by Brad Burgess

JD.com is a fairly complex company – and, frankly, many people are confused about the complexity. Is it the Amazon of China? Or, is it more like EBay? Or, is it something different entirely?

While analogies help us simplify and categorize things in our mind – and, they certainly make compelling news headlines – they aren’t always true or helpful. Apples, oranges, and false dichotomies often limit our understanding. JD is just such a company which may cause some head scratching with outside observers who have had limited understanding or exposure, leading to oversimplification.

It’s understandable. JD started as a retail company, doing what retail does best. JD is now still a retail company. Or, better yet – JD “owns” a retail company: the largest one in China (JD Retail). JD also owns a logistics company (JD Logistics). Again, it’s the largest one in China and the only one that handles end-to-end logistics. The third core business that is a part of the JD family (JD Digits) uses data technology and the Internet to help companies be more efficient. This is not all. There’s insurance, property management, health and others.

A Fundamental Strategic Shift

As of March 5th 2020, there is now a fourth core business: JD Cloud & AI.

JD has been under transformation for the past few years, on the path of becoming a technology and service enterprise. While retail was previously the center of JD’s business, now it is more broadly supply chain. And, technology and services are the future of JD. This doesn’t mean that the name JD will no longer be synonymous with the best customer service retail experience in China. Rather, it’s about continuing to improve that experience and opening up new frontiers as a service enterprise. JD’s R&D team now has over 18,000 personnel, among which over 80% hold masters or above degrees. In 2019, total investment on R&D by listed and unlisted affiliates of JD exceeded RMB 17.9 billion (USD 2.6 billion).

There’s been some fascinating results recently that improve the overall consumer experience. Consider, for example, JD’s “empathetic chatbot” which I find personally compelling and may write about separately later. This discerns people’s emotions when there is a customer service problem – enabling a better and more empathic experience when needing to handle mass inquiries such as during shopping bonanzas. My personal pet peeve is calling my bank in the US (not naming which one) and most recently getting the run around for 25 minutes before finally addressing the problem. And, all on an expensive overseas call.

So, the development – and, most importantly – the application, of technology to improve the consumer experience is very real; and, very necessary.

Blockchain Technology as Guardian and Guarantor of Quality

It’s equally necessary for tackling counterfeits. I’ve written in part one and two of this series how JD’s focus on tackling counterfeits and guaranteeing quality is a systemic question. The business model itself encourages greater oversight and acts as a general deterrent of poor quality and counterfeit goods. This is how quality is encouraged at the system level. At the technical level, the focus is the same: repelling the bad and encouraging the good.

One of the key technologies that JD employs to guarantee quality is blockchain. Blockchain is one of those technologies that has become a bit of a buzz word for the last couple years, becoming associated with mysteries like cryptocurrency. A quick stroll through LinkedIn reveals a slew of blockchain and cryptocurrency enthusiasts right up there with AI experts. And, yet, though it’s become highly buzzworthy, it’s a highly specialized area that few understand.

The key thing to note for here regarding the fundamental benefit of blockchain is that it provides a level of trust for all stakeholders who are involved in a product, from its genesis to its completion. JD is a pioneer in the development and application of blockchain technology. There are many ways blockchain is employed at JD, whether it’s tracing farm to table freshness or for the pharmaceutical industry, enterprise businesses or others. One of the recent interesting examples is how JD empowers carp enthusiasts across China who purchase the fish from China’s famous ancient Chagan Lake. Consumers can scan a unique blockchain ID assigned to each fish, detailing origin, qualification, and even the name of the fisherman involved.

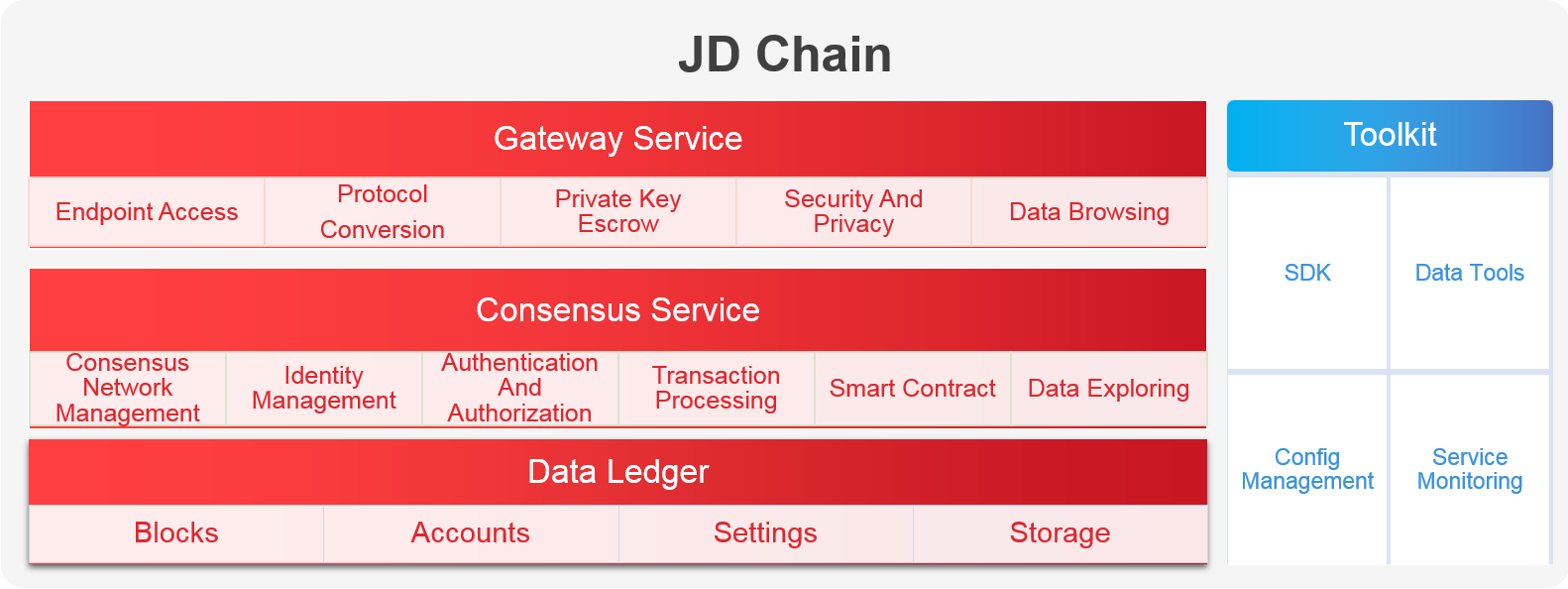

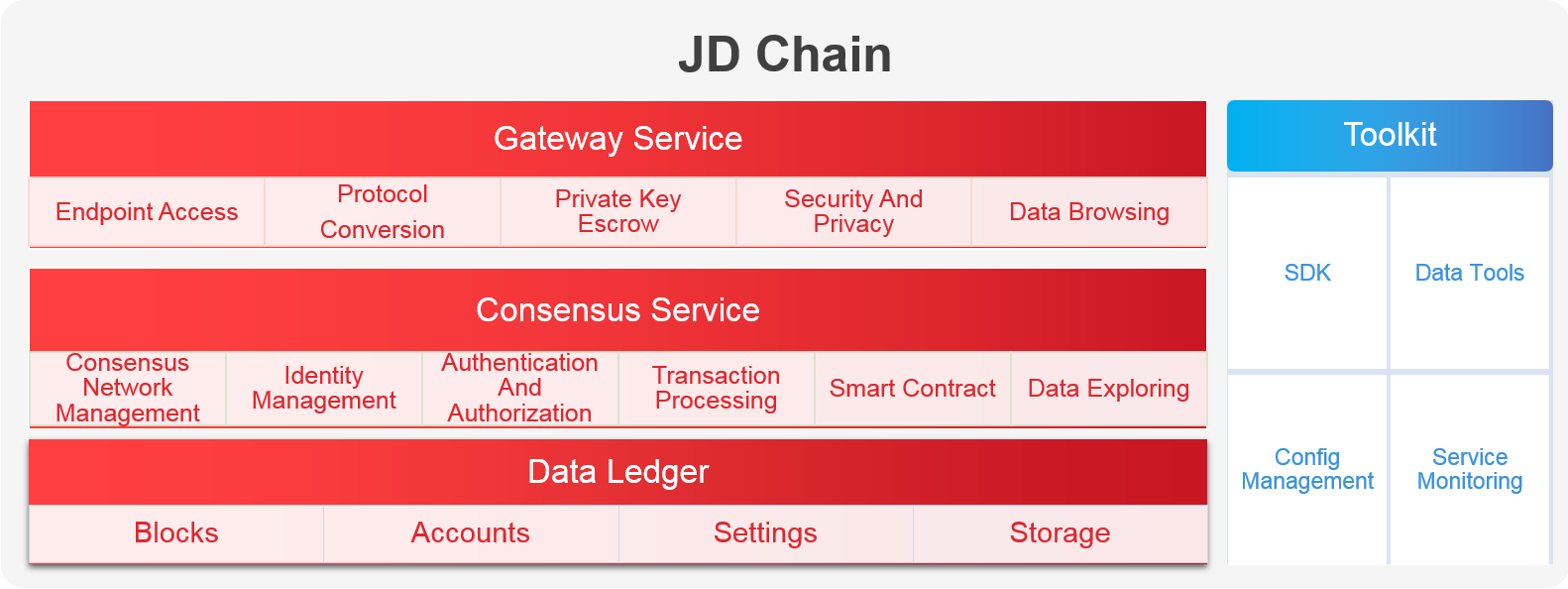

During April of last year, the company set up a branded blockchain solution called “JD Chain” which provides participating businesses with underlying technology, enabling them to build their own blockchain solutions from the ground up.

JD Chain, JD’s self-developed blockchain framework open for businesses

In terms of specifically addressing anti-counterfeits, JD Digits has developed blockchain technology for the business overall, which also has application for quality guarantee: Zhi Zhen Lian (智臻链). The naming essentially means employing smart technology to better people’s lives. The company set up a specialized blockchain team in 2016, incubating it internally as part of the company’s supply chain innovation. Following a year later, JD introduced the Zhi Zhen Lian anti-counterfeits blockchain tracing platform, in partnership with JD Retail and JD Logistics. Up to the end of last year, Zhi Zhen Lian covered over top 800 brands, over 70,000 SKUs, over 650 million after-sales user queries, and 1.3 billion items of data.

A perfect example of the effectiveness of blockchain in authenticity is in the farm to table scenario. The entire supply chain of fresh food is highly complex, involving IoT data collection, coding, communication and detection, consumer touch points and after-sales management. Through employing blockchain technology, the information at each point along this journey is interconnected in a secure framework to ensure data protection, tracking at each process and without tampering.

Farm to table scenarios may be bread and butter for certain parts of the world, such as in New Zealand, which consistently ranks the highest in the world in terms of transparency as a society with high institutional trust. It’s important to remember the China context, when there were major food crises during the past decade. In this context, blockchain raises both safety as well as trust. Indeed, in a recent JD and CEIBS study, researching 438 samples representing different categories of traceable products indicated that using anti-counterfeit block chain technology delivered nearly 10% overall sales growth, with an over 23% sales increase of mother & baby products, 45% increase in repurchases for health care and nutrition products, and a nearly 32% decrease in return rates for infant formula.

A visual example of the complexity of blockchain in a farm to table scenario

“Smart Brand Protection” Honing in through Big Data and Incisive Insights

In addition to blockchain technology, what I find really compelling is additional technology developed and implemented by JD for risk governance and quality control specifically. This first tool can be translated as “Heaven’s Mirror” (天鉴).

Heaven’s Mirror is an AI technology which leverages JD’s massive big data from across the business. The technology has three significant core elements:

- Semantic analysis. In a nutshell, this is taking customer service complaints seriously. Through specific keyword selection, emotional analysis and multi factor analysis, JD can identify comments about risky goods and apply this intelligence to identify risk through analyzing customer service complaints and external opinion. The NLP algorithm is able to identify issues with 99% accuracy.

- Image recognition. Through product pictures, user comments and related, using image search technology and OCR map recognition, JD can quickly identify high-risk products. For example, taking picture infringement cases as an example, one can go to the whole platform for picture comparison, mark the same kind of pictures found, and deal with the corresponding product links. This OCR technology is also applied to merchants’ qualification examinations to strictly set the threshold for merchant entry. The application of image recognition technology has greatly improved JD’s efficiency.

- Product DNA. This technology digitizes, identifies and monitors goods easily. Just as users have user portraits, JD builds multi-dimensional product portraits for each product, digitizes it in high granularity to improve accuracy. Data detection is then able to identify any abnormal characteristics.

Heaven’s Mirror is a smart product that can continuously accumulate and iterate through machine learning. Through deep mining of data and risk characteristics, JD has formed a series of complex strategies and rules. At the same time, JD’s accumulation of brand knowledge and historical investigation experience has formed its data assets. The accumulated data can constantly improve and enrich the risk characteristics. The cycle is actually the process of machine learning; and with the passage of time, it becomes more and more agile and intelligent.

“Guaranteeing authenticity has been in our blood since the very beginning,” says a JD spokesperson familiar with the company’s brand protection. “What makes JD unique is how we are able to take both a birds-eye view and hone in to look at specific cases first with our leading technology. We qualify potential issues and follow up offline rigorously. We call this our ‘smart brand protection’ approach.”

In terms of taking final steps in cooperating with the authorities, JD has strict measures regarding data privacy and encryption. The system identifies and associates criminal gangs through comparing an assortment of information that bring the data to a central decisive location. This “Eagle Eye” (鹰眼) simplifies a highly complex relationship network which is then useful in cracking the case.

The “Eagle Eye” hones in on specific information related to the identity of the people suspect, the nature of interconnected relationships, and location-based information. This combination of big data computing and subsequent high quality targeted search can be incredibly effective.

A modern day Sherlock Holmes couldn’t do it any better. The tools enable the sleuth. Whereas powder and a magnifying glass accompanied Holmes across Scotland Yard, JD’s team qualifies intuition and tips through data.

JD’s Quality inspection team, clocking over 1 million air miles and conducting traceability checks on over 1,200 factories in 2019

To better protect consumer safety and experience, JD has created dozens of industry quality standards over the past few years. These include safety standards in textiles for infants and children, reading lamps, appliances, electric water heaters, skateboards, and even yoga mats and toilet seats!

There’s an ancient saying in Chinese from a famous doctor, Bian Que(扁鹊,407B.C.-310B.C.), of the Warring States period of Chinese history which applies here: “上医治未病,中医治已病,下医治大病”. That is, top doctors can identify the cure before the signs of illness emerge, good doctors identify illness through diagnosis and ordinary doctors can only treat existing illness. In essence, while it’s important to discover and deal with risks when they emerge, its more effective to prevent them. And, the way that JD does this is through establishing the overall prevention system and process design, in addition to fortifying it through robust technology.

Much of what JD does is not – and, cannot – be disclosed with the public. But, this is a small taste of the technology that is behind the trust. Rest assured, there is a reason why Chinese consumers who know JD, trust JD.

This story concludes the three-part series on “How JD Tackles Counterfeits”. It starts with the business model, is secured through rigorous quality assurance and surrounded by a fortress of powerful technology. This is how JD is able to deliver authentic products every single day.

*”How JD tackles counterfeits” is a three-part series that tells JD.com’s story. Part one introduced how JD’s beginnings and business model guarantee authenticity. Part two introduced JD’s quality guarantee.

(Part 3 of 3)

Read Part 1: LINK or Part 2 LINK

(brad@jd.com)