May 8, 2021|

JD Shares Imported Products Consumption Trends at Hainan Expo

by Rachel Liu

JD data shows that customers are buying more diversified kinds of imported products; females and customers from lower tier cities are rising quickly for imported products. As more customers are pursing high-quality lifestyle, there are more opportunities for imported brands.

The report was released by JD Big Data Research Institute on May 7 at the forum themed “The Future of Imports and the Role of E-commerce” held by JD Worldwide at Hainan Expo.

Consumption upgrade has become the main driving force for the rise of imported products. Data of China Customs shows that in 2019, the retail import and export volume of cross-border e-commerce in China reached RMB 184.2 billion yuan, 5.2 times the volume of 2015. Behind the trend is the growing income of Chinese consumers and their pursuit of a higher quality of life.

More Diversified Categories

Beauty and makeup, healthcare and maternal and baby products are the Top 3 best-selling categories of imported products on JD. More categories such as pet products, food and beverages, and cooking utensils are rising quickly. Furthermore, more customers are buying imported home cleaning products, auto products, clothing and toys on JD.

Growing Demands from Lower-tier Markets

Though customers from first-tier lead in consumption of imported products, second and third-tier cities such as Tianjin, Chengdu, Chongqing, Suzhou and Dongguan are also growing. The sales of imported products in Shenzhen have surpassed that of Guangzhou. The proportion of imported products orders coming from consumers in fifth and sixth tier cities is increasing, and the gap with first and second tier cities is narrowing. Whether from first and second tier or lower tier cities, customers’ demands are similar – the top 5 imported categories are both beauty, healthcare, maternal and baby, personal care and food.

Female and younger customers

Female customers prefer to buy imported products compared with male customers, and the growth rate of female customers is also higher than males. However, the average number of orders and average consumption volume of male customers is higher than females.

Number of younger customers aging from 25 to 29 and senior customers over 50 years old is growing quickly. White collar workers are the key customer group for imported products.

More Opportunities for Brands

Imported products from the US, Japan, France, Germany and South Korea sell best on JD, and popular brands include Apple, Nestlé, Phillips, L‘oreal and Pigeon. Top selling imported brands continue to grow on JD. The sales of Top 5 brands in each category increased 55.3% YoY, and more small brands are growing and having more opportunities.

Participating in the Hainan Expo is also a good opportunity for JD Worldwide to introduce its leading position in China’s cross-border business and attract more bands to join its platform. Established in April 2015, JD Worldwide now offers over 10 million SKUs (stock keeping units) of imported products from 20,000 brands and 100 countries and regions.

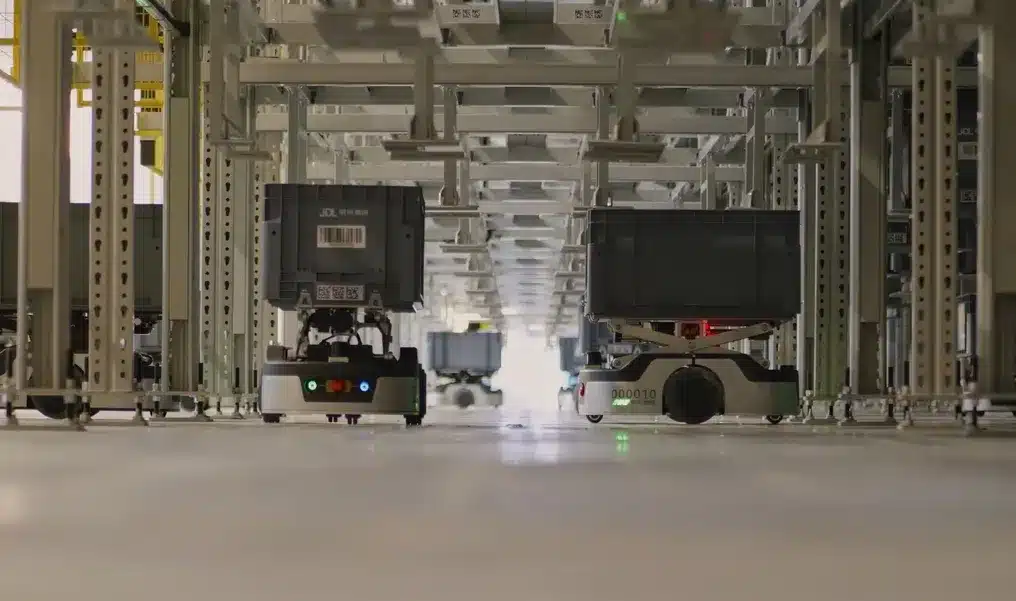

At the Hainan Expo, JD Worldwide also launched the JD Intelligent Inspection project to build product authenticity inspection ability with China Certification and Inspection Group. The two sides will jointly provide inspection for products before they enter JD’s warehouses, providing customers with even better quality assurance.

In-depth Report: Behind and Beyond JD’s Participation at Hainan Expo

In-depth Report: Behind and Beyond JD’s Participation at Hainan Expo