May 11, 2020|

In-Depth Report: JD Big Data Show Higher Earning Chinese Buy Domestic Brands

by Yuchuan Wang and Ella Kidron

Every year, May 10th marks China’s online “Chinese Brands Day” shopping event. This year, coinciding with the cyber holiday, JD’s Big Data Research Institute released a trends report looking at consumption of domestic brands in 2020. According to JD’s data, from January to April this year, transaction volume for 572 brands on JD’s platform surpassed RMB 100 million, of which 490 are domestic brands. Transaction volume for 230 brands surpassed RMB 300 million, 79 of which are domestic brands. Among the 151 brands that surpassed RMB 500 million, 125 are domestic brands.

Below are some of the key takeaways from the report, followed by an in-depth analysis.

- Domestic brands gradually become Chinese consumers’ top choice as quality keeps improving.

- Proportion of domestic brands consumption increases year-by-year in 1st-tier cities as more well-educated and well-paid consumers buy more.

- Female consumers aged below 25 pay more for and pay more attention to domestic brands.

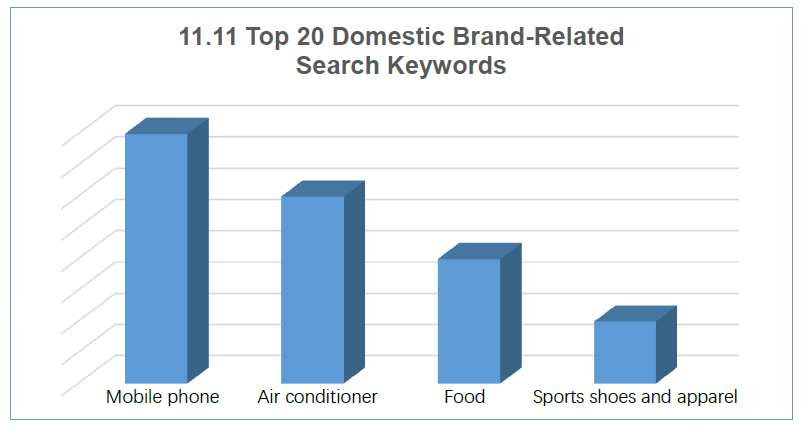

- Consumers are still more aware of domestic mobile phone brands.

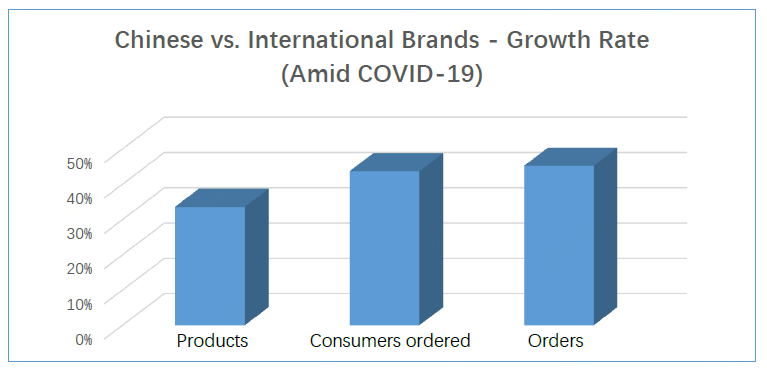

In 2019, the year-on-year growth rates of domestic brands in terms of the amount of products, brands, and orders are all 20%+ higher than those of international brands. In Q1 of 2020, impacted by COVID-19, the growth gap was further expanded to 30%.

In Q1 2020, transaction volume of domestic fresh food on JD increased by 156% compared with the same period last year, of which the transaction volume of meat (pork, beef and mutton), vegetables, poultry and eggs increased by 655%, 183% and 166%, respectively. At the same time, the consumption proportion of meat, frozen food and instant deli increased the most. For example, the proportion of meat transaction volume increased by more than 20%, and has become the top fresh food category, exceeding fruit and seafood.

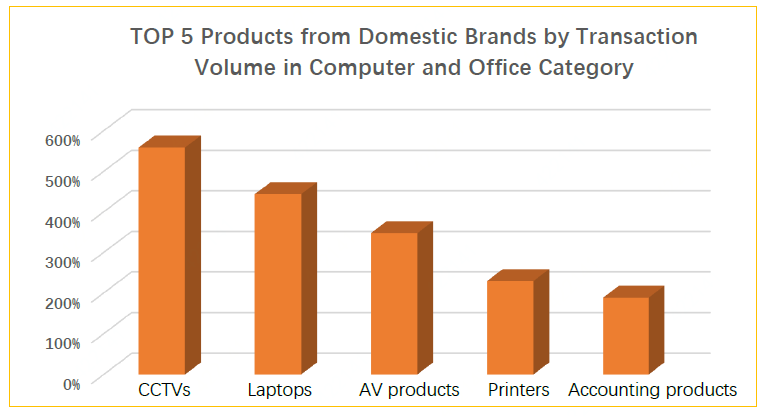

Transaction volume for bakery supplies increased over 10 times on a yearly basis as people choose to cook at home during quarantine. The transaction volume of computers and office products also increased 109% year-on-year.

Thanks to the local supply chain for protective products, transaction volume of masks in the first quarter increased over 10 times compared with the same period last year. Family care products, masks and glucometers became the top products in the healthcare category.

In addition, SMEs are benefiting from social group e-commerce, which has been pulled under the spotlight as a trendy new way to shop in China while stuck at home through recommending products to friends, customers and others in close proximity. In the first quarter, the number of orders from domestic brands through this new way of shopping was 20% larger than that of international brands.

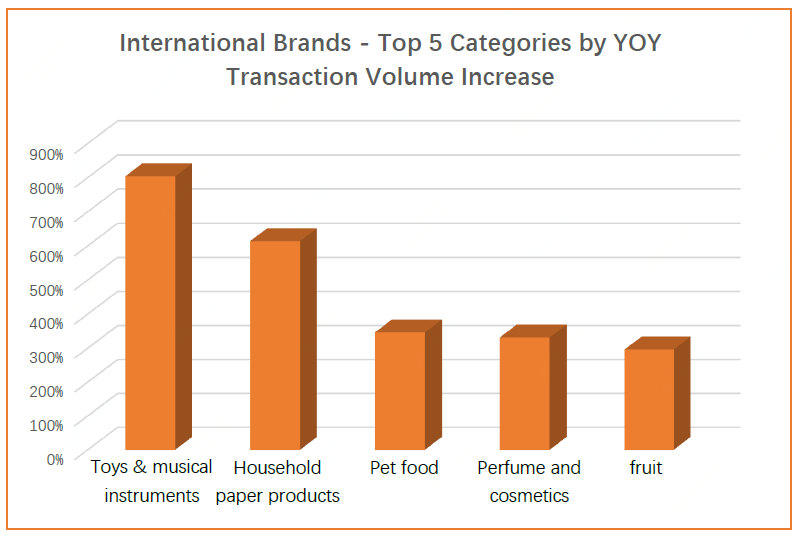

In terms of looking at transaction volume for domestic vs. international brands for the whole of 2019, the proportion of domestic brands in categories including maternal and baby, sports and personal care increased rapidly. In particular, facial cleaning products, female care products and other categories exceeded over 150% on average. Imported products grew the most in categories such as toys and musical instruments, cleaning and paper products.

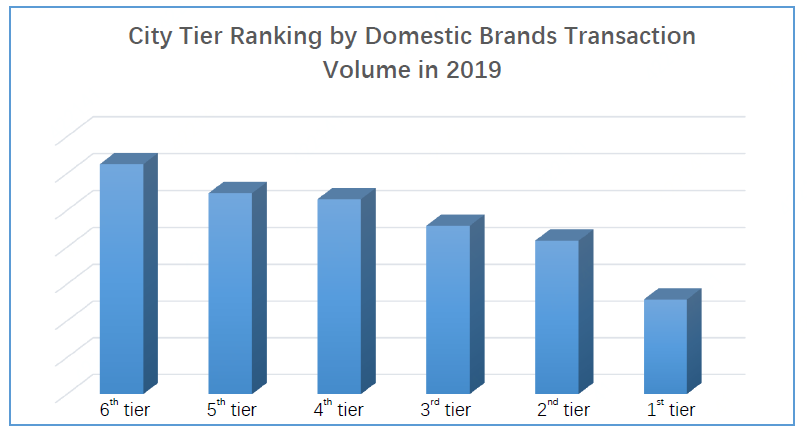

In 2019, e-commerce channels continued to help domestic brands reach the lower tier markets. Fifth and sixth tier cities remain the primary driving force of consumption of domestic brands. That said, the situation is quietly changing in first tier cities. For example, in the Shanghai area, domestic brands are embracing domestic brands more. Looking at the growth in proportion of consumption made up by domestic brands, Shanghai is already in the top five despite the fact that transaction volume of international brands in Shanghai remains second only to Beijing.

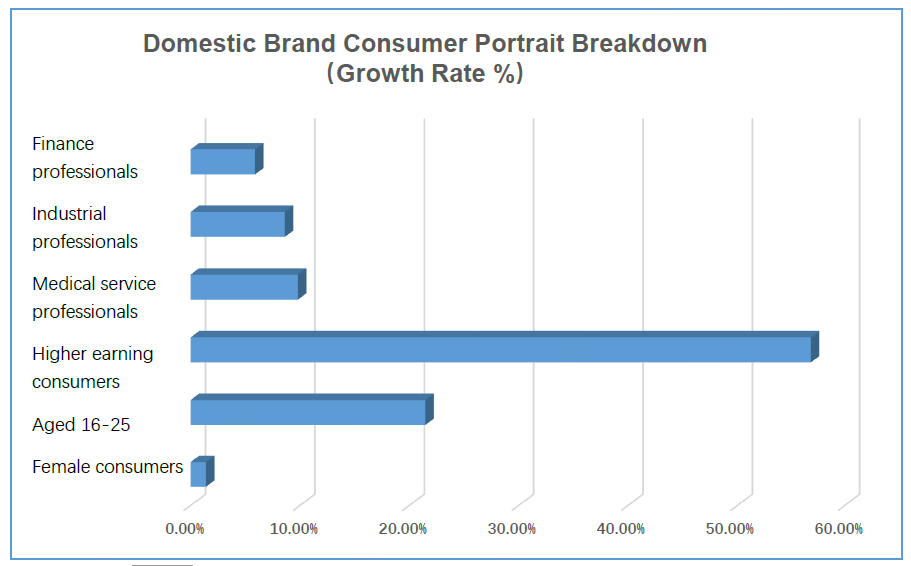

In terms of occupation and consumer groups, the proportion of goods from domestic brands purchased by medical and financial professionals is growing rapidly. In general, domestic brands are attracting more high-income consumers. From an age and gender perspective, young female consumers born after 1995 pay increasingly more attention to domestic brands.

In 2019, 94.27% of consumers of domestic brands were shown to be sensitive to product reviews, indicating emphasis on product quality and the general pursuit of high-quality consumption.

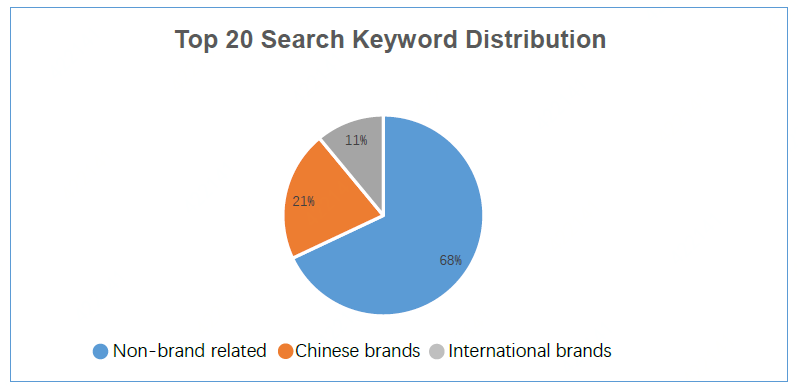

32% of the top 20 key words searched were directly related to brands, among which domestic brands accounted for 10% more of the search terms than international brands. According to search word data from Singles Day (November 11th), recognition of domestic mobile phones is relatively high.

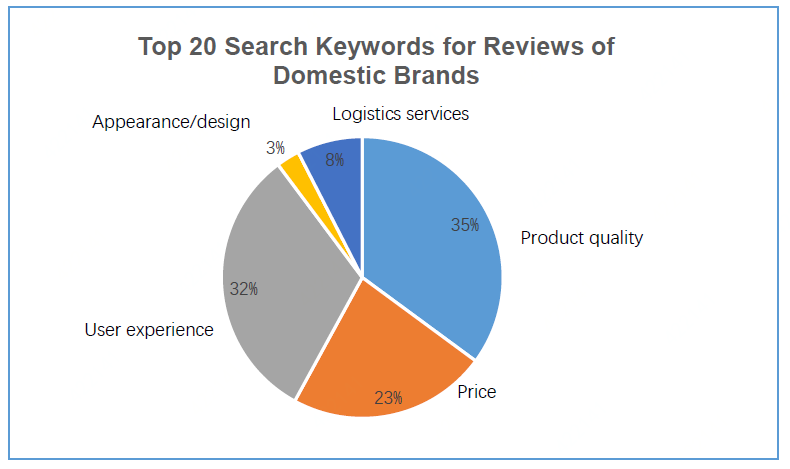

Looking at the top 20 keywords used in product reviews, brand quality and use experience are of top of mind for consumers, followed by price and service.

Zhao Ping, Director of the International Trade Research Department at the China Council for the Promotion of International Trade, believes that lower tier markets have huge consumption potential, and that compared with consumers in first and second tier markets, they will have higher requirements in terms of performance-to-price ratio for goods. At the same time, they are an “acquaintance society” (meaning that familiarity with a person or brand may have a better chance to drive a purchase), so the word of mouth regarding the product’s quality is particularly important. She adds that Chinese brands, especially small- and medium-sized enterprises can invest in bringing more goods with a favorable price-to-performance ratio to seize the opportunities presented by the lower tier markets, bringing them both a clear development path and a way to deliver more value to consumers.

(yuchuan.wang@jd.com; ella@jd.com)

This Harbin tourism boom has also spurred a surge in sales of winter apparel. JD.com’s data indicates a rapid growth in the sales of warm clothing items such as down jackets, snow boots, and thermal underwear between January 1st and 7th. The sales growth is especially pronounced in southern provinces and cities such as Jiangsu, Zhejiang, Guangdong, Sichuan, and Shanghai. Notably, tall snow boots registered a 206% year-on-year increase in transactions, while padded cotton caps and thickened long down jackets soared by 158% and 134%, respectively. Beyond clothing, travel gear has also seen a considerable uptick, with a 98% year-on-year growth in transactions for large suitcases and travel backpacks in these southern regions.

This Harbin tourism boom has also spurred a surge in sales of winter apparel. JD.com’s data indicates a rapid growth in the sales of warm clothing items such as down jackets, snow boots, and thermal underwear between January 1st and 7th. The sales growth is especially pronounced in southern provinces and cities such as Jiangsu, Zhejiang, Guangdong, Sichuan, and Shanghai. Notably, tall snow boots registered a 206% year-on-year increase in transactions, while padded cotton caps and thickened long down jackets soared by 158% and 134%, respectively. Beyond clothing, travel gear has also seen a considerable uptick, with a 98% year-on-year growth in transactions for large suitcases and travel backpacks in these southern regions. JD Data: Chinese Consumers Are Creating More Comfortable and Healthy Living Space

JD Data: Chinese Consumers Are Creating More Comfortable and Healthy Living Space