Jul 26, 2022|

JD Releases “2022 Import Consumption Trend Report”

by Mengyang He

JD.com’s Consumption and Industry Development Research Institute released the “2022 Import Consumption Trend Report” on July 25 ahead of the second China International Consumer Products Expo.

Key takeaways:

- Consumers are seeking more exquisite and high-end products.

- Young people are the major consumers for international products.

- Most sales of international products come from first- and second-tier cities.

China’s import business is now more diversified and toward high-end. According to the report, mobile phones, computers, mother and baby products, beauty and skincare products, and home appliances are the most favored by Chinese consumers among all international products. For instance, the sales of mobile phones from overseas brands accounted for over 30 percent of all imported products in 2022.

According to the data from JD’s 618 Grand Promotion ended last month, the presales volume of first-party imported healthcare products mounted by 140 percent YOY, and cross-border food and beverages grew by 100 percent. Many international big names, such as Apple, Dell, HP, Aptamil and Siemens are also well received by consumers.

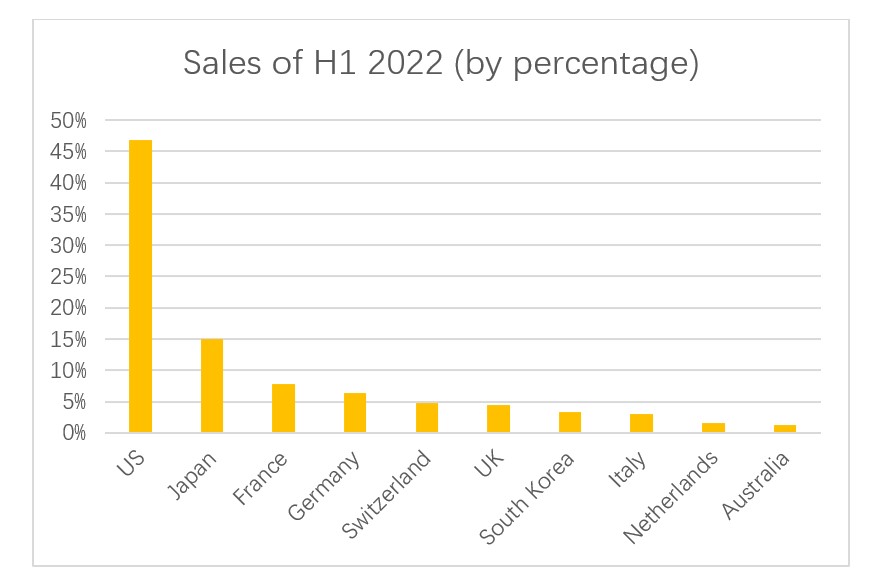

The report also reveals that the top 5 countries for imported products are the US, Japan, France, Germany and Switzerland. Because of international travel restrictions due to Covid, many consumers are now purchasing more products from JD’s national pavilions to stay close to an international experience.

JD has opened 65 national pavilions as of now. The national pavilions of Finland, Singapore, and Cuba were the top 3 in sales during JD’s 618 Grand Promotion this year, during which the French, Hungarian, and Singaporean national pavilions recorded a YOY increase of 194 percent, 147 percent, and 141 percent, respectively.

Young people between 26 and 35 are the major consumers for imported products, accounting for nearly half among all age groups. In addition, consumers between 46 to 55 are seen to have great potential in purchasing power, as their spending on international products increased by 283 percent in 2021 compared with that in 2019.

As for Gen Z consumers, they are more willing to buy watches, glasses, jewelry, and digital products from international brands, whereas senior shoppers favor food, beverages, clothes, and alcoholic products.

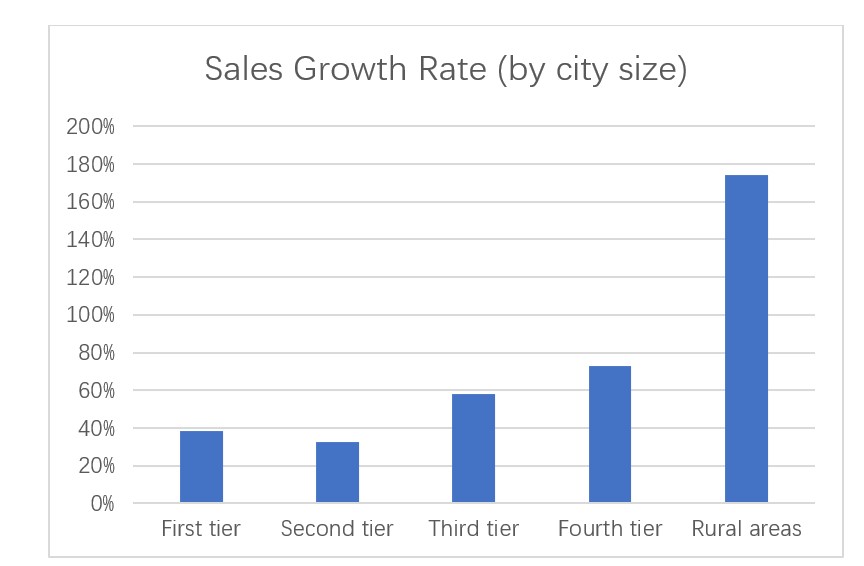

In the first half of 2022, consumers from first- and second-tier cities contributed to 55 percent of the sales of international products. However, a rising interest is also seen in rural areas. According to JD’s sales data, the transaction volume of international products generated from rural areas grew by 174 percent in 2021 compared with that in 2019.

By region, the report shows that consumers from Guangdong province, Beijing, Jiangsu province, Shanghai, and Zhejiang province purchased the most international brands, and 20 percent of the sales come from Guangdong province alone.

MICHAEL KORS Makes Debut on JD.com

MICHAEL KORS Makes Debut on JD.com