by Martin Li

AI as a fundamental technology is everywhere in the product system of JD Digits (JDD) and a cornerstone technology for the company which is committed to driving industrial digitalization with AI, according to Bo Liefeng, Chief Scientist of AI Laboratory of JDD.

Bo now leads the company’s intelligent technology unit, which covers technologies including computer vision, natural language processing, speech technology and machine learning. It’s tasked to support JDD’s demands for AI and intelligent technologies.

Bo Liefeng

AI technologies are applied to JDD’s four core business areas: financial technology, intelligent city, digital marketing and AI technology product.

“AI technologies including computer vision, natural language processing, speech recognition, and machine learning are widely used in JDD’s products, ” said Bo.

“In addition to developing AI as a fundamental technology, we also develop AI products, like robots,” he added.

Eyeing profound influence on industries

In Bo’s eyes, all Internet and hi-tech companies have a heavy reliance on AI. And such reliance is increasing. However, what differentiates JDD from other enterprises lies in its purpose of using AI.

“Some enterprises mainly use AI to support their core businesses from aspects like improving customer experience, customer service and marketing. For those pure AI enterprises, they develop ‘light-weight’ and general AI technologies which can be fast and easily applied to all industries, but there is still a distance – or a clear line- between AI and industries’ pain points (due to lack of industry know-how). For JDD, we seek to develop AI technologies to exert a profound influence on industries,” said Bo.

“When we want to have a profound influence on industries, we have to integrate closely with industries. In the process of integration, we learn industries’ characteristics and pain points, acquire industry know-how, and then gradually optimize our technologies and solutions in the related scenarios. It takes much time and energy. However, once it’s done, it will be well accepted by industries because it can solve pain points and deliver value,” he said.

“We don’t develop a solution in a blind manner and then sell it to industries. This is one of JDD’s core principles,” he added.

Currently, JDD’s AI technologies, solutions and products are used by banks, city governments, and commercial entities.

A successful trial at Nanning Power Plant of CHN Energy in March 2019 demonstrated that the model could reduce energy consumption by a maximum of 0.5 %, which means a medium-sized 600,000-kilowatt power generation set can consume 3,600 tons less coal each year and discharge almost 90,000 tons less carbon dioxide.

After another year’s optimization, the model now can increase boiler combustion efficiency by 0.55% at Nanning Power Plant and 0.5%-0.6% at Langfang Plant In Hebei province.

In developing AI products, JDD develops robots to address pain points of financial institutions, including banks.

Banks are facing a big challenge in maintaining an increasing number of data centers and computer rooms. The growth in numbers means a heavy burden on banks’ maintenance staff.

In March 2020, JDD’s self-developed patrolling robots went into use in data centers of many national-level commercial banks.

The patrolling robots carry various sensors to monitor temperature, humidity, noise level, smoke and dust in data centers on a real-time basis. It integrates AI technologies like deep learning, computer vision, voice recognition and edge computing.

A robot can finish monitoring of a single computer cabinet within 30 seconds on average, boasting an accuracy of over 98%. In addition, use of AI robots can reduce yearly cost of maintenance by 50%.

The robot can also monitor and verify identity of people entering or leaving data centers.

In breakthroughs of AI technologies and products, JDD also applies face recognition to the verification area in businesses like loan and finance, according to Bo.

“Our chatbots, which involve voice recognition and natural language processing technologies, now make more than 1.3 million times the number of calls each day, accomplishing workload of over 1,000 people,” said Bo.

COVID-19 drives willingness for digitalization

The global COVID-19 pandemic has increased industries’ awareness and willingness of digitalization, according to Bo.

“Take insurance company as an example. Its offline sales shrank to 10% of those before the pandemic. Its demand for digitalization turns very strong but its AI ability is very limited… There are two approaches to help it, one is to offer a new financial product, the other is to improve efficiency of its certain product,” said Bo.

“Before the pandemic, industries were not clear about their demands for digitalization. After the pandemic, they realized the demands…It’s good for JDD. Our persistent learning of industries’ know-how now can be better applied to products and solutions,” said Bo.

Bo said that he is optimistic about digitalization in industries like agriculture and service industry, since it’s already well-developed in the e-commerce industry.

More rooms to explore at JDD

Bo joined Amazon in 2013 as Principal Scientist at its headquarters in Seattle, focusing on basic algorithm research of Amazon’s unmanned store Amazon Go.

“My work at Amazon mainly focused on pure and fundamental technologies. After years of work there, I encountered bottleneck in my career. In 2017, JD’s CEO Richard Liu started putting technology in a key position in the company’s development strategy and the same year, JDD started transformation of its business focusing from financial technology to more comprehensive digital technology. I made the decision to join JDD because I believe in its prospects,” Bo recalled.

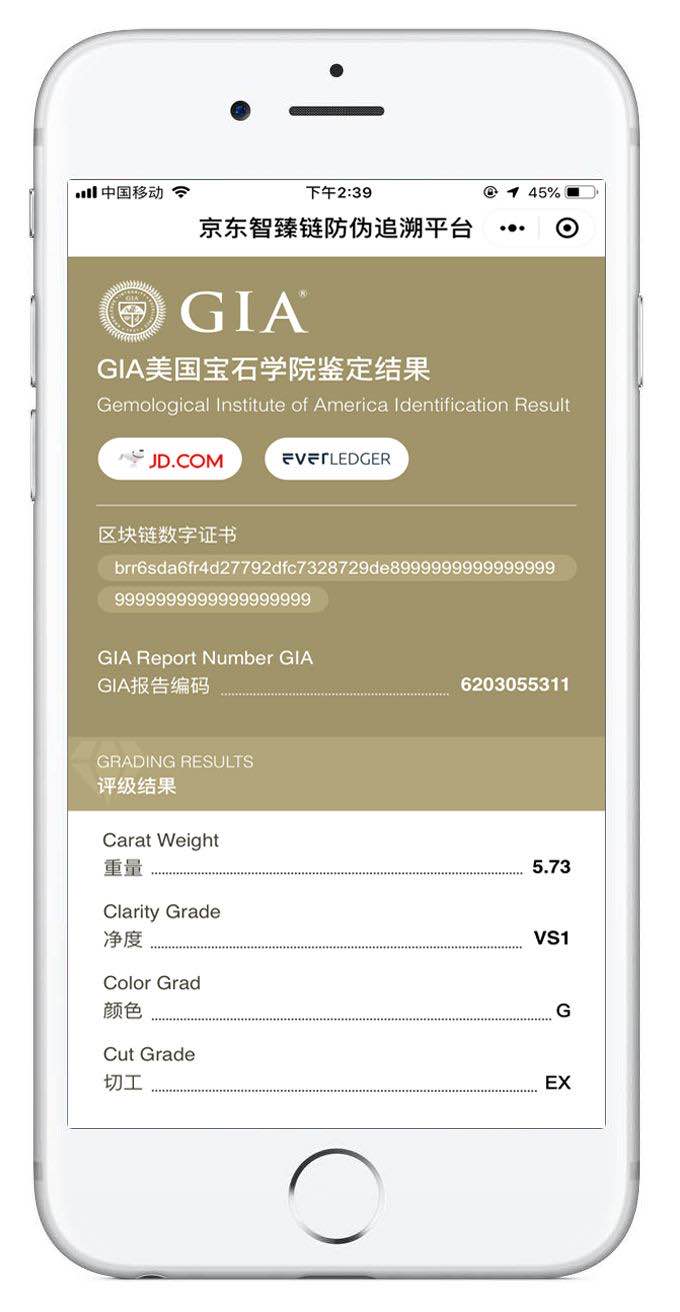

“I’m faced with a wider range of technologies at JDD because I have more freedom here. I have chance to have a full command of AI and blockchain development planning. Meanwhile, project is carried out fast and business evolves fast too. It’s conducive to personal growth,” said Bo.

“At JDD, we don’t do pure technology research. Our technologies need to be integrated with industries and businesses, so I can think about problems from multi-dimensions,” he added.

Bo now leads teams in Beijing, Chengdu and Silicon Valley in the United States, totaling over 160 scientists.

“I’m based in Silicon Valley and the team in Silicon Valley does AI algorithm research. Senior team members are from top technology companies like Google, Microsoft and Amazon. Young members are from renowned universities like UCLA, Carnegie Mellon and University of Washington in Seattle,” said Bo, who is a contract professor there.

“All people at JDD aspiring and enterprising. This is different from typical American companies,” Bo said.

(bjlihao3@jd.com)