by Vivian Yang

COVID-19 and its after-effects continue to create challenges for the global job market. Jacky Wang, Head of Recruiting at JD.com, shared the company’s overseas job prospects, insights on how international talents can adapt to a Chinese tech company environment and the transformation of recruiting for GenZ, as well as the future of jobs for technology companies.

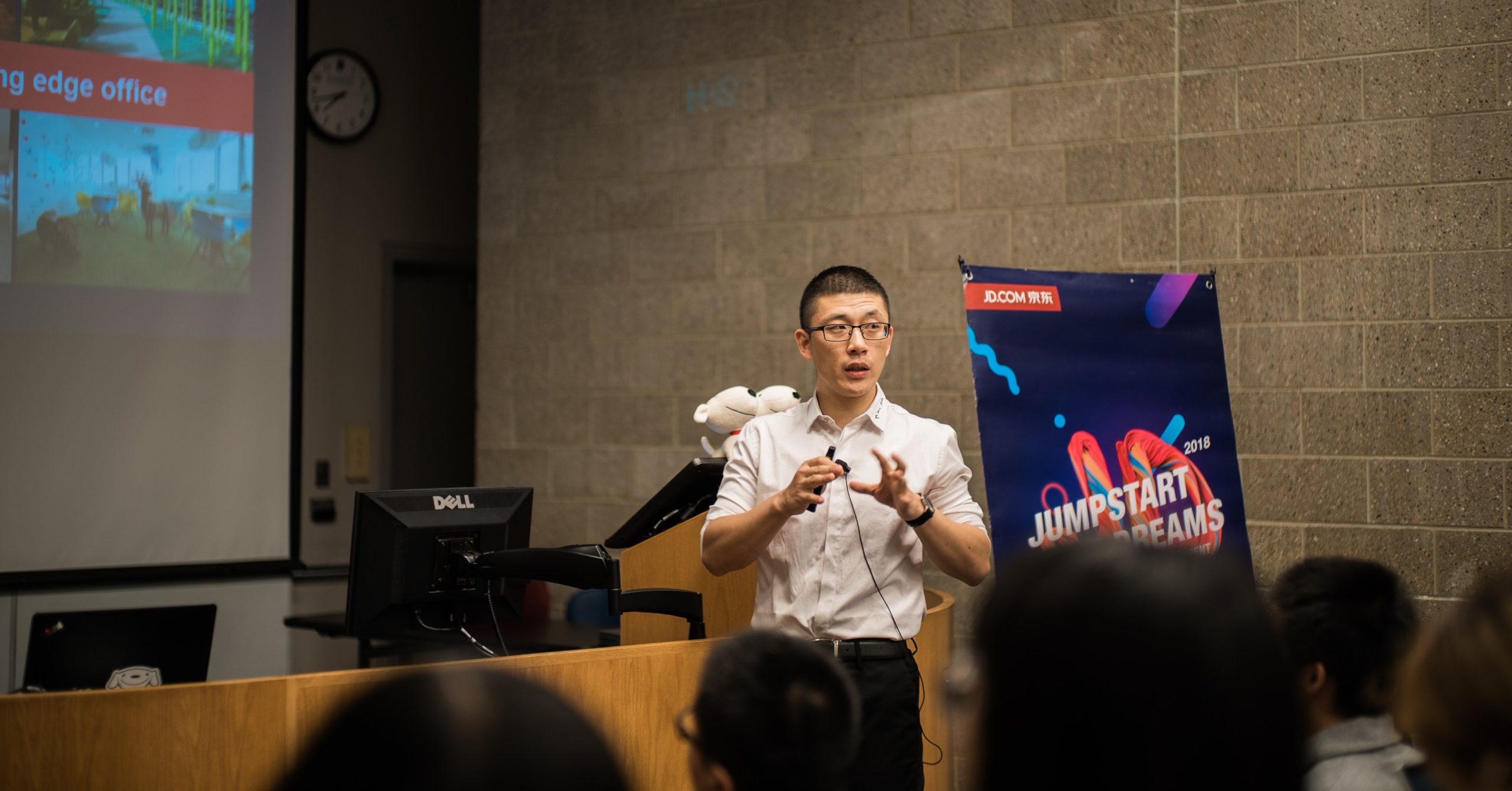

Jacky Wang, Head of Recruiting, JD.com

Q:What is candidate sentiment like during COVID-19?

A: During the COVID-19 period, even though JD cannot conduct in-person interviews, HR department never stopped talent sourcing. With good reason, job seekers show different degrees of anxiety in this turbulent situation, especially overseas graduates who are facing travel challenges. When people become more risk-averse, they are inclined to choose big companies like JD.com as they believe big companies are more mature and resilient, and can provide stable employment. In fact, JD’s offers to overseas students in 2020 have doubled since last year.

In addition, companies that demonstrate a strong commitment to social responsibility during the tough time received interest from candidates. In the past six months, JD has done a great deal in the fight against the COVID-19, from transporting medical materials at home and abroad to ensuring non-stop daily necessities for customers. In doing this, JD has always put our employees’ health and safety first. JD’s contributions have been recognized by a lot of candidates.

JD Recruitment’s livestreaming session during the epidemic period

Q:What job opportunities does JD.com offer to overseas candidates?

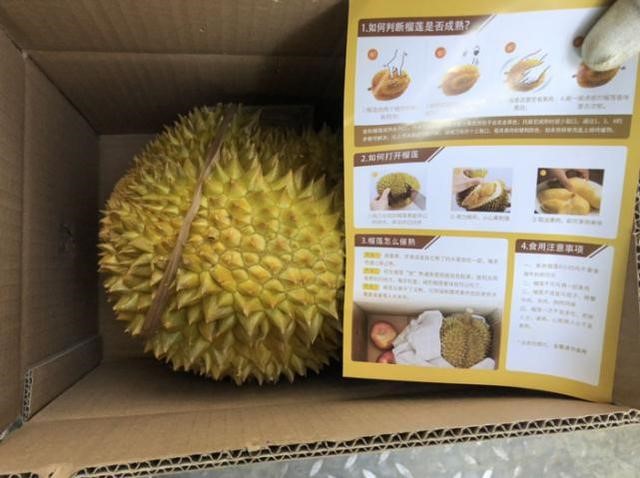

A:Globalization is an important strategy for JD.com. JD has developed a robust cross-border e-commerce business, connecting international brands and suppliers with over 387 million Chinese consumers. The company also covers a wide range of businesses including retail, logistics, technology, finance etc. JD has expanded its physical presence globally, and currently has footprints in Indonesia, Thailand, and the United States, and we are continuing to extend our reach in Southeast Asia.

As such, JD is hungry for talents with a global vision. JD offers a variety of job opportunities for people to explore their career paths in rapidly growing businesses.

Jacky Wang at a campus recruitment event at the University of Illinois at Urbana-Champaign

Q: What are the highlights of your talent development programs?

A: JD believes learning on the job is the most effective way to cultivate business leaders. Thus JD offers trainee programs tailored to different groups of employees, including interns, fresh graduates, international MBAs, technology experts and overseas corporate employees.

Given JD’s wide range of businesses, trainees have a unique advantage to participate in flexible rotation programs where they hold various posts in order to gain a full picture of our core business and culture before they decide on a specific position. JD offers training and development programs, both directly job-related and cross-discipline, while on the job. Furthermore, trainees will have 1 on 1 mentoring with designated executives and receive frequent coaching and mentoring from senior managers. Raises and promotions are based on merit – JD has cases of high-performing young employees who were promoted from T2 (an entry-level position) to T8 (a mid-senior managerial position) within three years’ time.

After finishing rotations at JD Headquarters, management trainee Christofer Surjadi

joined JD.ID’s Warehouse & Logistics Department in Indonesia

Q: What is it like working at JD Headquarters?

A: JD Headquarters is located in the Southeast suburb of Beijing. So far, four office buildings have been put into use, and several are under construction. JD currently has 15,000 employees working in the headquarters.

JD offers all sorts of facilities and services to accommodate employees’ work and life: gyms, a library, a hair salon, a bakery, laundry services, a pharmacy, massage services, and more. The staff cafeteria occupies five floors, and offer three meals a day with various flavors from different cuisines across China and globally – one of the most satisfying benefits for JDers. Unmanned convenience stores, vending machines and delivery robots ensure daily groceries are easily within reach.

It’s never easy to commute during Beijing’s rush hour, so JD provides over 60 lines of staff shuttle buses all around the city, and offers subsidized employee housing near the office. JD has also opened its own day-care and kindergarten, which is a rare benefit for employers to offer, but very much needed support to many people in China.

JD Headquarters in Beijing

Q:In your observation, what kind of international talents can do well in Chinese companies?

A: The understanding of Asian culture, especially Chinese culture, is quite important. I have spoken with a lot of international candidates, many of whom expressed challenges in internal coordination and communication with their Chinese colleagues. In Chinese culture, the inter-personal relations, or “guanxi”, is typically subtler than what you might find in a western workplace. However, if they can be aware of their subtleties and embrace interaction with their teammates and other colleagues, it is not impossible for them to navigate this kind of environment. Foreign candidates, who have the ambition to make a difference in the business world, see that one of the charms of a Chinese tech companies is the speed of execution. Once a decision is made, it will be actioned quickly.

Q: As a recruiter, how do you appeal to GenZ during their job hunts?

A: Indeed, compared with the post-80s generation, GenZ or the post-95s generation is much more independent and individualized. We find that when they go through the job application and interview process, many of them prefer digital interactions for answers to simple questions, such as which documents are required for application, or the address of interview locations. So we introduced a straightforward and effective chatbot to interact with them in the recruiting process. Also, during the wait time before face-to-face interviews, instead of giving them wordy questionnaires to fill out, we start to offer them gamified digital HR evaluations so they won’t feel bored.

But this doesn’t mean they don’t need human interaction. On the contrary, they need even stronger emotional connection. In the past, we won’t do much communication between when a student signs a letter of intent and when they graduate and sign official employment contracts. But now, we make a lot effort to keep them engaged in between by organizing office tours and warm-up campaigns in their ACG (anime, comic and games) culture. These activities have been greatly welcomed and enhanced their sense of belonging.

Q: Machines are replacing human jobs in a fast pace. What kind of future talent can thrive and help the company succeed?

A: Hiring employees with skills in new areas that are still in exploratory phases is difficult. But we do see people who can play multidisciplinary roles, have malleable skillsets, or the so-called “hybrid talent”, will have greater chances to advance. If an IT engineer understands management or arts, he might create new value in his coding that leads to better end-user experience products.

Soft skills are equally important. In the past, HR paid a lot of attention to a candidate’s working experience and how these match rigidly the job description. I think for now and in the future, leadership has become essential. Everyone needs leadership in a dynamic workspace – not only teamwork, and the ability to manage up and down, but also the ability to empathize, understand others’ needs and emotions, and be able to rise above challenges. An HR recruiter who only knows how to pick resumes and arrange interviews can easily be replaced by robots. But the ability for an HR specialist to recognize and understand a candidate’s emotions and value orientation is something near impossible for robots to take over.

Q: Do you see any new job format coming up in the foreseeable future?

A: Sure, in response to the rapid development of cutting-edge technologies and changes in society, there are already many innovative jobs emerging on the market, and JD is pioneering several of them.

For example, on the high-tech front, there are AI trainers, drone, VR and industrial internet engineers. On the retail front, global buyers for new product categories will continue to grow, as well as supply chain management experts. On the health services front, demand for telemedicine doctors, and personal healthcare consultants is on the rise.

To follow more information about JD.com’s recruitment activities, please visit the JD Campus website, LinkedIn, Facebook, Twitter and Instagram.