Apr 14, 2023|

JD.com Identifies Five Consumption Trends Driving Significant Growth in China’s Cross-Border E-Commerce Market

by Vivian Yang

Over the past three years (2020-2022), JD Worldwide, JD.com’s cross-border e-commerce platform, saw a 64% increase in sales of cross-border products, with user numbers nearly tripling and product volume growing by 43%. This growth reflects strong demand and supply, as highlighted in the “2023 Cross-Border Imported Products Consumption Report” released by JD’s Consumption and Industry Development Research Institute on April 12 in Beijing.

The report identifies five key consumption trends for cross-border imported products in China, providing valuable insights for international brands looking to establish themselves in the Chinese market, particularly those offering premium and niche products.

1. Prioritizing Scalp Care

According to a 2019 survey conducted by China’s National Health Commission, approximately 250 million Chinese individuals experience hair loss, with 84% encountering this issue before turning 30. An increasing number of people are seeking to enhance their personal care routines, viewing their bathrooms as sanctuaries for relaxation and self-indulgence. This trend presents the immense market potential for innovative products across various related categories.

2. Embracing Harm-Free Skincare

An increasing number of middle-to-high-end JD users aged 20-45 are willing to pay more for skincare products that align with their values, prioritizing natural, eco-friendly ingredients.

3. Choosing Sustainable Makeup

Echoing the trend for safer skincare, environmentally sustainable cosmetics sales on JD Worldwide outpaced the category’s sales by three times during last year’s 618 Grand Promotion event.

4. Opting for Premium Low-Lactose Infant Formula

This category has seen remarkable growth in China, outperforming ordinary formula products in transaction volume by 4.5 times in 2022. Brands like Nestle, Aptamil, and Friso are favored by Chinese parents who are increasingly discerning when it comes to their children’s nutrition.

5. Savoring Relaxing Beverages

JD’s consumer survey indicates that many Chinese people have adopted the habit of drinking alcohol for relaxation and better sleep at home. With a wide range of imported alcohol options available online, preferences vary among different age groups, with Gen-Z favoring brandy/cognac, middle-aged users opting for imported beers, and older consumers preferring wines.

According to the report, the top five imported products by transaction volume on JD Worldwide in 2022 were healthcare, baby and maternal, cosmetics and skincare, consumer electronics, and pharmaceutical products. The fastest-growing imported categories included consumer electronics, personal care, home appliances, alcohol, and cosmetics.

Female users (55%) continue to be the primary shoppers for cross-border products, focusing on family needs and personal well-being. Popular categories on JD Worldwide include skin and hair care, baby care, perfume, and cosmetics.

The 26-35 age group accounts for nearly 50% of all cross-border imported product shoppers. Consumers in this demographic often seek distinctive goods to express their individuality and tastes.

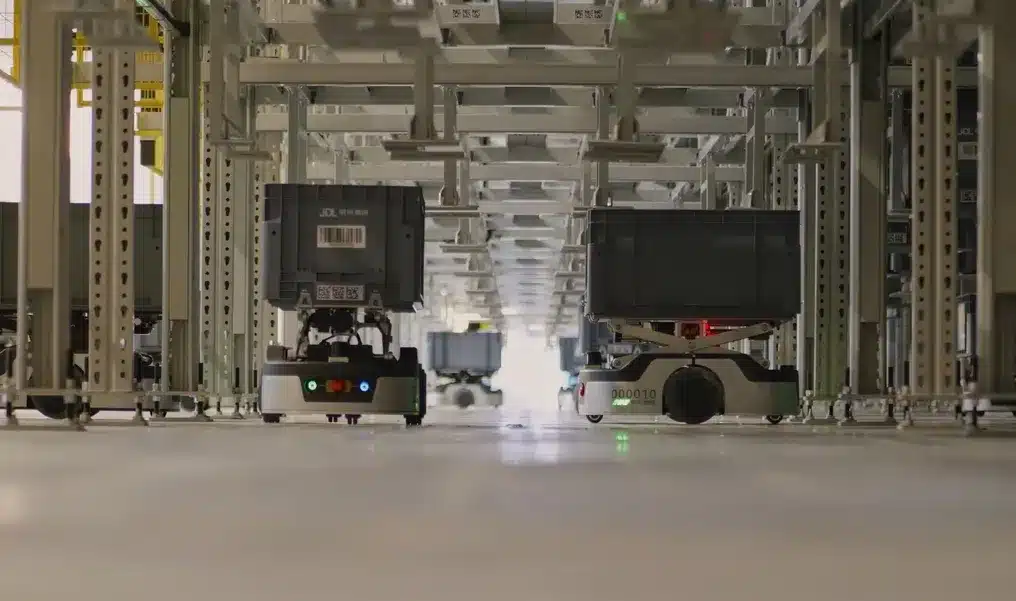

While first-tier market consumers remain the primary purchasers of imported products, there is a growing interest in lower-tier markets, driven by China’s advanced e-commerce logistics and improved supply chain efficiency.

JD.com Bolsters Zespri Kiwifruit Imports, Aims to Sell Over 2 Million Trays in 2023

JD.com Bolsters Zespri Kiwifruit Imports, Aims to Sell Over 2 Million Trays in 2023