Apr 15, 2021|

JD Books Report: Impact of COVID-19, Gen Z and Lower-tier Markets in China

by Vivian Yang

In the face of COVID-19, Chinese people spent more time reading in 2020, with a prominent increase of interest in health-related books. Meanwhile, young people from lower-tier cities demonstrated strong consumption potential in the book market, according to the 2020 China Book Market Report co-produced by JD Books and iResearch and released on Apr. 14.

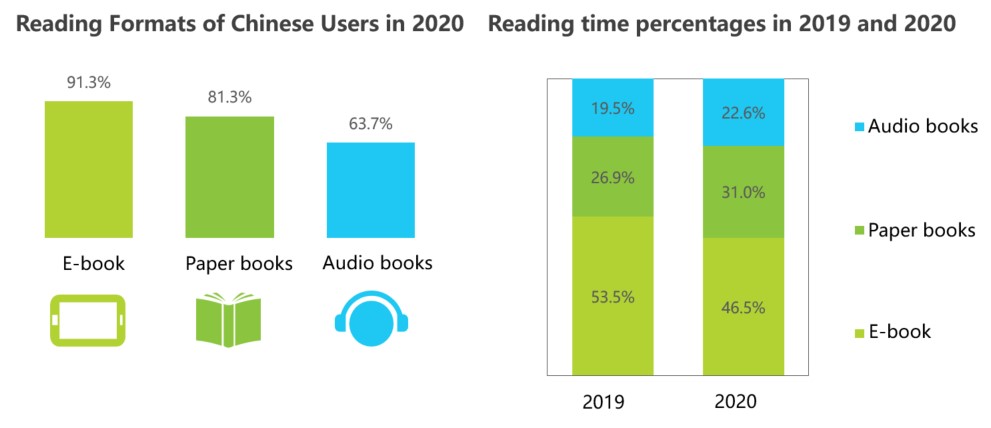

The report shows that 46.1% of survey respondents increased the time reading paper books, 59.6% increased their e-book reading time and 58.8% increased their time listening to audiobooks.

The number of buyers of all three types of books achieved 40% YOY growth, and overall consumers are spending more on books. The majority of respondents to the survey in the report spent RMB 200-500 yuan on books in 2020, accounting for 43.6% of overall book buyers. And the number of users who spent over RMB 500 yuan on book shopping increased by 6.1% compared with 2019. The per capita book spending in 2020 rose by 3.3% compared with 2018.

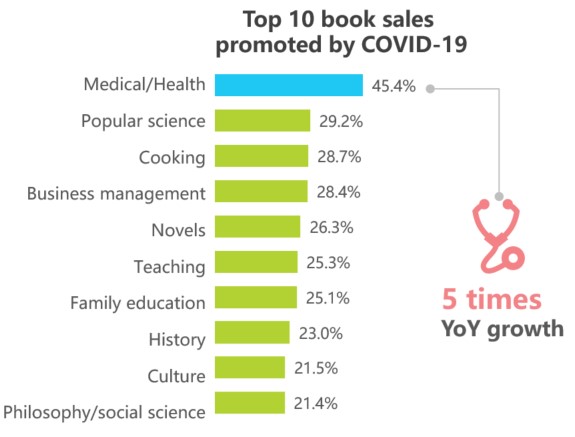

The pandemic contributed to a 45.4% sales boost on medical and healthcare books. Sales of books on preventative medicine and hygienic topics reached 5 times YOY growth.

“People’s reading media become more diversified and integrated,” said Daisy Wen, senior consulting manager of iResearch. “Not only do they spend more time on reading in general, but the time difference that they spent among paper, digital and audiobooks is narrowing.”

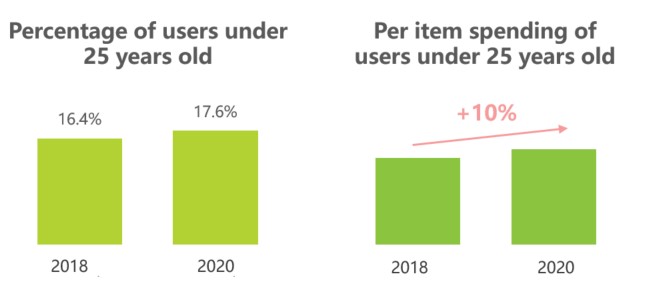

The rise of Gen Y and Z’s spending power in the book market, especially those from China’s lower-tier cities, is a key finding of the report. Book buyers on JD Books under 25 years old have increased from 16.4% in 2018 to 17.6% in 2020, with per-item spending going up by 10% from 2018.

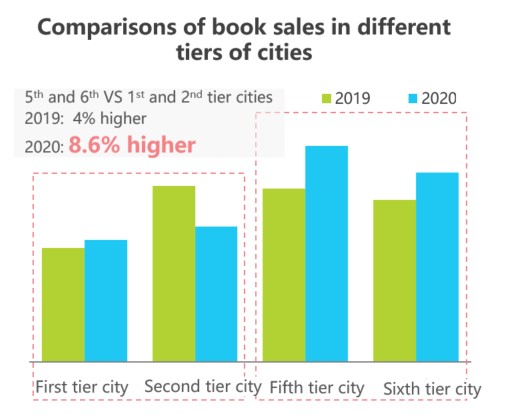

At the same time, the number of this group of young users from sixth-tier cities has increased 24% more than their peers from first-tier cities, driving the growth rates of the fifth to sixth-tier cities versus the first to second-tier cities to widen from 4 to 8.6% in a year.

In terms of purchase channels, the report shows that online and physical book stores account for 79% and 21% of book retailing sales respectively, meaning that online book shopping has become the mainstream. But this does not mean a conflict— rather instead, a growing book shopping experience that combines both online and offline resources.

“66.5% of online book buyers still express their willingness to go to offline book stores to enjoy an immersive reading experience. And 96.4% users said they will consult book recommendation lists online when purchasing books offline,” Wen added.

To adapt to these trends, JD.com will continue to develop its omni-channel platforms to satisfy customers’ needs with services including one-hour fast book delivery service, supply chain support via various terminals to small book store owners, livestreaming programs to promote interactions between authors and readers, according to Min Lei, general manager of JD Books, Culture, Education and Entertainment.

JD Worldwide and TMG Announce Cooperation

JD Worldwide and TMG Announce Cooperation