Sep 30, 2020|

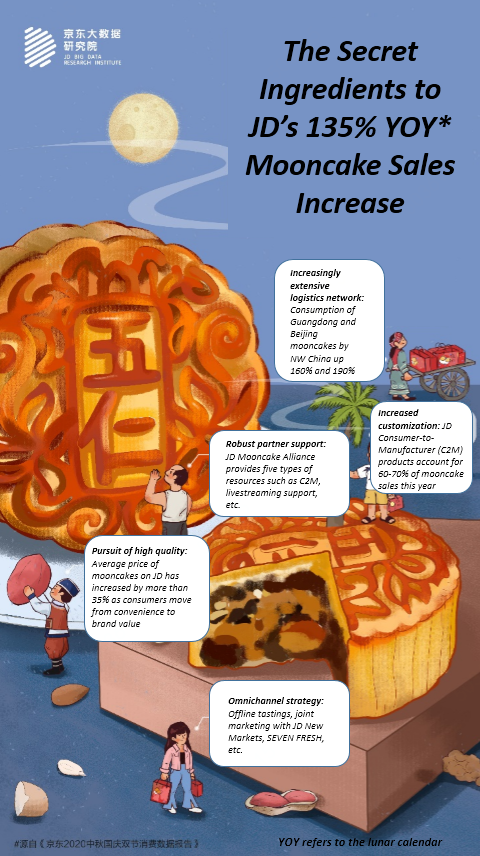

In-Depth Report: The Secret Ingredients to JD’s 135% YOY Mooncake Sales Increase

by Ella Kidron

Like everything in 2020, trends around mooncakes ahead of China’s upcoming Mid-Autumn Festival this year, are anything but ordinary. With Mid-Autumn Festival and the eight-day Golden Week holiday (National Day) happening concurrently this year, many consumers take a much-needed trip to their hometown for a family reunion after half a year in lockdown.

As a traditional Chinese food that symbolizes family reunions, mooncakes are an essential ingredient for the Mid-Autumn Festival celebration. This is the case not just in China, but around the world for overseas Chinese and others who choose to observe the holiday. According to a recent report, over the next five years the mooncake market will register a 3.4% CAGR in terms of revenue, and the global market size is estimated to reach $2539.6 million by 2025, from $2219.6 million in 2019.

Given the unique circumstances of this year, the mooncake market in China has seen some surprises. JD Big Data Research Institute has the low down.

First, mooncake sales on JD increased 135% YOY (Note: year-on-year from here on out refers to the lunar calendar), the largest amount of growth on record. Some of the reasons for this growth include purchases of gifts for families in preparation for the journey home, the movement of more consumption of mooncakes online, increased customization of products and packaging, and increased attention to quality.

Xiaojun Wang (王晓军), general manager of dry goods at JD FMCG Omnichannel who oversees the mooncake business had a clear strategy going into the sales season. “We have continued to vigorously develop exclusive C2M mooncake products, causing the proportion of C2M mooncake sales to continue to increase.”

Providing consumers more access to mooncakes through a multi-pronged approach is also important. He explained that this year the team has also carried out numerous omnichannel activities such as offline tasting promotions, joint marketing with JD New Markets, SEVEN FRESH, Yihaodian and other self-operated channels. “We have also integrated offline stores of suppliers such as Daoxiangcun(稻香村,literally means Village of Rice Fragrance), integrated supplier resources and implemented an omnichannel operations strategy to gain a larger increase.”

Selected data from JD Big Data Research Institute report on mooncake sales trends

From local to regional

One famous Shanghai mooncake brand, Xinghualou (杏花楼, which literally means Apricot Blossom Tower) discovered that one of the many benefits of starting to sell online is that they can reach consumers far outside of the Shanghai region. The brand was surprised to find that through JD, besides Shanghai, their mooncakes sell best in Chongqing, a city about 2000km west. Despite the fact that Shanghai (known for light and sometimes sweet cuisine) and Chongqing (known for lots of spice) have very different eating preferences from a regional perspective, they happen to overlap in taste preferences for mooncakes. It might be near impossible for Chongqing consumers to find Xinghualou mooncakes locally, but they can access the real thing, just as if they were in Shanghai. Previous reports also indicate that the channels consumers choose to buy mooncakes from are becoming more and more diversified. Thanks for services like JD Logistics’ broad coverage network, many brand are observing similar trends. For example, consumption of Guangdong- and Beijing-style mooncakes by consumers in Northwest China has increased 160% and 190% respectively.

From standardized to custom

It is not enough to provide nice-looking traditional mooncake boxes anymore. Now it is all about appealing to consumers’ individual needs and preferences. This is where JD’s data-driven product development approach, Consumer-to-Manufacturer (C2M) comes in.

In fact, C2M products have accounted for between 60-70% of mooncake sales on JD this year. Through Big Data, JD is able to provide manufacturers with insights about specific tendencies from regional or economic status standpoint, all of which can help guide them as to packaging, price range, flavor and more.

As a result of making products that are suitable for JD consumers, sales have improved, as has customer satisfaction. Sales of mooncakes on JD have surged in the last few months. From July 21st to September 16th, sales of the Palace Museum (Forbidden City) themed mooncake gift box developed through JD’s Consumer-to-Manufacturer (C2M) initiative increased 143% YOY, and became the most popular mooncake gift box on JD. A custom mooncake box developed with Starbucks also saw sales increase among young customers. According to JD’s research, only 10% of consumers surveyed are aware of the concept of C2M. But 92% of consumers surveyed are satisfied with C2M products, whether or not they know how the product is designed.

To develop new products, JD mooncake buyers will spend significant time analyzing customer profiles and market trends. And, once a product is ready to go, they will do taste tests to ensure quality. One JD mooncake buyer even gained 20 pounds as a result of taste testing mooncakes in advance of sales season, all in the name of guaranteeing an unmatched customer experience.

JD’s C2M mooncake box in partnership with the Forbidden City

Early this year, JD Super formed a mooncake alliance with famous Beijing snack brand, Daoxiangcun , Guangzhou Restaurant (广州酒家), traditional Peking duck chain Quanjude (全聚德) and other brands. Under the alliance, members have access to five major types of resources provided by JD, such as customization through C2M. Furthermore, on Sept. 28th JD Super kicked off its livestream for mooncakes in which executives of major mooncake brands, as well as industry experts discuss the Mid-Autumn Festival traditional and mooncake production process. On that day JD Live, the company’s livestream studio, attracted over one million viewers.

JD and brand partners launch alliance for mooncake sales

From a ‘good bargain’ to ‘good quality’

COVID-19 has brought significant unprecedented challenges to mooncake brands this year. According to industry experts, the main sales period for mooncakes kicked off late and is shorter than previous years. As a result, many mooncake makers were not optimistic about sales performance this year.

However, consumption demonstrates a positive upward trend. Not only has the number of consumers increased by a lot, but also a considerable number of new consumers come from lower-tier markets. Moreover, as consumers across the board pursue quality much more than last year, major brands with top-level mooncake boxes have seen good sales.

Owing to these factors the average price of mooncake products on JD has increased by more than 35% compared with last year. In addition to highly developed areas such as Beijing and Guangdong, the main driving force of the price increase actually comes from Northwest, Southwest and Central China. This sends a clear signal to the whole industry that consumers are moving from emphasizing price and convenience to focus on brand and value, including taste, safety, nutrition (a hot topic in the wake of COVID) and more.

Who is buying these mooncakes anyway?

By analyzing mooncake growth across tier 1-6 cities based on unit price, brand concentration, high education and age, JD Big Data Research Institute discovered that 70% of JD’s mooncake consumers have undergraduate or higher degrees. Sixty-five percent of consumers were born after 1990. In addition, consumption from the “small town middle class” is on the rise. These consumer groups are pushing the overall market from performance-to-price ratio to pursuit of brand and aesthetic.

One type of mooncakes, five kernel or mixed nuts (五仁), which have been shunned in recent years, surprisingly occupy first place in sales this year (although its overall proportion has declined). Five kernel mooncakes are traditionally from Yunnan province. The very first five kernel mooncake was born there in 1939, while the baking style is in fact Cantonese. The five kernels are apricot seeds, peach seeds, peanuts, sesame and melon seeds (or sunflower seeds).

One of the causes for concern around five kernel mooncakes is that the production process is quite complicated, and in the past some companies use peanut kernels to replace other nuts in an attempt to cut costs. The fact that these mooncakes perform well on JD, especially those from top brands, is testament to the extra mile JD and its buyers go to ensure that only the best of the market is made available.

What’s next?

With this year’s mooncake season nearing its end, Wang and the team are thinking about what’s next. “Overall, this year’s mooncake market presents the following characteristics – health and nutrition, tasty and fashionable, varied style and abundant flavors. Overall quality will see improvements.” He sees the proportion of online sales continue to expand. “Online will become a leader in development of the industry.” While the overall market may remain basically flat or even experience a slight decline, high quality brands and enterprises will maintain a stable growth trend.

This Harbin tourism boom has also spurred a surge in sales of winter apparel. JD.com’s data indicates a rapid growth in the sales of warm clothing items such as down jackets, snow boots, and thermal underwear between January 1st and 7th. The sales growth is especially pronounced in southern provinces and cities such as Jiangsu, Zhejiang, Guangdong, Sichuan, and Shanghai. Notably, tall snow boots registered a 206% year-on-year increase in transactions, while padded cotton caps and thickened long down jackets soared by 158% and 134%, respectively. Beyond clothing, travel gear has also seen a considerable uptick, with a 98% year-on-year growth in transactions for large suitcases and travel backpacks in these southern regions.

This Harbin tourism boom has also spurred a surge in sales of winter apparel. JD.com’s data indicates a rapid growth in the sales of warm clothing items such as down jackets, snow boots, and thermal underwear between January 1st and 7th. The sales growth is especially pronounced in southern provinces and cities such as Jiangsu, Zhejiang, Guangdong, Sichuan, and Shanghai. Notably, tall snow boots registered a 206% year-on-year increase in transactions, while padded cotton caps and thickened long down jackets soared by 158% and 134%, respectively. Beyond clothing, travel gear has also seen a considerable uptick, with a 98% year-on-year growth in transactions for large suitcases and travel backpacks in these southern regions. JD Guarantees Authenticity of Yangcheng Lake Hairy Crabs

JD Guarantees Authenticity of Yangcheng Lake Hairy Crabs