May 20, 2021|

Seven Consumption Trends of 2021 in China

by Vivian Yang

Trend #1

Enthusiasm for brands from both home and abroad

The rise of “China-chic” is an obvious trend since 2020 as Chinese consumers increasingly embrace products from domestic Chinese brands. This can be attributed to Chinese consumer’s more mature consumption mindset and local brands’ increasing channel penetration. Domestic brands in food & beverages, beauty & personal care, baby & maternal categories are showing a particularly strong rise.

According to a report by the JD Big Data Research Institute released on May 10, compared with international brands, the transaction volume growth of Chinese brands is 6% higher, while growth in consumers is over 18% higher, YOY. The highest ratio of consumption of domestic products is in tier 6 markets, but the appeal of Chinese brands to consumers in tier 1-5 cities is also rapidly increasing, among which the tier 2 cities are seeing the fastest growth.

JD’s C2M mooncakes featuring the Forbidden City

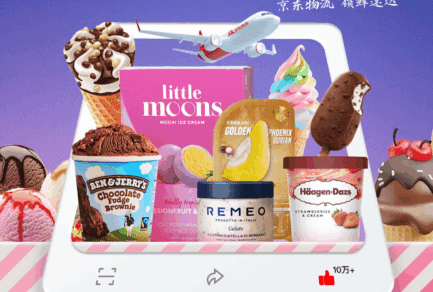

Meanwhile, Chinese consumers’ appetite for international brands is not going away. Imported products in luxury, healthcare and other categories maintained high-speed growth in the past year, prompting foreign brands to seek more innovative ways to align with local culture, social norms and customers’ shopping behaviors.

JD Worldwide, JD’s platform for imported products with over 10 million SKUs, celebrated its sixth anniversary on April 15. More than 20,000 imported brands from over 100 countries participated in the anniversary shopping festival, with purchases of more than 1,000 brands increasing by over 100% compared with the day before, indicating the surging demands for international brand consumption at home and the recognition of innovative marketing approaches.

JD Worldwide opened a duty-free store in Sanya, Hainan

Trend #2

Omni-Channel at Full Speed

China has become the benchmark for omni-channel retailing. The business model, which aims to meet customers’ diversified shopping demand whenever and wherever they need, asks for optimized supply chain capacities to deliver state-of-the-art shopping experiences.

As the vanguard in omni-channel supply chain management in China, JD’s omni-channel approach extends across multiple categories and industries, with its over 12,000 offline home appliance experience stores across China serving as a clear example of how offline stores can add value for consumers.

So far, JD.com has achieved one-hour on-demand delivery services for digital products, fresh groceries, medicines, even luxury products and more in many Chinese cities, enabled by JD Logistics’ nationwide logistics network as well as in collaboration with Dada Group. The company is expanding the model to cover more areas, customer cohorts and all categories, in order to improve overall retail efficiency, meet consumers’ diversified and instant needs for purchases of goods and services, and create value for merchants and consumers.

A JD Computer and Digital offline store

Trend #3

The Emergence of New Categories

Generation Z is becoming the main force of consumption in the market. JD’s data shows that in 2020, Gen-Z had the highest growth rate in online shopping turnover, at 23% higher than the average growth rate of the entire platform. A slew of new brands in new product segments are emerging on the internet as answers to young people’s need for individualization and new shopping experiences.

For instance, as many young people in China are getting more indoorsy and wanting to eat healthier, JD’s recent consumption studies identified several popular new food categories, such as pre-prepared dishes known as “fast-hand dishes”, buffalo milk, low-alcohol wine, compound condiments, enzymes, dietary fiber snacks, vegetarian meat and so on.

With JD’s Customer-to-Manufacturers (C2M) model which leverages AI, big data, and supply chain technologies to help partners to analyze consumption trends and insights based on JD’s 500 million user base, the company vows to create 10,000 new C2M products to better meet customers’ need in the next three years.

JD Super released seven new trending food categories in May

Trend #4

Lower-tier Cities and Rural Revitalization

Online retail is quickly going deep into China’s lower-tier markets, with more diversified shopping demands and consumption upgrading trends being seen. Consumers from mid to lower-tier cities are spending more than their peers from 1st and 2nd tier cities on home appliances and smart devices in part because they continue to buy property at affordable prices in these areas.

There’s an indication that in recent years more migrant workers have moved their children’s future education plans from the big cities to their hometowns, possibly also reflecting an overall improvement in the employment opportunities available closer to home. The trend can be verified by the orders’ addresses and consumption growth of JD’s children’s books and auxiliary teaching materials.

On the other hand, agricultural products in scalable production and good brand awareness become a vibrant driving force for rural revitalization. Up to now, JD’s platform has realized RMB 580 billion yuan in transaction volume of agricultural products. A JD survey published on Mar. 4 shows that the procurement volume of agricultural product merchants has seen explosive growth with the help of e-commerce, growing 51% and 82% YOY in 2019 and 2020 respectively.

The company aims to build a full supply chain for agricultural products covering planting, transportation, and sales, integrating upstream and downstream agricultural industry players through a products circulation middle platform. It also works directly with farmers or local partners to build up brands and add value to premier agricultural products, such as in the case of JD’s collaboration with Wuchang in Heilongjiang province to nurture the iconic “Wuchang rice” brand.

The owner and her friends of a JD convenience store in Qinghai province

Trend #5

Responsible Consumption

Chinese consumers demonstrate rising tendency towards products which embody features like original, environmental-friendly, renewable, organic and more. This propels all the participants of the entire supply chain to collaborate closely to adopt eco-friendly measures in product offerings ranging from product design, procurement, transportation to end-of-life disposal.

As China’s largest retailer and a leading supply chain solution provider, JD.com is pioneering the ecosystem approach to green supply chain management in China. Under the “Green Stream Initiative” which was jointly initiated by JD and its partners, including P&G, Nestle, Lego, Unilever, WWF and more in 2017, a number of decarbonizing actions have been implemented throughout the supply chain.

JD.com released its first ESG report on Apr. 19. Stemming from its mission of “Powered by Technology for a More Productive and Sustainable World,” the report highlights JD’s long-term approach to ESG initiatives. It captures JD’s corporate social responsibility strategic framework, which is centered on using digitally intelligent supply chain to cover three pillars: boosting the real economy, improving social efficiency and enhancing environmental friendliness. A few areas worth noting include: green supply chain, green data centers, poverty alleviation and giving.

JD’s Green Stream delivery boxes

Trend #6

Product + Service

From mobile phone trade-in plans, online medical consultations, at-home installation services to buying apartment via VR technologies online, service consumption is growing by leaps and bounds in China. On the one hand, the development of O2O and standardized services offered by trustworthy platforms like JD.com provide ultra-convenience and a peace of mind to consumers encouraging the adoption of buying services on the internet.

On the other hand, merchants are quickly seizing the opportunities to create services customized to e-commerce scenarios to satisfy the need of their customers. JD Auto’s cooperation with ExxonMobil is a prime case. The two companies will not only work on creating more tailor-made lubricant products for Chinese customers, but also integrate their offline car maintenance resources, namely JD Auto Service stores and Mobil 1 Car Care Outlet, to provide convenient and reliable services to car owners on the ground, Meanwhile, customers will be able to enjoy more shared benefits from both JD Auto and Mobil’s membership programs.

JD Life and Service business division focuses on providing O2O local life services within a 3-kilometer radius of people’s work and life, including car maintenance, real estate, travel, auction, fresh flowers delivery, home cleaning and other convenience services, with the goal to provide a “product + service” consumption model for more consumers.

A JD’s omnichannel car mantainance store – JD Auto Service

Trend #7

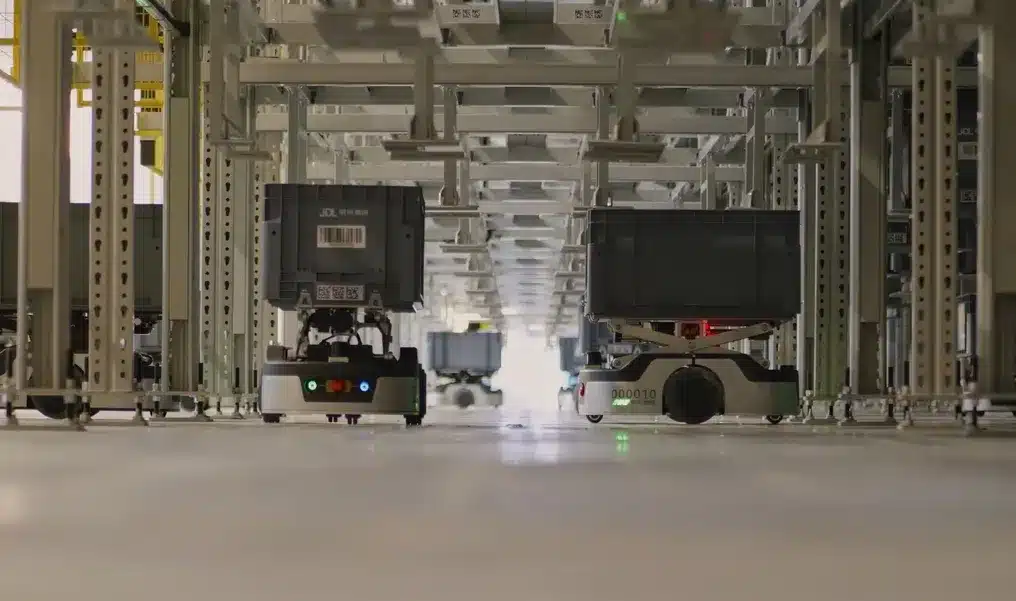

Supply Chain + Technology

The digitalization is happening quickly on both the consumption end and in the entire industrial value chain. For example, JD has applied its AI and big data technologies in creating its C2M products, crafting marketing content like product introductions for its e-commerce platform, and helping manufacturers to automatically inspect product quality on assembly lines.

By deeply engaging with manufacturers, suppliers, brand partners, and online shoppers, JD.com is at a unique position to gain and integrate its rich know-how in both the digital and real economies.

Now the company is opening up its core capacities in digital intelligent supply chain and cutting-edge technologies to support all businesses and partners with the goal of improving cost, efficiency and users’ experience, so as to optimize social resources for sustainable growth that benefits customers, businesses, industries, and the environment.

JD built a supply chain management platform for Hubei province at the peak of Anti-Covid-19 fight

Hefei Welcomes JD’s Second E-Space Store

Hefei Welcomes JD’s Second E-Space Store