and cross-border ecommerce platforms have become their preferred choice,” said Frank Yu, general manager of marketing and operations for JD Worldwide, JD.com’s platform for imported products.

According to China’s Ministry of Commerce (MOFCOM), consumer goods imports to China grew 8.2% in 2020, reaching RMB 1.57 trillion yuan (US $242.1 billion). This growth was echoed on JD Worldwide during the 2020 Singles Day Grand Promotion, with total sales during the festival increasing by 50% YOY.

A driving force: “Be kind to yourself”

Popular categories included self-care, beauty, health and luxury, which experts speculate is due to increasing health-consciousness and self-care resulting from the stressful conditions of the pandemic.

“With consumers increasingly concerned about health and quality of life, products catering to the desire to ‘be kind to yourself’ have become a new growth driver,” said Tianbing Zhang, Deloitte APAC Consumer Product and Retail Sector Leader, in a new report from Deloitte.

For many consumers, this has translated as a focus on international brands associated with higher quality. During the current Chinese New Year Grand Promotion, international branded health products are leading in sales rankings with a YOY growth rate of over 343%; and JD’s 2020 Singles Day Grand Promotion saw sales for imported healthcare products increase by five times in the first 30 minutes of the festival. Foreign infant milk powder brands Maxigenes, Devondale and Nestlé also saw sales spike during the festival.

Additionally, self-care has become a major sales driver. JD Worldwide’s Black Friday sales of self-care products increased YOY by over 180%; makeup products by four times YOY; and luxury bags by 93%. The three most popular brands in the self-care category were foreign brands Kao, Shiseido and Ryo.

“I’m confident that we’ll continue to see a strong level of personal investment in health and wellness,” said Jerry Clode, founder of brand strategy agency The Solution, in an ecommerce report by digital marketing agency Alarice. “Importantly, this will continue to be weighted towards international brands in terms of premium ingredients and products, supplements, skin care products and dedicated products for children.”

While in the past many consumers preferred to purchase luxury and high-end products in store, growing trust in ecommerce platforms like JD combined with competitive prices has made it both convenient and safe to shop online. Many foreign brands do not have brick and mortar stores in China.

Other factors have also fueled the increase in imported sales online. “Post-lockdown ‘revenge spending’ has also fueled the consumption of imported goods from popular travel destinations,” Zhang added in the Deloitte report. “Additionally, the boom in celebrity livestreaming has spurred cross-border e-commerce purchases by domestic consumers. Finally, overseas brands are moving to cross-border e-commerce platforms as they expand their distribution channels in light of disruptions to offline retail.”

Expanding channels for growth

As the only major economy to grow in 2020, China has been a particularly attractive market for foreign brands trying to find new channels for growth during the pandemic. Recognizing this development, China has also announced some preferential policies to support foreign brands, including lower import taxes and expanding the approved range of imported goods.

JD Worldwide has also ramped up efforts to support foreign brands in multiple areas. Navigating e-commerce operations in the Chinese market can come with a steep learning curve, so in 2020 JD Worldwide offered online training sessions to hundreds of foreign brands and merchants on store operations targeting pain points.

For example, AMPLEUR flagship store, a store focused on beauty products, saw its daily sales double after participating in JD Worldwide’s trainings. The store was launched on JD over a year ago, but before the course it had been troubled by low marketing ability and poor sales performance. After taking the training specifically designed for cross-border beauty brands, the store leveraged big data analysis to understand that most of the customers found the store through searching for the name of the brand. After increasing exposure of the brands’ name, the store doubled its daily sales during the Singles Day Grand Promotion(Nov 1-11).

Complicated logistics transit and high warehouse management fees can also be barriers to entry for overseas merchants. In the event of an order mix-up or a damaged product, customers previously found the return process to be overly complicated, resulting in poor customer feedback. In response, JD Worldwide has developed logistics solutions to help merchants like Electronic Partner, which moved all of its products to JD Logistics’ warehouse in Hong Kong, resulting in lower costs and significant improvement in both order collecting speed and fulfillment satisfaction ratings.

Additionally, JD Worldwide launched a smart operation tool in October to help stores analyze performance bottlenecks to provide customized suggestions through algorithms.

As the market changes, customers’ tastes and preferences are also changing. While foreign brands may carry an association with being high quality, the type of customers that are willing to spend more to acquire foreign products has expanded.

New demand

The rise in demand for international brands is mainly driven by younger consumers and people living in lower-tier cities, including tier-3 and below cities, according to the Deloitte report.

Foreign niche brands are mostly consumed by a population of young, active women, mostly students and makeup enthusiasts who have independence to make purchase decisions, according to the ecommerce report by Alarice. Younger Chinese consumers are also more inclined to consider product quality.

“Coming out of COVID-19, Gen Z will be an essential barometer to assess how Chinese consumers consider international brands moving forward,” said Clode of The Solution. “More global than their older generations, Gen Z will be key to maintaining the premium status of international brands in categories such as luxury, autos and travel.”

Rising demand in lower-tier markets is becoming a significant growth driver. Whereas demand for luxury and foreign brands was once primarily centered in tier-one cities, people in lower-tier cities are now also increasingly health-focused, which has translated to a higher willingness to pay more for imported products, according to the Alarice report.

“Peace of mind”

Also essential to the success of JD Worldwide is consumer trust in JD’s commitment to fighting counterfeits. According to a survey of Chinese consumers conducted by iResearch consulting firm in 2020, JD is rated the most trustworthy ecommerce brand in China, with 56.56% of respondents tagging JD with the keyword of “trustworthy”, followed closely by “high-end” and “highly efficient.”

To further bolster its guarantee of 100% authenticity, JD Worldwide adheres to 35 “peace of mind purchase” initiatives to guarantee product quality and improve the overall consumer experience. These initiatives are split into quality control and after-sales service. To break it down, there are six pre-sales quality control measures, seven during the sales process and twenty-two after sales. This rigorous standard is a best practice for the industry, and demonstrates JD’s absolute commitment to building the most comprehensive and reliable cross-border ecommerce platform for top brands from around the world.

JD Home Appliance Stores to Stay Open During CNY

JD Home Appliance Stores to Stay Open During CNY