by Ella Kidron

On March 2, JD reported its fourth quarter and full-year 2019 financial results (full press release here). The company saw strong performance across key metrics including user growth, net revenue and profit, reflecting the strength of its retail business model, and its dependability, to customers and partners alike. An infographic with highlights from the release can be found at the bottom of this article.

JD has made ongoing efforts to improve its service. This has enabled the company to not only meet, but to anticipate and exceed consumer expectations.

At the same time, a strong supply chain and logistics infrastructure and technology expertise has made JD a partner of choice for companies in a wide range of industries far beyond retail. JD’s guarantee of authenticity, combined with its promise of fast delivery, including same-day or next-day deliver as standard – a level of service matched by any company globally – keeps people coming back again and again. It all really comes down to trust.

Trust: Foundation for development

Continued commitment to the customer and to the customer experience has cemented customers’ trust and reliance on JD. JD has been investing in lower tier cities for years, establishing its nationwide logistics network to cover these areas early on. It has also leveraged its supply chain resources to provide quality products and different price points.

JD customers come in all shapes and sizes, ranging from people in lower-tier cities, to tier one cities, and from Chinese nationals to expats. Their impressions differed based on their experience, but trust came up repeatedly in conversations with them. For some, it’s trust from being a veteran user, while for others it has built up based on repeated positive experiences in a short period of time.

Ms. Niama is a five-year expat resident, currently living and working in Beijing’s Chaoyang district. She shared, “I started to shop on JD a few years ago and it was revolutionary for me. I find everything I need with just a click.”

Ms. Niama often turns to JD from everything from clothes and electronics, to cosmetics and gifts for her family back home in Morroco. She continued, “The beauty is the delivery speed. When I leave China, JD will be the thing I miss the most.”

Ms. Wu is a Chinese national from Tongdao, Hunan, who is currently living and studying in France. She remembers her years as a JD customer fondly. “It’s quick. Also the delivery service is a huge advantage. With others you have to worry about other delivery services throwing your packages around, but with JD, you never have to worry. Sometimes you can even become friends with the couriers. And the coupons help me save a lot.”

Whether it has been in customer engagement initiatives, especially in lower-tier cities, improvement of experience through unique omnichannel initiatives, or expanded product selection by giving consumers the products they ask for through Consumer-to-Manufacturer (C2M), trust is the common thread that has driven the company to a strong 2019, and positions JD for future growth.

Loyalty: Robust customer growth

JD saw robust user growth in Q4, especially in lower-tier cities (defined as 3-6 tier cities), with annual active customer accounts increasing to 362 million in Q4, due to innovative marketing, superior product selection and better customer service.

During the 2019 Singles Day(November 11th)sales festival, growth in lower-tier cities drove new customer growth, with the number of lower-tier cities users placing orders increasing 60% YoY and over 70% of new users on JD during the period from lower-tier cities.

Mr. Dai, who resides in Urumqi, is a regular customer who also participated in the Singles Day festival. He was brief yet resolute in explaining why he shops with JD. “Quick! I order today and get it tomorrow. The couriers are well-dressed and polite. They deliver to your door.”

Ms. Harrison, an expat resident of Beijing who was just a few months into her China journey and joined JD ahead of Singles Day said, “To be honest, I don’t fully understand it because I can’t read Chinese, but all I know is that once I make an order, before I know it, the JD courier is calling me to let me know my package has arrived. It’s unlike anything I experienced in my home country.”

Convenience: Enhanced customer experience

JD has continued to leverage its supply chain and logistics strength to push into omnichannel with several models. JD’s Omnichannel Fulfillment supply chain innovation program sources products that customers order on JD from offline stores closest to customers. What it means is that, particularly for every day necessities like bottled water, when an order places an order through JD’s first-party retail model online, JD’s supply chain system can source the product from a partnering offline outlet in the customers’ surrounding area, instead of the product having to travel from JD’s warehouse to a delivery station and ultimately to the customer.

Launched on Singles Day last year, JD’s E-Space, is a 50,000 square meter mega store that offers consumers the chance to try virtually anything in the store, including washing machines, vacuums and even go-karts and Segway-type devices. To buy anything in the store, consumers simply scan a QR code next to the product which will take them to JD.com where they can purchase the product and choose to have it delivered home. What it means is that even consumers who are not located in the Chongqing area where E-Space is, can enjoy same- or next-day delivery of products in the store.

Jeff Towson, Peking University and CEIBS professor with a 3.1 million-person following on LinkedIn, wrote in a post, “The store is also focused on dramatically improving the customer experience. [JD is] attempting to reinvent the retail experience – with a focus on ‘experiential retail’”.

JD E-Space in Chongqing

7FRESH, JD’s offline fresh food supermarket brand also launched two new store models. 7FRESH LlFE is focused on becoming the “go-to” store for the surrounding community. With a store area of between 300 to 400 square meters, 7FRESH LIFE combines restaurant + fresh food grocery +convenience store and provides more than 3,000 items, including fresh produce and daily groceries as well as ready-to-cook and ready-to-eat food. The first store is located in the Huilongguan residential area of Northern Beijing and services 38 surrounding residential compounds and three office areas, reaching 50,000 families and 1,000 office professionals. Delivery is available within a 1.5 km radius in as fast as 30 minutes. At the same, consumers will find an extended selection of products online, such as large-size products, beauty and baby and material products.

Ms. Chen is a middle-aged professional living in Beijing’s Dongzhimen area while her parents live in Northern Beijing. She often goes to 7FRESH for groceries for the week for both her and her parents’ houses, but now her parents can also go to 7FRESH LIFE. “When the first 7FRESH opened, I’d make a special trip out to Yizhuang just to go there. Now there are more stores closer to my parents’ house, it’s much more convenient.”

SEVEN FUN, the lifestyle brand launched under 7FRESH is aimed at servicing the working professional. With 12 food stalls, many of which are part of popular local or national chains, three bars and a full-grocery section, SEVEN FUN can cover all meals – breakfast, lunch and dinner – and also offers a place to hang out, catch up and even catch live music on occasion. For the busiest of professionals, delivery is also available within a 1km radius of the store.

Selection: Consumers benefited from C2M initiative

Launched several years ago, JD placed even more emphasis on its Consumer-to-Manufacturer (C2M) initiative this year. JD’s C2M model leverages the company’s big data and customer analysis capabilities to optimize a brand’s products specifically to meet the unique demands of the Chinese market. As China’s largest retailer, JD has access to a vast database of customer feedback, as well as specialized data analytics tools which can perform sophisticated key word searches and trend analyses.

During the 2019 Singles Day shopping festival, sales of C2M PCs increased 491% YoY and 2 of 5 monitors sold were C2M monitors. Recent data from JD revealed that sales of C2M health-related home appliances from January 25-February 21 tripled compared with the same period last year.

Challenge: Bringing in more trust

The trust cited by several customers in conversation is not just a big driver of a strong 2019 for JD. It is also why, when the COVID-19 outbreak struck in mid-January, in the most trying period of time for people from all walks of life in China, people turned to JD.

JD has spared no efforts in the fight against the coronavirus. The company immediately stepped up and mobilized its resources across retail, logistics, technology, health and other areas – to provide immediate support for the anti-virus fight.

It has ensured people’s livelihoods through regular supply and delivery of daily necessities across the country, while providing much needed support to ensure a continuous supply of emergency medical goods in the epidemic epicenter in Wuhan.

Ms. Wang, a middle-aged JD customer in Beijing’s Daxing district mentioned while picking up her latest package from JD’s makeshift delivery station outside of her apartment, “The only time I’ve gone outside since the virus hit is to pick up my packages from JD. I only trust them. I don’t know what I’d do without [the JD couriers].”

Today, well over a month into the outbreak, this sentiment remains. In fact, JD’s net promoter score, a measurement of customer satisfaction, reached record high levels in January. In addition to providing basic needs and medical supplies, customers have turned to JD pick up healthy habits while at home.

Ms. Fan, a young professional who has been in self-quarantine in Beijing for the past month, said, “During this special period, with restaurants closed, you have no choice but to become a ‘big chef’ at home, exploring your own way to cook something tasty. I’m no exception.”

According to JD data, in the month of February, sales of kitchenware, such as multi-purpose knives, woks, pots and baking tools have all increased significantly, with baking tools taking the lead, increasing 332% compared with the same period last year.

Ms. Fan continued, “My friend in Shanghai has been teaching me how to cook remotely. The other day, she showed me some pictures of her dishes and recommended a pot she’d bought on JD. I didn’t order immediately because I didn’t believe that in the epidemic it would still get to me on time. But when I finally made the order, JD surprised me. Even in this period, I got the package the next day.”

Whether it is now during COVID-19, or in the future when it passes, JD will continue to deliver trust, and to empower its partners to do the same.

(ella@jd.com)

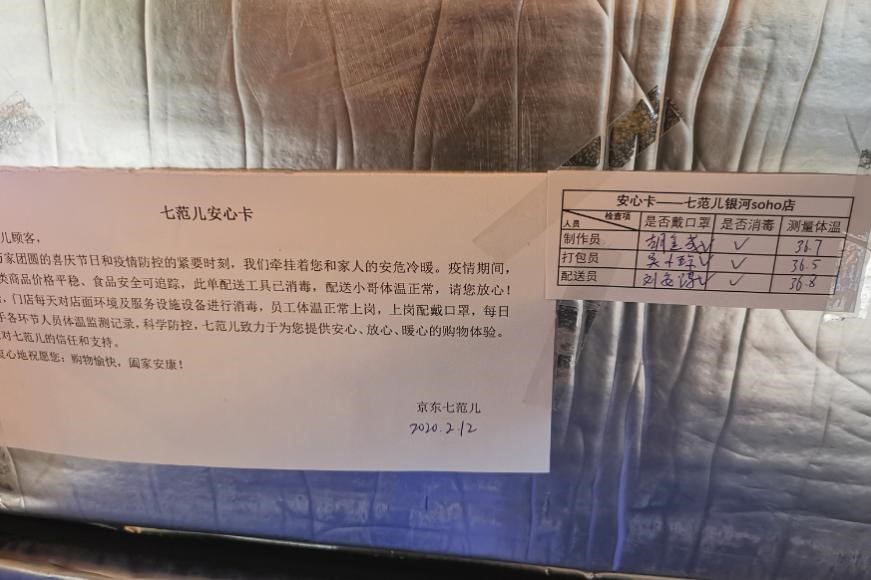

Card with temperatures and other health information for preparation and delivery staff on a SEVEN FUN lunch service delivery box

Card with temperatures and other health information for preparation and delivery staff on a SEVEN FUN lunch service delivery box