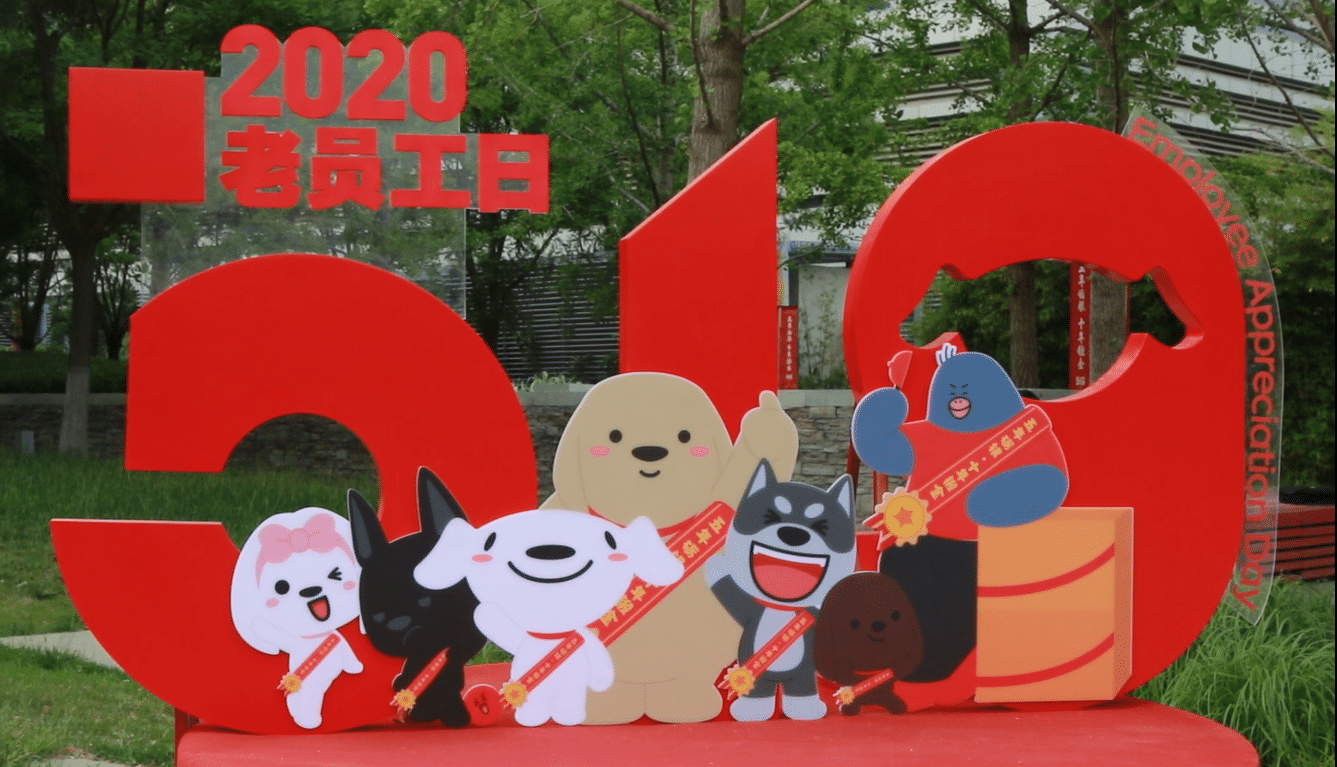

On May 19th, JD.com’s Employee Appreciation Day, Chairman and CEO Richard Liu sent an open letter to all employees. Below is a courtesy English translation.

Who is JD.com?

Brothers and Sisters, the year of 2020 saw an abnormal beginning. We cancelled the annual management conference due to the COVID-19 outbreak. However, JD has seen many changes and accumulated reflections in the past year. Therefore, via this internal letter, on this very special day, our Employee Appreciation Day, I still hope to communicate with you about who JD is, where JD comes from and where JD is going, as well as our mission and values.

This year’s COVID-19 had a deep impact on everyone, and people all over the world had to unite and support each other to fight it. JD contributed our strength to the fight, not only donating supplies in the first instance, but also guaranteeing livelihoods from beginning to end. We took on the important responsibility of ensuring daily necessities for consumers.

This reminds me of 2003, when SARS wreaked havoc in Beijing. That year we had to close the magneto-optical products retail store in Zhongguancun. In order to survive, we had no choice but to be cornered into entering the e-commerce industry by launching JD Multimedia in 2004.

From 2004 until today, JD has been around for almost 17 years. In the past 17 years, JD has gone from a fragile start-up, which was forced by SARS to transform, to an entrepreneurial company, growing to become a corporate citizen capable of making contributions to the country in an extremely difficult time like the COVID-19 outbreak. The past 17 years also witnessed the growth of JD from a micro enterprise with only dozens of employees to a Fortune 500 enterprise with over 260,000 brothers and sisters and a complete supply chain system. Such equipment has enabled us to transport critical supplies to virus-affected areas. It took 17 years for us to develop from a low-profile late comer to an industry leader who has a positive influence on suppliers and helped stabilize price and ensured supply of daily necessities during the COVID-19 outbreak.

However, growth should not only be measured by scale and size. Rather, self-cognition is an important measurement. For an individual, 17 is an age to form an initial view of life, the world and values. For an enterprise, 17 should be an age to think deeply about and define “who we are” after years of rapid growth.

It’s critical to know “who we are”. Only by knowing it can our company locate the anchor of value, which will provide our brothers and sisters continued incentives to work hard. Only by realizing “who we are” can JD complete its coming-of-age ceremony and likely achieve the transformation from “big” to “great”.

The Original Intention of the Company in the Early Stages (Before Year 2014)

“The mountains dance like silver snakes and the highlands charge like wax-hued elephants, vying with heaven in stature.”—from Snow by Mao Zedong

To answer the question of who JD is, we need to go back to our original intention during the period when the company was established.

During the early stages, we were far from having big dreams. JD’s move from a single counter in Zhongguancun to an online platform was more of a forced move made in a helpless situation. But from day one, JD has been a company that dares to think, and dares to act.

“Dare to think” is to challenge convention and do extraordinary things. I remember that during that time at the counter of my store in Zhongguancun, nearly all companies had the same business model –a notebook worth RMB 25,000 would be sold at RMB 35,000. There were even Zhongguancun’s “ten tricks” to teach merchants how to deceive customers. But we insisted on doing two things differently. One is to mark the price clearly, making small profits and quick turnover. The other is to provide good service. In this way, word of mouth and repeat customers will gradually accumulate. These two things seem quite commonplace today, but at that time, this approach went completely against the grain because I believed at the time that the chaotic atmosphere in the market must be changed.

In 2007, after obtaining its first round of financing, we decided to invest in self-built logistics. Logistics is a huge investment, and at that time nearly all the media and our peers were not optimistic about Internet companies doing logistics, and repeatedly questioned our decision. But JD did not hesitate, and despite everyone’s opposition, insisted on “burning money”. The result of this “burn” in fact was our user good experience and our core competitiveness. Today, JD.com’s reputation and advantages, whether it is authentic products or logistics and service experience, are inseparable from our original intention to dare to break the rules.

“Dare to do” is the spirit of hard work and to do the hardest, dirtiest and most tiring things. From day one, JD.com has not been a high-profit business. Logistics is the hardest and most tiring job, and retail industry profits are thinner than a piece of paper. In order to do well, we must rely on the fighting spirit and manage cost, efficiency and experience with a high degree of self-discipline at every step. In the early days of the company, in order to save money, I was reluctant to rent an apartment and slept at the office every night. In order to guarantee the promise of 24-hour service, I put an old-fashioned alarm clock near my ear and would wake up every two hours to see if there were any issues. This continued for four years. In 2007, all the employees and I moved to the warehouse and would come to the office at 5:00 each morning. Once, my receptionist left the key in the warehouse, and we slept directly on the side of the road in front of the Yinfeng Building.

It is because of such a fighting spirit, being “all in” with our brothers and sisters, that we have been able to survive in the midst of competition with thousands of e-commerce companies, and gradually expand.

Today, many people still say that JD.com is a little “unfashionable” and too “real”. I consider these to be compliments. It represents what we carry in our DNA – idealism, persistence and fearlessness. It is because of this that JD is a class of its own. I think JD.com is lucky, despite the twists and turns, our idealism, persistence, fearlessness has been recognized by the market and our business has maintained rapid growth, resulting in the company being listed on the capital market.

The pains of adolescence (2014-2018)

Disordered flowers have grown almost enough to confuse the eye,

Bright grass is able now to hide the hooves of horses. –from A Visit to Qiantang Lake in Spring by Bai Juyi (Tang Dynasty)

In May 2014, JD.com was listed on the NASDAQ Stock Exchange in the United States. This marks the fact that JD.com has officially gone through the start-up period and entered a new stage of development: larger scale and richer business, and at the same time, internal and external relations became more complex.

Some people outside of JD said: “JD.com’s heyday was when it first listed on the stock market in 2014 to 2015, and it was feared by the whole industry. But suddenly everyone found that JD began to follow others and learn everything from competitors. JD began to lose itself.” This comment is very sharp but to the point. JD was still young at that time, it really experienced quite a long period of confusion and struggle after listing. Today, if we want to define “who is JD.com”, we have to first answer who the “self” that we lost is. We must face this period of confusion head on. We can’t escape the problem, and there is no need to escape it.

In business, our desire once replaced logic. We were attracted by so many opportunities that we wanted to pursue, but that our ability may not be able to support, and sometimes we couldn’t wait and would jump in without thinking through the business logic. For example, we rushed too quickly into innovative businesses, and looking back, we found that there was no value created, our customer experience didn’t improve, and industry costs and efficiency were not optimized. We invested in a lot of projects, ultimately finding that we didn’t have the ability to touch a stone and turn it into gold. We were not ready to open ourself, and we were still used to doing everything on our own and having strong control over everything. Integration following investment was often not successful. At the same time, many new businesses (such as village promoters, Paipai, etc.) were not given continuous investment and attention. We lack patience and barely scratch the surface. The lack of depth and focus made us lose consistency in our strategy.

In terms of management, JD.com also encountered internal bottlenecks. At the time the company was rapidly expanding, the construction and updating of our management and cultural systems did not keep up. We suffered from “big enterprise disease”, arrogance, mountain-stronghold mentality, etc. – the whole company lost its vitality and it eroded our competitive foundation.

In 2018, JD.com came to its “darkest moment”. The outbreak of internal and external problems pushed JD.com to the forefront, and morale was very low for quite a while. But this was also an opportunity to improve our self-awareness and keep the essence of our team. We have no time to cry. Only by being calm and hard-working can we get out of the predicament. The Group quickly established the Strategic Decision Committee (SDC), the Strategic Executive Committee (SEC), the HR Committee (HRC), the Finance Committee (FC), and the Technical Committee (TC). And we spent a whole year to sort out the six lines of strategy, organization, mechanism, talent, culture and business. Facing the new situation, we proposed the Bigboss management system. Today, the strategy of the group and each business line has become gradually clear and focused; our organization is now built as blocks with an emphasis on coordination and innovation; the mechanism level revolves around decision-making, incentives and elimination; as for talents, we put forward new employment standards according to the Bigboss standards, and eliminated more than 10% of executives who do not meet the requirements. Culturally, we sorted out the company’s new positioning, new mission and new values. We also gave full authorization to business leaders, and gradually reached a consensus on quality growth.

Setbacks are not to be feared, what matters is what you learn from them. If JD.com’s initial stage is like a newborn calf who is not afraid of tigers, then after experiencing the pains of adolescence, his values on life, the world and his values are reconstructed through the process. I am very glad to have experienced these growing pains with my brothers and sisters. They helped us to recognize what we are and what we are not, and become more mature.

Who didn’t experience rebellion in adolescence? Broken bones well set become stronger, and we have no regrets!

Who is the adult JD? (after 2019)

Big enough to accommodate the public, virtue enough to be far-reaching. –from Huai Nan Tzu, by Liu An (Western Han Dynasty)

So, who is JD.com?

People may say, JD is China’s largest B2C e-commerce platform, or a Nasdaq listed company, or a Fortune Global 500 company, or a private enterprise who is transforming to technology based…… but these definitions all change with time and the environment, and have no way to define the essence of JD. Looking back on our history from starting a business to experiencing setbacks and coming out of the darkest period, makes me clearer about what hasn’t changed at JD, and what is unique at JD. This DNA, which will not change even in the face of an even bigger crisis in the future, define who JD is.

Dream chaser

JD has been a dream chaser since its start in Zhongguancun.

In retrospect, the dream in Zhongguancun was actually very small, and I knew almost nothing about what my career would be like. But dreams will gradually broaden with the expansion of knowledge, vision and experience. At the beginning, JD’s dream was to resist the commercial chaos in Zhongguancun and to succeed by taking the right way and building integrity. Later, the dream became to shorten the fulfillment process to provide consumers with the best e-commerce service experience. It was these most simple dreams that would have been ridiculed at that time that have led JD step by step to today.

What is JD’s dream today?

When I shouted “technology, technology and technology” at our annual meeting over three years ago, many people laughed at us: why did JD, a hard-working company, want to do high-end technology? Even today, many people still doubt whether JD can succeed. But when has JD’s dream not come true in the face ridicule and doubt? In 2019, listed and non-listed enterprises under JD invested a total of RMB 17.9 billion yuan in R&D, making JD one of the Chinese enterprises with the largest investment in technology. In the past six years, JD’s R&D investment has far exceeded its revenue growth rate. This is because we are all very clear about how much technology can play a role in the front-end customer experience, the efficiency of the back-end supply chain, and the well-being of frontline employees. Our drones, smart supply chain, cloud computing and AI services are all developed for these goals. The technology capabilities gained from our business scenarios will be of the greatest value only if they are applied on a larger scope: reducing social supply chain costs, and improving the quality of life of all mankind. In the next decade, technology progress will be more drastic than that of the past 100 years. We will also unswervingly transform into a technology driven supply chain services provider.

We also have a dream to become an internationalized company. JD’s vision is to become the most trusted company in the world. In fact, we have indeed been laying out our international business: entering the Indonesian market in 2015, opening up the Thailand market in 2017, and actively developing our cross border business, international business group, international logistics, international payment and other businesses. In the construction of talents, systems and processes, we should adjust measures to local conditions and gradually build an international management system. Last year, we made it clear that at the corporate level, we should make international business a strategic priority for the next three to five years. If the first half of the existence of the Internet is ” copy to China”, in the second half there are more opportunities for “from China to the world”. We are confident that we can bring our accumulated retail infrastructure – from logistics to supply chain, technology and other capabilities to the world. We do the work of paving roads and bridges in overseas markets. Roads have been repaired and bridges have been built to help Chinese brands succeed overseas, benefit customers, merchants and partners, and create another JD.com overseas.

With the growth of JD, there are different dreams at each stage. It is dozens of times harder than in the past to realize our technology and internationalization dreams. But, no matter what time, JD is the one who has dreams and dares to pursue them. It is more frightening to not dare to think than it is when your head was cracked open and bleeding due to pursuing your dreams.

JD is the lone guardian

If JD is likened a dream chaser, perseverance is the treasure we once lost and later recovered. Loss in puberty and growing pains have taught JD to be perseverant again.

First, we persevere in adherence to commercial values. It was considered crazy when JD decided to invest in its own logistics infrastructure. However, such a crazy decision was the result of the perseverance. Before JD went online, products were transferred five to seven times before they reached consumers. Each transfer didn’t create value for society. Therefore, JD built our own warehouses and reduced time of product transfer, greatly improving delivery speed and customer experience. We strongly believe that it’s wrong to conduct valueless commercial activities. This is JD’s business philosophy. However, there was a certain time where we lost ourselves and failed to adhere to this value. After one year of introspection and discussion, we have yet again realized that JD has to create value for industries via each product and service. We have to either reduce cost and increase efficiency for partners or deliver a better user experience. A product or service which can’t address an industry pain point has zero commercial value, and is destined to vanish when the hype passes.

Second is to guard our long-term philosophy. JD is a long-distance runner in the Internet industry. From the very beginning, our first-party products and self-built logistics were developed in tandem, over time laying the foundation for our supply chain capacities. Looking forward, the journey for us to open up our integrated model will also be long. This requires our time and patience to co-create a business ecosystem with our partners. Our growth might be slow, but we raise the bar for competition rather high along the way. Believing in the long term means that we are running a marathon rather than a sprint. It means that our muscular structure must be completely different from that of sprinters. But as long as we are going in the right direction, no path will be too far. The key is that we must have faith in our long-term value.

Furthermore, we must guard the philosophy of challenging ourselves. In the past, we challenged our competitors, but today the biggest challenge we are facing is ourselves: from a self-operated model to a platform model, the challenge is model transformation; from retail to technology and service, the challenge is new business domains; from integration to integrated openness, the challenges are awareness and organization… All of these require us to embrace a “back to day one” mindset. We must be humble, and think of ourselves as the challenger to the retail industry and the learner in the technology and service industry, rather than the leader. We must always keep our mind as open as when we began. The biggest transcendence is to transcend ourselves.

Guarding our philosophies is proof of our inner strength and wisdom as we learn from the classic military strategy that to gain lasting victories an army requires that they first build a solid foundation for their own camps and proceed steadily step by step. It’s a wisdom to build a solid castle, and fight a dull war. In the past, we often feared of missing out, but what’s more fearful than missing opportunities is opportunism. The ups and downs in the past few years have made us rethink what really matters, regain consensus and refine our gene as a “guardian”.

JD is the partner for all

JD has always held up business integrity and social responsibility on its road of development together with its partners and society.

Adhering to business ethics is JD’s bottom line: JD has never done anything to cheat or swindle. All the goods it sells are invoiced. It has never sold fake goods, evaded taxes, paid or take bribes. It doesn’t seem like something to brag about, but this has all been true since day one when JD starts as a micro-business. This is JD’s DNA. Our story gives the young people hope that building a business in a fully legal way can lead to success.

We always discipline ourselves in shaping the business ecosystem. Back in 2006, when JD first started selling home appliances, the average margin for the whole industry was less than 1%, while it could be as high as 6% for the offline retailers. The inventory turnover period was 87 days and the accounts receivable period was up to 180 days. Low-efficiency in the retail process abnormally became the highland for value acquisition which made it possible for JD to enter into the market. Two years ago, we started to manage the margin level of the home appliances category at a relatively low and stable rate. Even though we could make more profits, we chose to give more benefits to our customers and partners as we believe this is the right thing to do to protect this industry and ensure it can grow in a healthy and sustainable manner. Such operating practices do not only apply to the home appliances category. Today, we are opening up many infrastructure services as we continue to believe that greater value will not exist in constantly expanding ourselves or engulfing others, but in opening up ourselves to connect with the outside. We might not even necessarily stay at the center of the network. More importantly, we need to actively get ourselves integrated into the outside world, to be part of others, live with others, support each other, and rebuild with others.

As for our responsibility to society and the environment, we constantly practice this in our daily work. During COVID-19, we were widely reported by the media for our medical supplies donation to society, whereas we have paid equal attention to provide our supply chain capacities to support all levels of governments on ensuring people’s daily fresh grocery supplies and on leveraging our platform influence with suppliers to stabilize prices. We have always believed that besides charitable donations, the biggest contribution of a company to the society and environment should be measured by its peaceful co-existance with the environmentthroughout its business activities (e.g., Green Stream Initiative, digital invoice), how many social problems can be solved by its business model (e.g. poverty alleviation by developing industries, digital lending in the agricultural industry) and how it works with all stakeholders for a sustainable world (e.g. the responsible consumption initiative).

If you want to go fast, go alone; if you want to go far, together. JD is a responsible company. We have responsibilities to our family members, employees, industries, and society. We will never sway along the way to guard the integrity of our business, environment, and society.

Who is JD.com? It is a dream chaser, a consistent guardian, and a partner for all. No matter what changes take place in the external environment and our own business, this will always remain true in our hearts.

Our Mission, Our Future

Powered by technology for a more productive and sustainable world

As JD.com is just on the verge of 17 years old, we have a deep understanding of ourselves and can face internal and external change more calmly.

Today, external change is at a structural inflection point. In the last decade, the mobile internet era has brought tremendous changes on the consumption side, giving rise to many new business models. But this era is coming to an end. In the future, the integration of cloud, AI, 5G and other technologies, and the advent of the “intelligent era” bring more cost reduction and efficiency and entirely new opportunities to the supply side. Technology will play a huge role in the industrial internet.

JD.com, as an Internet company linking production and consumption, has a solid supply chain system and data foundation, and has both an opportunity and a responsibility to proactively embrace the incoming intelligent era. This year, we have already updated our strategic positioning: We are “a supply chain based technology and service enterprise,” meaning that we need to harness our supply chain advantages even more, and apply them to industrial scenarios, working together with partners to reduce industry costs and improve society’s productivity.

With this internal and external context, in the past several months, leaders from JD’s Strategic Planning Committee, Strategic Execution Committee as well as managers of individual business units have undergone multiple rounds of discussion and deliberation as to our new mission. We hope that the new mission can bear the weight of the true value JD might be able to bring to the industrial internet, and define JD’s responsibility to society even more clearly. In the end, after thorough consideration from multiple facets, we have determined JD’s new mission: Powered by technology for a more productive and sustainable world.

Our new mission highlights three keywords: technology, productivity and sustainability. “Technology” represents our goal as a “dream chaser”. Internally, guided by value creation, using technology to reduce costs and increase efficiency and enhance product and service experience. Externally, using the export of our technological capabilities as a starting point from which we promote continuous upgrade of the industry. Productivity serves as our yardstick for the quality of our guardianship: The only measure of success of our business model is whether or not we have improved the productivity of the industry and society be more productive, and created real value. In the past, through reducing the number of times goods needed to be moved, we improved the productivity of the retail and logistics industry. In the future, connecting people and enterprises, connecting enterprises and enterprises through a technology-based coordination network will bring even more room for productivity enhancements. Sustainability refers to our desire as partners: to share business success with partners, to provide a platform for fair and balanced development for employees, to protect the ecological balance, and to be a grateful and responsible corporate citizens, achieving a balance of people, planet and profit, and to do our part for the sustainable development of the world.

Looking towards the future, with technology as the cornerstone for our development, JD will continue to provide the ultimate customer experience while opening up our capabilities to become basic infrastructure, working with our partners to reduce industry costs and upgrade productivity. With the pursuit of maximum social value as our goal, we will uphold our long-term philosophy to co-create a sustainable world with our partners.

The renewal of our mission represents our official step into a new stage of development. Who is JD.com? It is no longer a new born calf, nor is it a restless rebel, but it is in awe, still moving forward bravely. It is not slow, but unswerving. It is 17 year-old JD.com, who bids farewell to her ego and converges herself in to the blue ocean to embrace the even brighter sunrise.

Chairman and CEO, JD.com

Richard Liu