Jul 2, 2020|

JD’s Observation: Three Trends for Service Consumption

by Vivian Yang

JD Life and Services provides online-to-offline services covering car maintenance, travel booking, home-buying, auctions and fresh flowers delivery. As the provider of diversified services, which attend to various consumer needs and have a long consumption chain, JD Life and Services has been striving to improve its “Product + Service” integration model to let customers immerse themselves in handy, fluid and tailored-made shopping experiences.

Such integrated services have been well-received by customers as reflected in JD’s 618 Grand Promotion consumption data. Three trends about the rise of service consumption are identified:

Rise of Spending on High-Quality Services

From buying goods to buying services, Chinese consumers’ demand for services that enable greater life convenience has grown rapidly in recent years while JD ensures that customers are in good hands with premium service providers and omnichannel solutions.

For the automotive aftermarket, online-to-offline conversion rates keep going up. During 618, over 80% tire buyers on JD selected platform-offered offline car repair services. Transaction volume of car maintenance services on JD increased 293% YoY.

JD Real Estate introduced an RMB 6.18 yuan (less than US$1) “Five Benefits Service Package”, comprising of housing selection assistance, exclusive offers, price protection, “cancel for any reason” insurance, and online reservation. During 618, over 500,000 home-buying orders were made with these standard benefits on JD.com.

Increased Demand for Door-to-Door Services

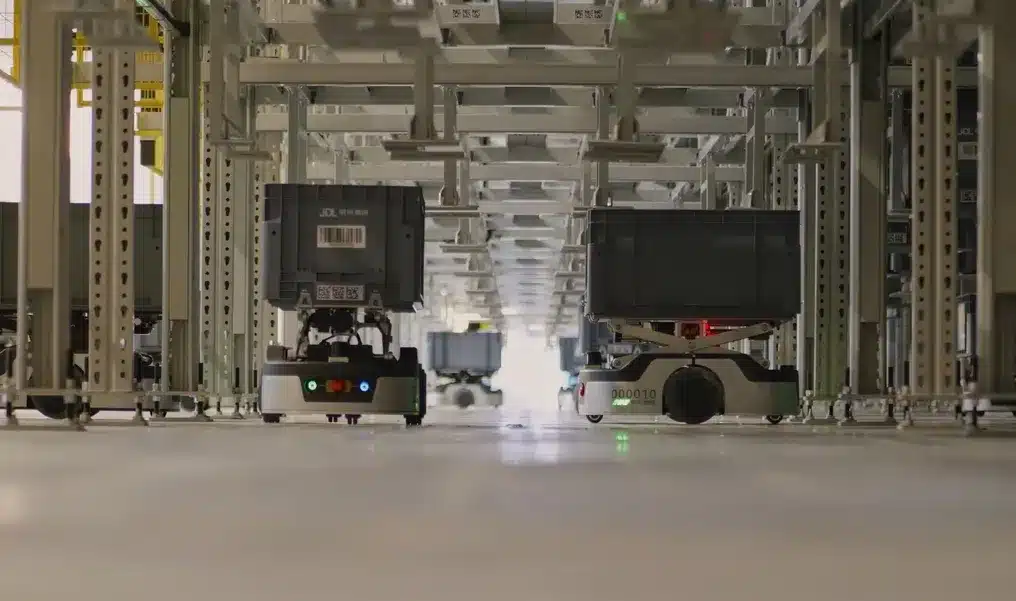

From going out to search and shop to matching products and services and deliver them to customers’ doorsteps, JD Life and Services leverages its technology, resources, channels and infrastructure to make the shopping process more transparent and efficient.

For example, flower service has long been bugged by problems such as decentralized planting, long supply chain, high risk of packaging damage, and inconsistent service quality. To solve these pain points, JD brought in its cold chain logistics and Allianz insurance services (JD has a 30% stake in Allianz China) in its flowers booking and delivery service, standardizing several products and services, such as one-hour flash delivery. The transaction volume of flowers on JD platform increased by 150% during 618 Grand Promotion.

Through developing door-to-door services, JD is plugging in more and more quality guaranteed offline merchants and service providers on the platform who make daily chores easier for JD customers and gradually help JD Life and Services expand its business scope at the same time. For example, during 618, laundry pick-up service orders increased 15 times. Online payment for bills of electricity, water, gas, phone services, and more increased 9 times compared with the same period last year.

Enthusiasm for Offbeat Products and Services

Many offbeat products and services are finding favor with customers. For example, young customers who seek to display their lifestyles via their motorcycle gear, are seeking more personalized and fashionable products on JD. JD has held several cycling culture events and enriched product selection and after-sales services to meet this demand. During 618, transaction volume of retro motorcycles increased 5 times YoY.

Online auction starts to gain traction as well. During 618, JD offered an array of auction items, including house properties, jewelries, luxury goods, ceramics, art collections, handicrafts, tea and wine, automobiles, etc. Online auction of old coins has been viewed more than 1.21 million times, and auction of Pu-erh tea cakes has been viewed over 270,000 times during 618.

According to China’s National Statistics Bureau, service consumption expenditure in 2019 accounted for 45.9% of per capita household consumption expenditure, 1.7% higher than in 2018. The steady growth is mainly attributed to the country’s rapid urbanization and the widespread consumption upgrade.

Compared with the over 60% share of service consumption expenditure in developed economies like the US and Japan, China has vast potential to further develop in this field. Under the backdrop of post-COVID economic recovery, JD is playing its role in boosting the development of service consumption based on the trust it builds with both the customers and merchants as well as the insights it has accumulated through integrating online and offline consumption.

100% of JD’s Nucleic Acid Tests on Fresh Produce Are Negative

100% of JD’s Nucleic Acid Tests on Fresh Produce Are Negative