by Hui Zhang

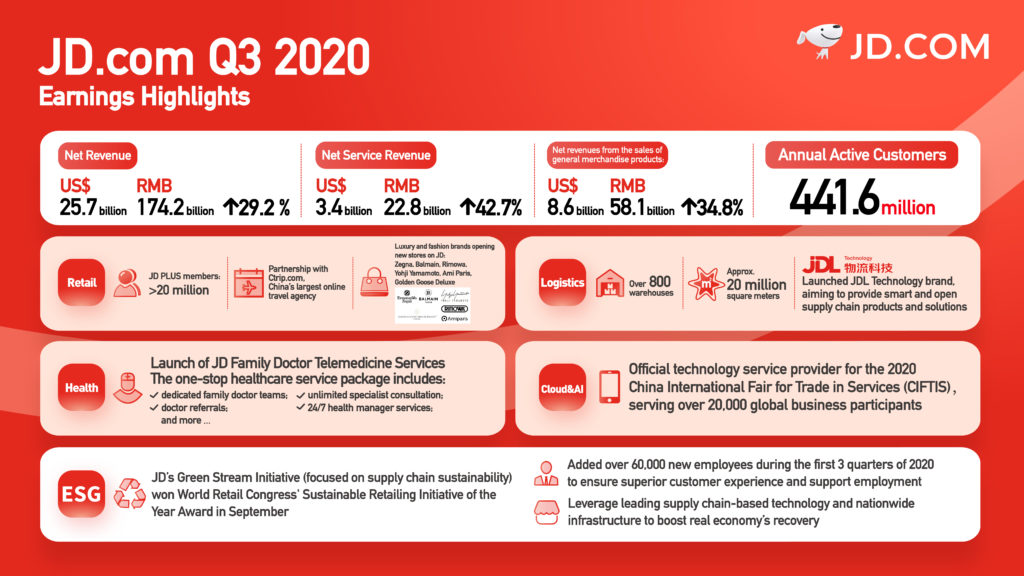

JD.com’s unwavering efforts in always positioning consumers at the center of its business have been reflected in its user growth. JD’s annual active customers reached 441.6 million by the end of the third quarter, 32% up from a year ago. This is the highest annual growth rate in the past three years. On the Nov. 16 earnings call to discuss the results, JD’s management team attributed the strong growth to the strength of its supply chain and services, both of which have made JD a highly trusted platform, as well as improved user engagement in lower tier markets.

Sandy Xu, CFO of JD.com shared that the company obtained more than 24 million net additional customers in the third quarter. The robust growth of the number of active users validates the company’s long-term operating philosophy to put its customers at the center of its business. Eighty percent of JD’s new users this quarter came from lower-tier c markets.

Core users on JD were found to buy products from more categories and more frequently, making JD an important part in consumers’ daily lives. The number of JD PLUS members exceeded 20 million in October, a milestone for its paid membership program. JD PLUS was the first paid e-commerce membership program in China designed to better serve its core users besides the benefits offered on JD app such as shopping rebates and free shipping coupons. JD PLUS has partnered with over 600 industry-leading brands to provide its members with comprehensive privileges in sectors such as movie tickets, travel, hotel bookings, education, dining and entertainment. JD’s data shows that JD PLUS has effectively improved the engagement and retention of its core users.

Lei Xu, CEO of JD Retail explained, “For the new users, they’ve already been educated and have been calibrated through other platforms. When they become more mature and more customized online shoppers, they will shift to a platform that can provide better services for them.” He added: “ We have a better competitiveness to match the shopping behavior for more and more customers.”