by Ling Cao

When making a purchase online, some consumers may opt to filter search results by top sales performance – this is a simple expression of a consumption trend. A more complex version is a report which considers multiple factors. For example, as Spring Festival is approaching, a report has revealed trends that C2M (Consumer-to-Manufacturer), which uses big data to provide advice to brands about how to create products to better meet market demand, house decoration and local specialties are popular. This report could also serve as a guide for consumers who haven’t bought New Year gifts yet. In China, there were 83 billion parcels circulated in 2020, according to the State Post Bureau, equal to 59 parcels per person per year on average. This massive parcel volume has formed a unique database that let consumption trends emerge.

The JD Big Data Research Institute, an open and professional platform based on the big data of JD.com, has generated around 120 reports in 2020, three times higher than that of 2017, when it was just launched. The Spring Festival report is just coming out by working with Chinese financial media Jiemian.

Hui Liu, chief data officer of the Institute shared, “Unlike peers, JD’s core advantage regarding data is the long value chain. For example, starting from a customer searching on JD’s website, to purchasing a product, to last mile delivery and after sales, the integrated process can be connected as part of JD’s big data.” Liu added: “The integration and complexity allow us to produce accurate customer profiles and consumption trends. Ultimately, we can know the why and how behind a transaction.”

Hui Liu (center) with JD colleagues

How to create a report

There are always interesting trends on people’s radar. Ahead of last Chinese Valentine’s Day (Qixi七夕, July 7th on the lunar calendar, falls on July 25th last year), the institute found that when it comes to adult, COVID-19 may have impacted their purchase choices, but certainly hasn’t caused consumer interest to wane. The report was popular, and was even reported on by leading marketing media, The Drum. The outlet wrote: JD’s data “saw dramatic changes in related search keywords when people in China went into lockdown as it drove a huge increase in demand for contraceptives and stimulated long-distance partners’ desire to make purchases for their counterparts from afar.”

Liu shared, “Qixi is the best time to discuss such a topic, and even to take advantage of it since people are usually too shy to talk about it. Leveraging the timing and our big data ability, we can show the society the culture of this category in China. And we also have industry data showing that we have a comparative advantage in this category such that we can represent the online consumption of adult products in industry.”

Liu shared four general steps for generating a report: 1) Forecast insights by reading relevant materials and interviewing business teams at JD; 2) Consider holding a workshop with internal and external experts. 3) Reflect the insights in the task of data selection, 4) Proof or override the forecast insights based on data analysis. If the data don’t agree with the initial forecast, the team will find new insights and conduct further research.

“Generally, it’s important to forecast insights at first, otherwise insights will be buried in the massive amount of data,” added Liu.

The institute is focused on much more beyond the basic process of putting together a report. Fei Lu, senior researcher at JD’s Big Data Research Institute was responsible for making the adult products report. He shared an innovative way to combine objective data analysis with a subjective questionnaire, which could make the result more persuasive. For example, data can reflect certain sales performance, while the questionnaire can reflect reasons behind the purchase. Lu also shared another creative way of making cross analysis, especially comparing two items which seem unrelated. Lu said, “Most of the efforts are in vain but there is still the possibility of an unexpected surprise.”

For instance, last Chinese National Day holiday was a time to test whether China’s offline consumption had recovered amid the pandemic. As a major online platform, JD also planned to work on a consumption report. Lu cross-analyzed many different aspects of data. For example, Lu has put Hubei’s (Hubei’s capital city Wuhan was the epidemic epicenter of the COVID-19 outbreak in China last year) local food sales performance together with third party tourism data, which unexpectedly showed that the increased growth rate of the food may be related to population mobility. Taken together, this implied that Hubei’s consumption growth rate had recovered to the level before the epidemic. The data was used in several domestic media reports.

The institute has consistently provided insights during COVID-19, finding for example, that the younger generation took on much more responsibility; JD has become one of the most trusted platforms by customers; and consumption upgrading and rationalization are carried out simultaneously. These trends could provide a direction and insight in the industry.

Lu added: “Our internal business team came to us after we published the adult products report, and said it could be good material for business development purpose. I felt like this is also part of the value of our job.”

Why launch the institute

Right now, the institute not only produces consumption-related reports, but also has expanded to cover to industrial or regional economy research, providing broader value. This is far beyond the objectives when the institute was first established. “In the beginning, we found that JD’s R&D team had already used big data to make valuable analysis for internal use, such as to determine the most active customer group,” explained Liu. “This inspired me to consider how to expand its external value.”

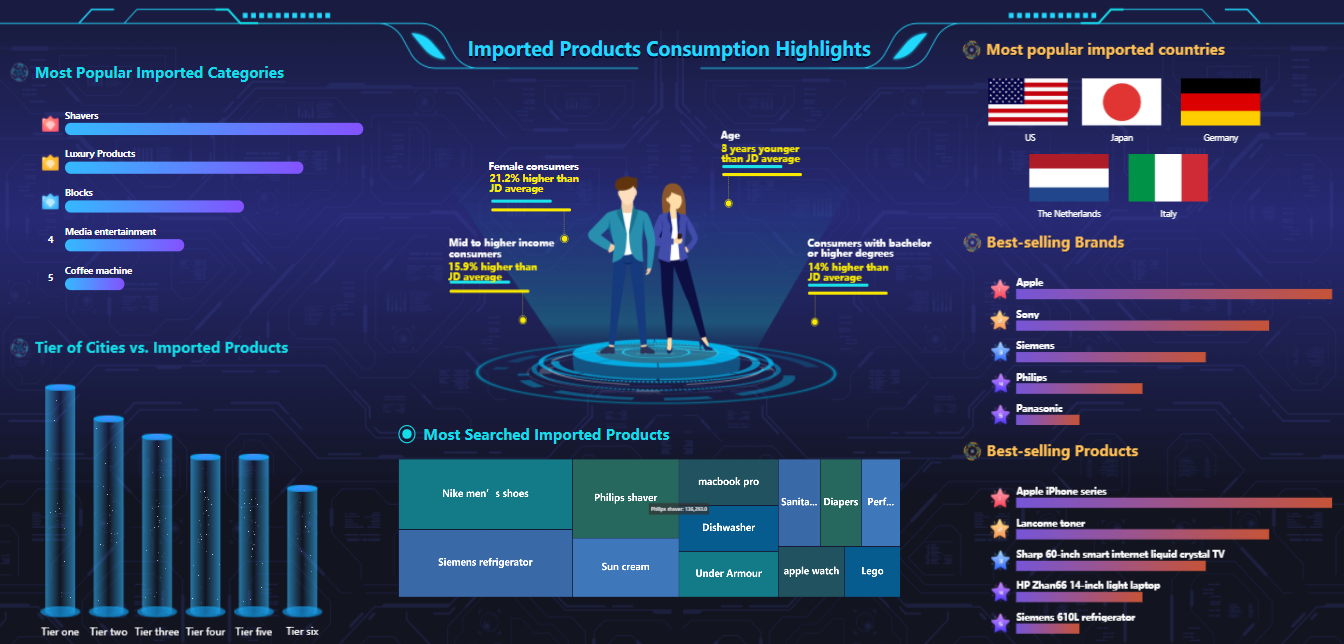

There were several objectives at first: 1) Response to media requests, supporting reporting with certain trends; 2) Response to business team’s needs, making vertical industry reports covering electronics, home appliance, FMCG(fast moving consumer goods), as well as baby and maternal products; 3) Work with external think tanks or institutions to produce meso-economic and industrial reports, such as a rural e-commerce analysis; and 4) Visualize the data in a command center during important promotions such as the 618 Grand Promotion, and introduce the findings to a multitude of internal and external stakeholders.

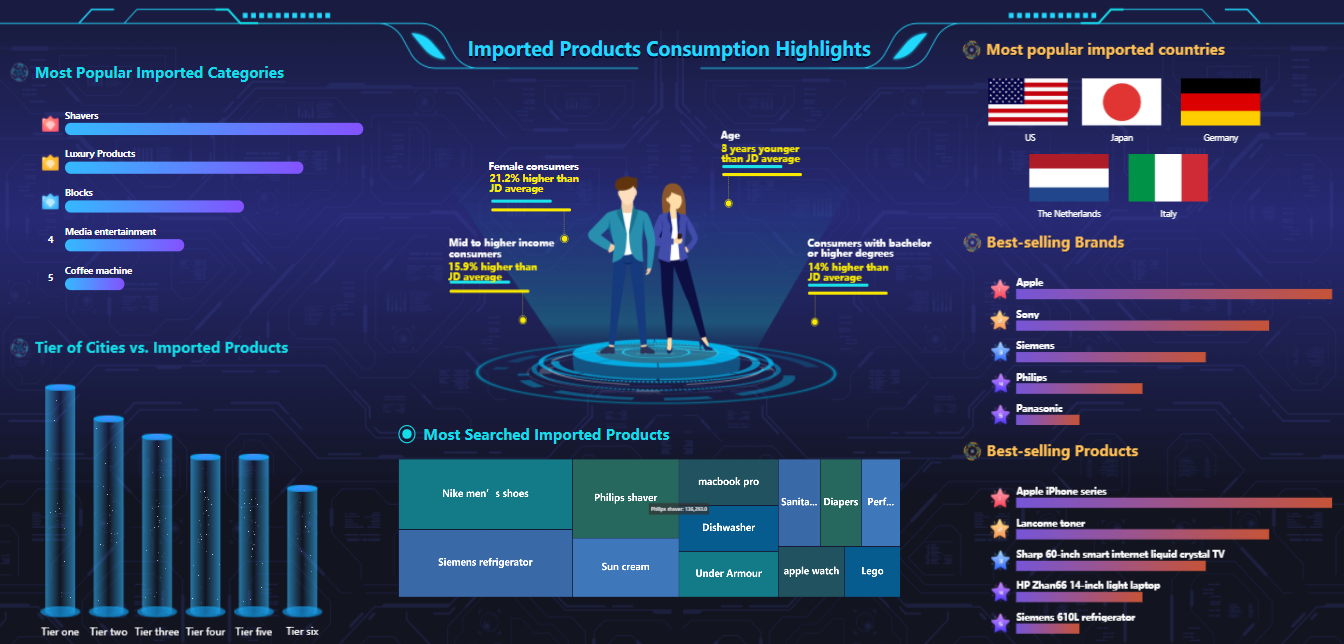

Imported products consumption highlights exhibited at the command center during 11.11 Grand Promotion in 2020

Combine strength of JD and external experts

Fei Dong, senior researcher at the Institute shared, “JD’s own data mostly represents an online sales trend, while we will consider whether it’s thorough enough to reflect a macro trend. That’s why we are willing to expand cooperation with external experts, such as universities, and enterprise-level think tanks at companies such as Tencent and Ctrip.”

One case was an employment report produced by JD and Maimai, China’s workplace social networking platform. Under the program, both companies provided data to complement each other.

Experts, such as professors at universities, have the advanced knowledge architecture, and a more far-reaching understanding of the industry, as well as better analysis methodology. When looking at certain topics such as lower tier market penetration, JD will invite them for a workshop, to discuss the macro trends in society.

For example, JD and Renmin University of China have cooperated on an environmental protection program, which targeted to research how green awareness will impact customers’ consumption. Specifically, by combining the university’s methodology with JD’s data, the team labeled two groups of products. Group A showed green related labels in the product description page, and group B was normal. The differentiation in sales, customer profile and more were compared.

Dong added, “The Institute focused more on consumer related reports before, but as we have recruited colleagues with different expertise backgrounds, as well as cooperated with more and more external experts, we have more confidence to do industrial forecasts.”

Future direction

Liu pointed out the importance of providing value for brands and partners at the industrial level. He shared an example of how regional economy research can effectively help brands better manage their business and set goals. Take Chongqing for example. JD will analyze how Chongqing’s local specialties perform in and outside the region, and compare the customer profile of local residents with the national average. This can help brands better understand the industry and know whether customers have awareness of certain products, so as to judge where the potential opportunities are. Liu added, “JD is designing an interaction system, enabling partners to search for regional economy development rankings in China, with specific profiles for a particular province, and performance for certain products.”

Liu also added, “We hope the institute can not only provide value to brands, customers, industries, but also to young talent. Going forward, we are thinking of open up part of our data and case studies to them, providing value for their academic research. In the same time, they can bring fresh thinking to us.”

Consumption trend reports or vertical industry analyses are mostly dealing with micro economies. JD hopes to extend from data analysis to deep case studies, producing industrial-level and meso-economics-related reports, on topics such as the development of the industrial internet. JD will expand its retail-centered analysis to service and technology, extending the value of big data to broader areas.

Liu concluded, “In fact, data is just a foundation. It’s all about how technology can shape the real economy.”

(ling.cao@jd.com)