JD.com announced impressive Q2 2025 financial results on August 14 highlighting robust growth, key milestones, and a deep commitment to social responsibility. They underscore the company’s success in strategic initiatives and solidify JD.com’s leadership in retail and innovation. Read our full report.

Strong Financial Performance Across Sectors

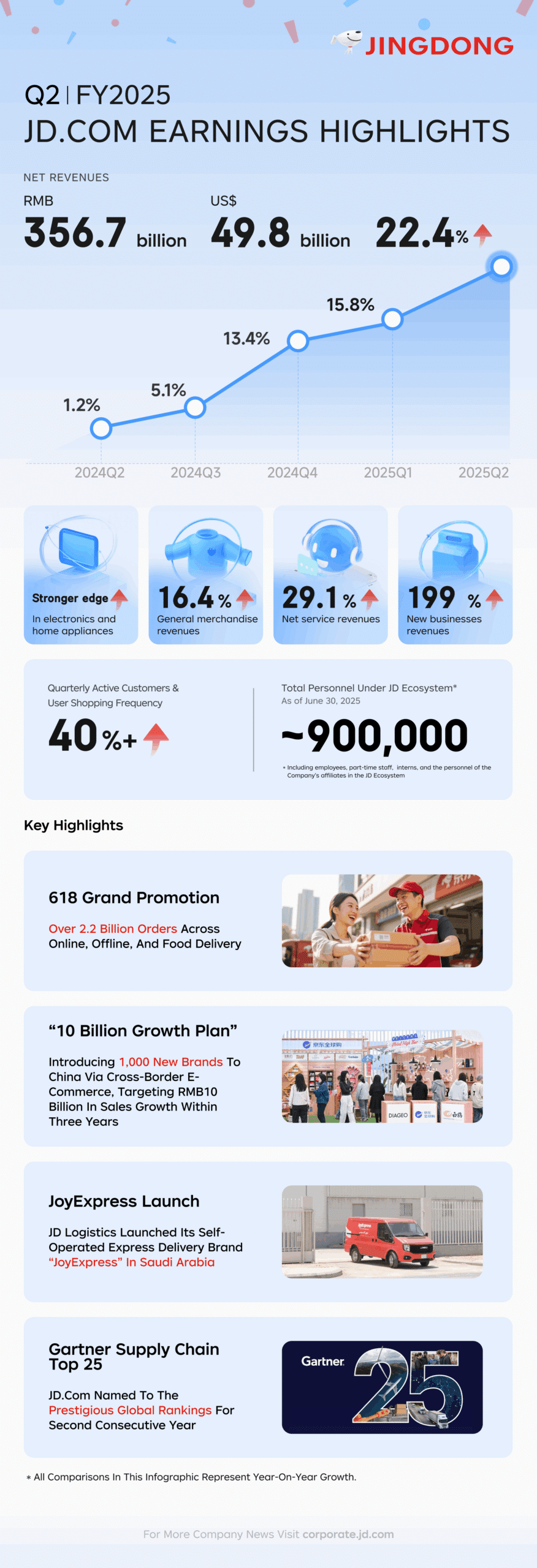

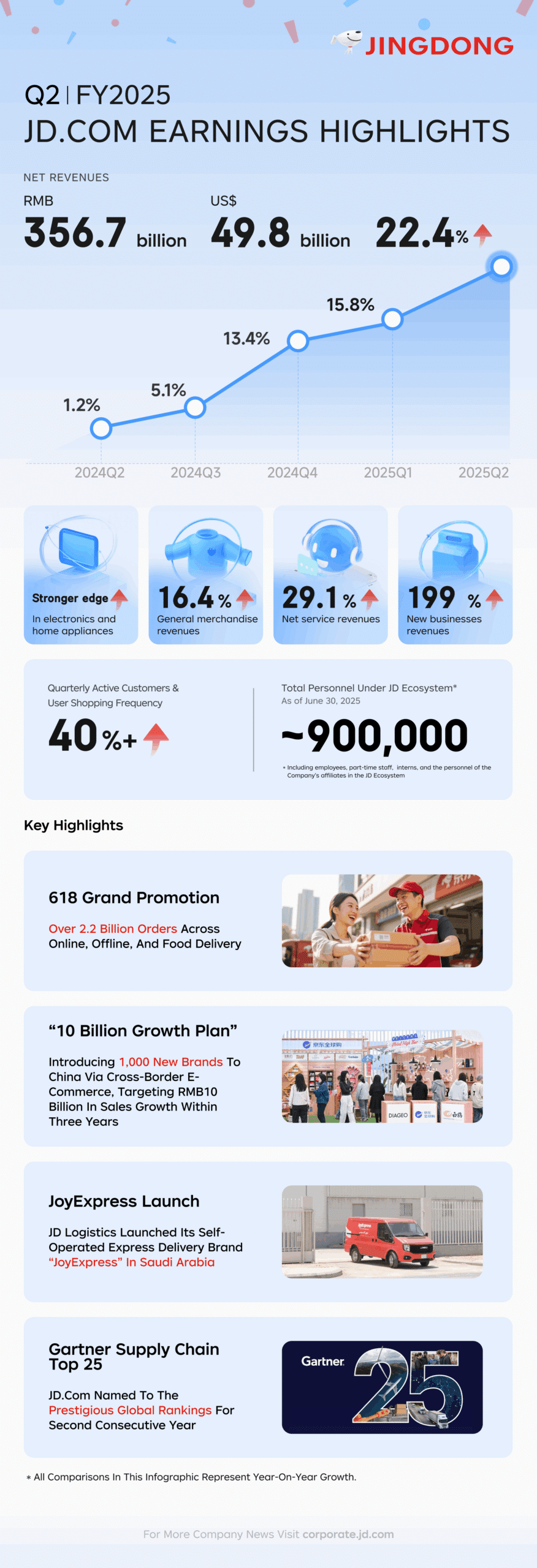

- Revenue Growth: Total revenue reached RMB356.7 billion ($49.8 billion), up 22.4% year-on-year (YoY), exceeding expectations and marking the highest YoY growth rate in the recent three years.

- Core Retail Strength: Electronics and home appliances strengthened their lead, general merchandise revenues rose 16.4% YoY, and the supermarket business revenues achieved double-digit YoY growth for the sixth consecutive quarter.

- Service Expansion: Net service revenues surged 29.1% YoY, reflecting strong diversification.

- New Businesses’ Momentum: Revenues from new businesses, driven primarily by food delivery, jumped 199% YoY.

- User Engagement: Quarterly active customers and user shopping frequency both increased over 40% YoY, marking seven quarters of double-digit user growth.

Strategic Business Milestones

- 618 Grand Promotion Attains Unprecedented Success: The annual 618 event doubled the number of order-placing users YoY, processing over 2.2 billion orders across online retail, offline businesses, and JD Food Delivery. The event featured a record number of daily active users on the JD.com app and leadership in 3C electronics, home appliances, and fashion & beauty categories.

- Cross-Border E-Commerce Initiative: The launch of the “10 Billion Growth Plan” introduced 1,000 overseas brands to China, bringing in RMB10 billion ($1.4 billion) in total sales growth within three years.

- Global Logistics Expansion: JD Logistics, also known as JINGDONG Logistics, launched its self-operated express delivery brand “JoyExpress” in Saudi Arabia, offering same-day or next-day delivery for e-commerce purchases.

- Industry Recognition: Secured a spot in the prestigious Gartner’s Global Supply Chain Top 25 for the second consecutive year, China’s only retailer recognized for supply chain innovation excellence.

Commitment to Social Responsibility and Employee-First Initiatives

JD.com remains dedicated to creating value for employees and communities worldwide. As of June 30, 2025, the JD Ecosystem’s personnel reached 900,000, with plans to offer 35,000 new positions through its 2026 campus recruitment, including the “Top Young Tech Talent Program” to attract global innovators. In Beijing, JD.com is investing RMB7 billion to build nearly 5,000 youth apartments, with free accommodation for interns starting in September 2025.

The company also champions inclusive employment, having provided jobs to over 4,000 individuals with disabilities. Through its “Sunshine Angel” program, JD.com aims to employ 1,000 more disabled individuals, offering free training, operational support, and subsidies to foster entrepreneurship and stable incomes.

JD.com’s focus on innovation, growth, and social impact continues to deliver value to customers, partners, investors, and communities, reinforcing its position as a trusted global retail leader and supply chain partner.

(vivian.yang@jd.com)

JD.com Debuts Mongolian and Finnish National Pavilions During Singles’ Day Grand Promotion

JD.com Debuts Mongolian and Finnish National Pavilions During Singles’ Day Grand Promotion